Shares of optical components specialist Lumentum are experiencing a powerful rally, driven by solid financial results and a series of upgraded analyst outlooks rather than speculative trading. Market experts are increasingly convinced that the company is poised to be a key beneficiary of the expanding artificial intelligence sector.

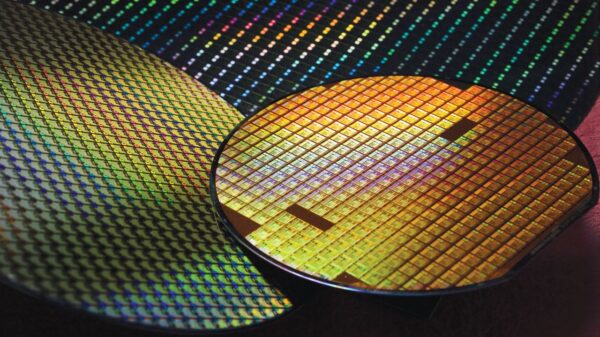

The core driver behind this bullish sentiment is Lumentum’s strategic role in a critical market. The company manufactures essential optical network components, including laser chips and high-speed transceivers. These products are indispensable for the rapid and efficient data transfer required within modern data centers. As demand for AI computing surges, major cloud service providers are significantly scaling up their infrastructure, creating a substantial tailwind for Lumentum’s core business. Analysts now regard the firm as a pivotal supplier within this megatrend.

The foundation for the recent optimism was laid by Lumentum’s financial report for the first quarter of fiscal 2026, released in early November. The corporation exceeded analyst consensus estimates for both revenue and earnings per share, with a revenue increase of more than 58% year-over-year particularly notable. Perhaps more crucial for investors was management’s confident guidance for the current quarter, which projects performance well above existing market forecasts.

Should investors sell immediately? Or is it worth buying Lumentum?

This robust performance has prompted several research firms to raise their price targets. For instance, the investment bank Rosenblatt increased its target from $280 to $380 per share, citing Lumentum’s significant potential in the AI infrastructure market. The firm’s analysts anticipate that the company will continue to outperform consensus revenue and profit estimates in the coming years.

The technical chart picture further reinforces the strong fundamental story. Lumentum’s stock is trading at an all-time high, having multiplied in value more than fivefold since the spring. While a price-to-earnings ratio exceeding 200 indicates that the market has already priced in high growth expectations, investor appetite remains undiminished, suggesting further potential is perceived.

The next significant milestone for Lumentum will be the release of its Q2 2026 results, expected in February. This report will be closely scrutinized for evidence that the company can sustain its AI-driven growth momentum and meet the elevated expectations now placed upon it.

See also Banks Invest Billions to Upskill 90,000 Engineers for Rapid AI Advancements

Banks Invest Billions to Upskill 90,000 Engineers for Rapid AI Advancements Coupa Reveals 80% of Companies Prefer Unified AI Platforms Amid Executive Skills Gap

Coupa Reveals 80% of Companies Prefer Unified AI Platforms Amid Executive Skills Gap AI Research Overwhelmed by 21,500 Papers in 2023, Experts Warn of Quality Crisis

AI Research Overwhelmed by 21,500 Papers in 2023, Experts Warn of Quality Crisis Pentagon Unveils AI Adoption Plan for 3 Million Users Amid Complex Challenges

Pentagon Unveils AI Adoption Plan for 3 Million Users Amid Complex Challenges