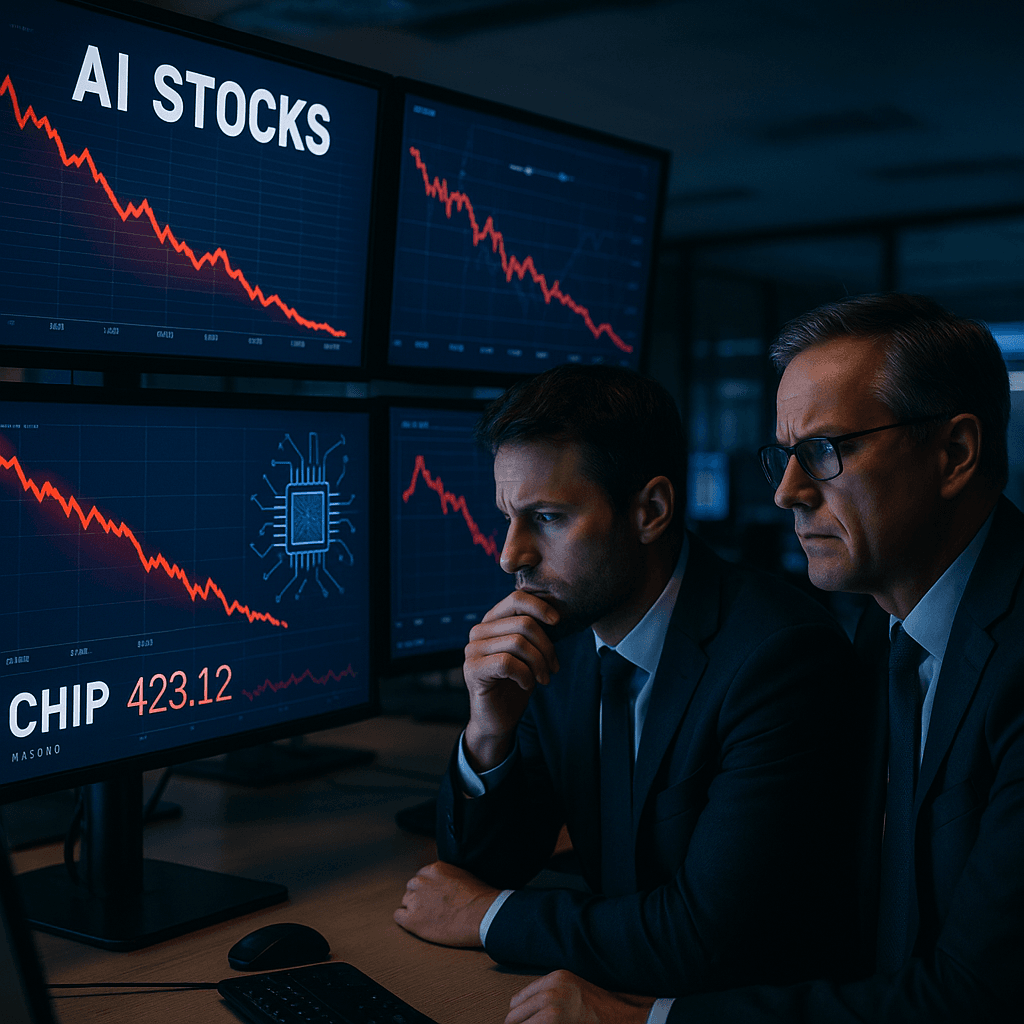

AI stocks faced significant declines on Monday, as investor concerns over valuations prompted a sell-off in technology shares. The Nasdaq index dropped by 0.84%, with AI leader Nvidia seeing a nearly 2% decrease just ahead of its crucial earnings report scheduled for Wednesday. Other major tech companies, including Apple, Meta, and Oracle, also experienced reductions of over 1% in their stock prices.

This downturn isn’t merely another routine fluctuation in the tech market; rather, it signals deeper anxieties regarding the sustainability of AI valuations and potential returns on capital expenditure. The upcoming earnings report from Nvidia has become a pivotal moment for the AI ecosystem, particularly following CEO Jensen Huang‘s optimistic prediction of “half a trillion dollars” in revenue for the years 2025 and 2026. This ambitious figure now looms large as a benchmark against which the market will assess the viability of the ongoing AI boom.

“If they offer any even slightly muted guidance or forecast for demand for their chips, the market would take that poorly,” remarked Ross Mayfield, investment strategist at Baird, in an interview with CNBC.

The anticipation surrounding Nvidia’s performance reflects broader investor unease regarding AI and tech valuations. After months of aggressive investment in AI infrastructure—including data centers and specialized chips—questions are emerging about when these expenditures will translate into meaningful profits. Recent sell-offs indicate that some investors are beginning to rethink their positions.

Despite the pessimism, not all analysts are resigned to a bearish outlook. Michael Graham from Canaccord Genuity conveyed a mixed sentiment in a Monday note, stating that while there are “a balance of bullish and bearish signals heading into year-end,” his firm maintains an expectation of a potential year-end rally. This perspective contrasts sharply with the prevailing market sentiment.

Further bolstering this view, Max Kettner, chief multi-asset strategist at HSBC, asserted that the likelihood of a “melt-up” in equities by year-end is greater than the risk of an AI bubble bursting. Kettner’s assertion suggests a belief that the fear of missing out on potential gains will outweigh current valuation concerns as December approaches.

The market’s current turbulence underscores the contentious debate between AI skeptics and advocates. While some investors are questioning the longevity of the AI surge, others are betting on a resurgence as the year closes. The outcome of Nvidia’s earnings report will serve as a crucial litmus test for both sides of this debate, shaping the trajectory of AI stocks moving into 2025.

In summary, the recent decline of AI stocks reflects a complex interplay of investor sentiment, valuation concerns, and the potential for future growth. As Nvidia prepares for its earnings announcement, the implications for the broader AI landscape hang in the balance, making this an increasingly critical moment for stakeholders within the tech community.

See also Nvidia Reveals 80% of Top Supercomputers Now Use GPUs, Transforming Scientific Computing

Nvidia Reveals 80% of Top Supercomputers Now Use GPUs, Transforming Scientific Computing Brands Double AI Adoption, Explore Generative Tools and GEO Strategies at AI Commerce Town Hall

Brands Double AI Adoption, Explore Generative Tools and GEO Strategies at AI Commerce Town Hall Anthropic Expands Data Center by $50B as U.S. Education Dept Launches $167M Tech Plan

Anthropic Expands Data Center by $50B as U.S. Education Dept Launches $167M Tech Plan Industrial AI Projects Surge: 60% of Companies Plan Implementations Within 3 Years

Industrial AI Projects Surge: 60% of Companies Plan Implementations Within 3 Years Abidur Chowdhury, iPhone Air Designer, Joins Unnamed AI Startup Amid Talent Exodus at Apple

Abidur Chowdhury, iPhone Air Designer, Joins Unnamed AI Startup Amid Talent Exodus at Apple