Intel’s stock has staged a remarkable recovery after a challenging 2024, outperforming Nvidia’s shares as it closed out 2025. Despite this resurgence, the long-term outlook for Nvidia remains considerably more optimistic than that for Intel. Once a dominant player in the computing industry, Intel (NASDAQ: INTC) has faced increasing challenges in maintaining its competitive edge. Its foundry business, which allows other chip design companies to contract for chip production, has struggled to secure large clients. However, a significant development in late 2025 has rekindled investor interest.

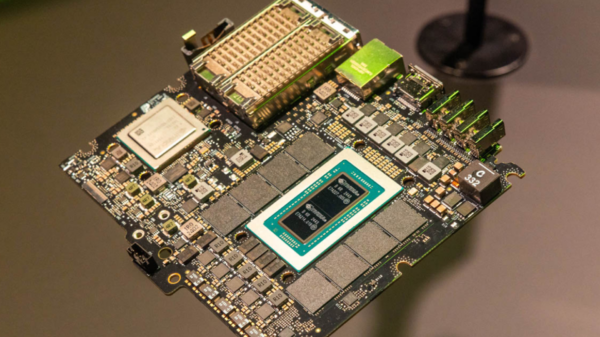

Nvidia (NASDAQ: NVDA) announced a $5 billion investment in Intel, a move that involves collaboration on various products, including plans for Nvidia to integrate Intel’s central processing units (CPUs) into some of its computing units. Following the announcement in September, Intel’s stock surged over 100%, reflecting renewed investor confidence. While there is optimism surrounding Intel’s potential turnaround, experts suggest that Nvidia remains the safer investment option.

The enthusiasm for Intel was partially rooted in its historically low stock price, but that characterization has changed. Currently, Intel’s shares are trading at over 100 times forward earnings, while Nvidia is valued at a more modest 24 times forward earnings. This shift indicates that the market may be overestimating Intel’s immediate turnaround prospects, even as revenue growth continues to lag.

Analysts on Wall Street appear skeptical about Intel’s growth trajectory. For fiscal 2026, they project Intel will achieve only 2% revenue growth, rising to nearly 8% by fiscal 2027. In stark contrast, Nvidia is expected to experience a staggering 52% growth rate in the same fiscal year. Given these projections, the rationale for choosing Intel over Nvidia is rapidly diminishing.

A key factor contributing to this disparity is the nature of the AI computing market, which is primarily driven by graphics processing units (GPUs) rather than CPUs. While CPUs do play roles within AI computing, GPUs excel at handling complex computations in parallel, making them ideal for the demands of AI workloads. Although CPUs remain essential in directing workflows within data centers, their quantity is diminishing relative to GPUs.

Nvidia’s established presence in data centers significantly exceeds Intel’s, regardless of Intel’s potential turnaround. As a result, many analysts deem Nvidia the superior investment choice. Concerns regarding an impending AI bubble have surfaced among investors, particularly regarding soaring valuations for generative AI companies. However, this situation does not directly impact Nvidia, as many AI hyperscalers are committing substantial annual spending on computing infrastructure, in which Nvidia will capture a sizable share.

While it may take years to fully understand the transformative potential of generative AI technologies, hyperscalers are expected to invest trillions in building the necessary computational capacity. Nvidia is well-positioned to capitalize on this ongoing expansion. Although some investors worry about a potential bubble among generative AI companies, Nvidia’s near-term prospects remain strong, especially as the demand for data center construction shows no signs of slowing.

As investors evaluate whether to place their bets on Nvidia, it’s worth noting that the Motley Fool Stock Advisor team recently identified ten stocks they believe are currently better investments than Nvidia itself. Historical data illustrates the potential of such recommendations; for instance, an investment of $1,000 in Netflix in December 2004 would have returned approximately $443,299, while a similar investment in Nvidia in April 2005 would have grown to roughly $1,136,601. The Motley Fool’s overall average return stands at 914%, significantly outperforming the S&P 500’s 195%.

Keithen Drury, who has disclosed positions in Nvidia, emphasizes the importance of thorough research before making investment decisions. While an Intel recovery could carry significant implications for the U.S. tech landscape, the immediate prospects appear more favorable for Nvidia. As the company continues to thrive within the data center market, it solidifies its standing as a leading investment choice amid a rapidly evolving technological landscape.

See also Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity

Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity Affordable Android Smartwatches That Offer Great Value and Features

Affordable Android Smartwatches That Offer Great Value and Features Russia”s AIDOL Robot Stumbles During Debut in Moscow

Russia”s AIDOL Robot Stumbles During Debut in Moscow AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse

AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse Seagate Unveils Exos 4U100: 3.2PB AI-Ready Storage with Advanced HAMR Tech

Seagate Unveils Exos 4U100: 3.2PB AI-Ready Storage with Advanced HAMR Tech