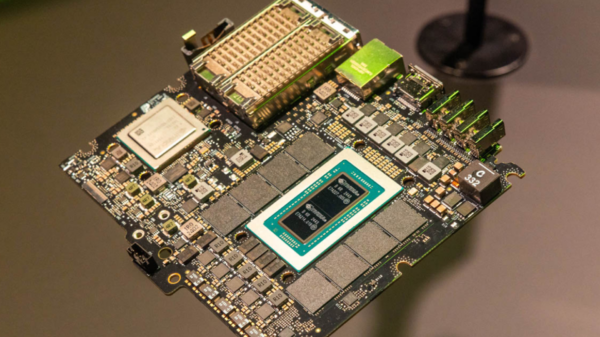

Investors are increasingly optimistic about Intel (NASDAQ: INTC) following a pivotal investment from Nvidia (NASDAQ: NVDA). Intel, once a dominant force in computing innovation during the early 2000s, has faced challenges in recent years, particularly within its foundry business. However, the tide shifted in late 2025 when Nvidia acquired a $5 billion stake in Intel and announced plans for collaborative projects, including the integration of Intel’s central processing units (CPUs) into some of Nvidia’s computing units. This strategic partnership has propelled Intel’s stock, which has surged over 100% since the deal was made public in September.

Despite this resurgence, some financial analysts caution that Intel’s current valuation might be inflated. The company’s stock is now trading at over 100 times its forward earnings, while Nvidia offers a comparatively attractive valuation at 24 times forward earnings. While the market has responded positively to Intel’s potential for a turnaround, revenue growth remains elusive, raising questions about the sustainability of its current stock price.

Wall Street analysts forecast modest growth for Intel, anticipating only 2% revenue growth for its fiscal 2026, which is expected to increase to nearly 8% in fiscal 2027. In stark contrast, Nvidia is projected to experience an explosive growth rate of 52% in the same fiscal year, suggesting that investors may find greater value in Nvidia’s stock.

The ongoing shift towards artificial intelligence (AI) has positioned Nvidia favorably, as the AI computing market is predominantly driven by graphics processing units (GPUs). Although CPUs are essential in AI data centers for managing workflows, GPUs are far more efficient for the parallel processing tasks critical to AI applications. As the demand for AI technology grows, Nvidia’s market presence in data centers is expected to overshadow Intel’s, regardless of whether Intel can effectuate a turnaround.

Concerns about a potential AI bubble have surfaced among investors, particularly regarding the soaring valuations of generative AI companies. However, analysts assert that this phenomenon does not directly affect Nvidia’s position. Many major AI hyperscalers are committed to investing tens of billions annually in computing infrastructure, with Nvidia poised to capture a substantial share of that spending. With the expectation that AI will require a massive expansion of computing capacity in the coming years, Nvidia appears well-situated for continued growth.

While some may speculate about a bubble among generative AI firms, the infrastructure demand indicates that Nvidia is not at immediate risk of being caught in such a market fluctuation. As data centers continue to expand rapidly, Nvidia is likely to remain a strong investment choice. In contrast, an Intel recovery, while potentially beneficial for the U.S. tech landscape, may not present the same level of investment appeal at this time.

In summary, despite the recent excitement surrounding Intel’s strategic partnership with Nvidia, the broader market context and growth projections suggest that investors might be better served by focusing on Nvidia. The burgeoning AI sector, which increasingly relies on GPU technology, underscores Nvidia’s potential for sustained growth, setting it apart in a competitive landscape.

With the AI computing market poised for unprecedented expansion, Nvidia remains well-positioned to capitalize on this trend, while Intel’s prospects appear more uncertain. As tech investors make their choices, the contrast between the two companies highlights a compelling narrative in the evolving landscape of computing technology.

See also Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity

Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity Affordable Android Smartwatches That Offer Great Value and Features

Affordable Android Smartwatches That Offer Great Value and Features Russia”s AIDOL Robot Stumbles During Debut in Moscow

Russia”s AIDOL Robot Stumbles During Debut in Moscow AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse

AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse Seagate Unveils Exos 4U100: 3.2PB AI-Ready Storage with Advanced HAMR Tech

Seagate Unveils Exos 4U100: 3.2PB AI-Ready Storage with Advanced HAMR Tech