Tech Stocks Under Pressure Amid Growing Skepticism

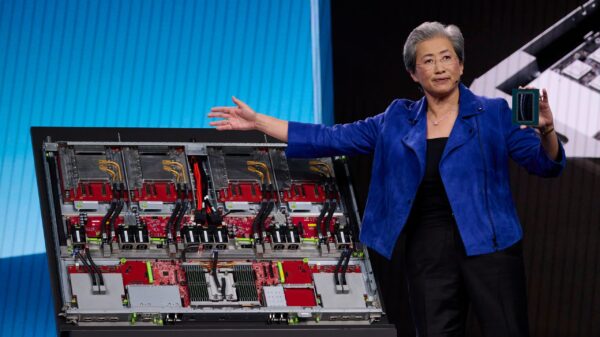

This week, the tech sector experienced a significant downturn, with stocks losing their previous momentum. Despite Nvidia‘s impressive earnings report—where it surpassed revenue estimates and projected strong future sales—the overall market sentiment remained cautious. Shares of major players such as Nvidia, AMD, and Broadcom all faced declines as volatility spread across the market. Notably, other industry giants like Meta Platforms and Microsoft were also swept into this decline, reflecting mounting investor uncertainty regarding the pace at which artificial intelligence (AI) can convert into substantial profits.

Many market observers are expressing concerns that tech valuations may have outpaced their actual worth, especially amidst a backdrop of consumer discretionary and information technology (IT) stocks on a trajectory for weekly losses exceeding 4%. The uncertainty was exacerbated by speculation about the Federal Reserve‘s next moves regarding interest rates, with a delayed jobs report and upcoming speeches creating further ambiguity about the economic outlook.

Market Implications of Recent Developments

This week’s turbulence indicates a critical reality check for tech momentum. Both the S&P 500 and Nasdaq futures slipped, highlighting investor jitters concerning the high-flying tech stocks and the real potential for AI monetization. Major players leading the market retreat have sent the Nasdaq lower, signaling a cautious shift in investor sentiment. Additionally, persistent high borrowing costs accompanying increasing corporate debt only deepen the uncertainty surrounding tech’s potential upside moving forward.

The ripple effect of this market decline extended to the cryptocurrency sector as well, with firms like Coinbase and MicroStrategy witnessing significant drops as Bitcoin and Ether prices reached multi-month lows. However, not all companies faced setbacks; Gap managed to defy the trend, reporting better-than-expected quarterly sales and profits, providing a glimmer of hope amid the market’s challenges.

Reassessing Risk in a Changing Landscape

As the market navigates through these challenges, investors appear to be becoming more discerning about growth narratives, especially with lingering questions surrounding the Federal Reserve‘s decisions for December and new labor data on the horizon. While the tech and cryptocurrency sectors experience turbulence, traditional industries like retail are demonstrating that there are still opportunities for positive surprises, as shown by Gap‘s performance. This suggests that a strategic reassessment of investment risks, along with a broader perspective, may be necessary as markets recalibrate.

As the tech sector faces a potential reevaluation of its valuations, industry stakeholders need to focus on the underlying fundamentals rather than being swept away by hype. The current environment illustrates the importance of patience and a critical eye when assessing emerging growth opportunities, particularly in the dynamic field of AI and technology.

See also 40% of Enterprises Risk Shadow AI Breaches by 2030, Gartner Warns on Employee Education

40% of Enterprises Risk Shadow AI Breaches by 2030, Gartner Warns on Employee Education 95% of AI Projects Fail: Insights from Pegasystems CEO on Overcoming Adoption Hurdles

95% of AI Projects Fail: Insights from Pegasystems CEO on Overcoming Adoption Hurdles ChatGPT group chats expand AI-assisted collaboration for everyday team workflows

ChatGPT group chats expand AI-assisted collaboration for everyday team workflows India Unveils AI Governance Guidelines, Emphasizes Self-Regulation and Digital Infrastructure

India Unveils AI Governance Guidelines, Emphasizes Self-Regulation and Digital Infrastructure Consilium and Hyundai Test AI Cameras for Maritime Fire Detection on Container Vessels

Consilium and Hyundai Test AI Cameras for Maritime Fire Detection on Container Vessels