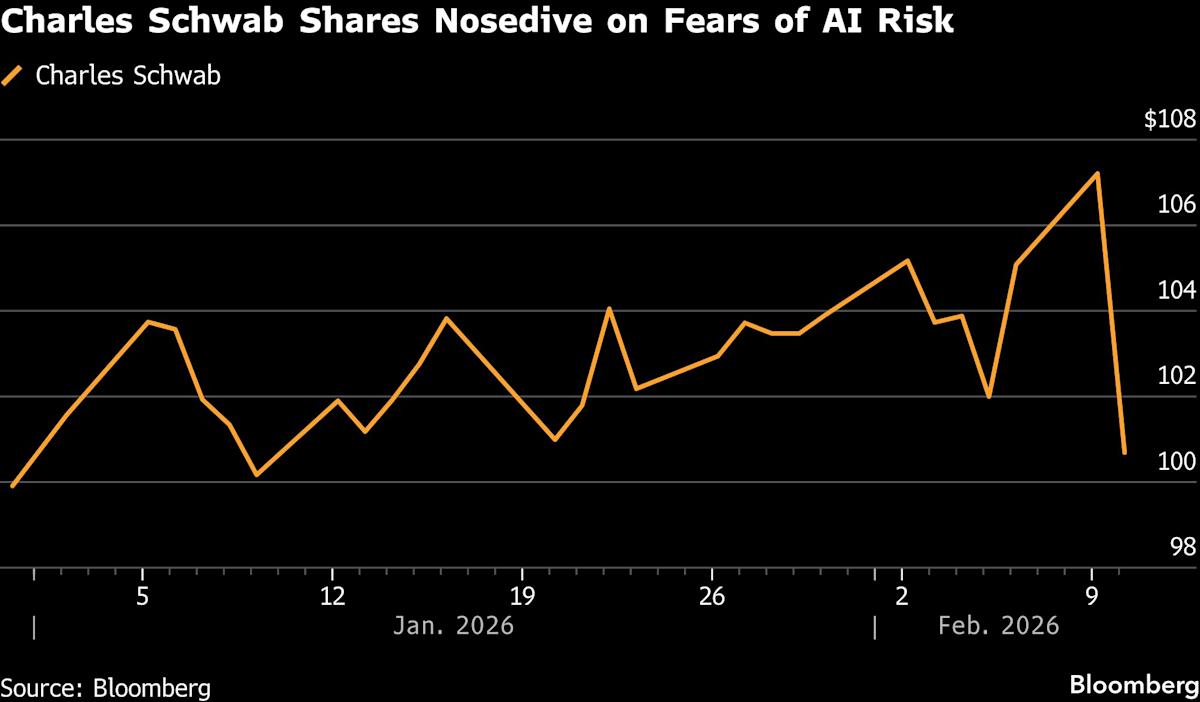

(Bloomberg) — An artificial intelligence tool aimed at creating tax strategies sparked a selloff in wealth-management stocks Tuesday as investors fear the business could be at risk from automated advice. The innovation puts the wealth-management industry in the crosshairs of AI competition, similar to the recent upheaval in software stocks and insurance brokerage shares. Investors responded predictably by unloading shares, with major firms such as Charles Schwab Corp., Raymond James Financial Inc., LPL Financial Holdings Inc., and Stifel Financial Corp. experiencing declines between 7% and 8%, marking their worst trading days since April.

The abrupt market reaction caught Wall Street off guard, particularly given that Charles Schwab was the only stock among the group with a sell rating, as noted by one of the 24 analysts tracking the company. The new tool, unveiled by tech startup Altruist Corp., assists financial advisers in personalizing strategies for clients and generating pay stubs, account statements, and other documents, according to a company statement. Jason Wenk, the company’s founder and Chief Executive Officer, has a background with Morgan Stanley, while Chief Operating Officer Mazi Bahadori previously worked at Pimco Investment Management, underscoring Altruist’s connection to Wall Street.

Neil Sipes, an analyst with Bloomberg Intelligence, attributed the selloff to broader fears that AI could disrupt the traditional wealth-management model. He stated that investor attention is likely focused on concerns regarding fee compression, efficiency losses, and potential market-share shifts. The anxiety surrounding AI’s impact on established business models is reverberating throughout the economy, with recent selloffs in various sectors exacerbating these worries. The jitters began last week when Anthropic released tools aimed at automating tasks in areas such as legal services and financial research, igniting a downturn in related stocks.

The Monday decline in insurance brokers followed the introduction of Insurify’s new rate-comparison AI tool, which raised alarms about the sustainability of traditional insurance practices. The S&P 500 insurance index fell 3.9% on that day, marking its worst performance since October. UBS insurance analyst Brian Meredith noted that market perceptions may be shifting toward the belief that insurance brokers could be disintermediated by AI technologies, questioning whether platforms like ChatGPT or OpenAI might replace them entirely.

Altruist represents a growing number of startups attempting to leverage AI to enhance financial services. Other companies, such as Rogo Technologies Inc., are developing software that aids investment bankers with specific tasks and aims to create an AI counterpart to banking analysts. Similarly, Hebbia is branding itself as an “AI platform for finance,” designed to help businesses analyze data more efficiently.

Prominent AI developers are also venturing into the financial sector. In addition to Anthropic, OpenAI established a partnership with Intuit Inc. late last year to provide applications within ChatGPT that allow users to access and interact with financial data stored on Intuit’s platform. This trend underscores a broader theme in the financial landscape, where technology firms are increasingly challenging traditional paradigms in wealth management and financial services.

The evolving dynamics of AI and its impact on various industries suggest that the current wave of technological disruption is far from over. As financial institutions grapple with the implications of automated tools and AI-driven solutions, the landscape of wealth management may witness significant transformations in the near future.

See also AI Transforms Health Care Workflows, Elevating Patient Care and Outcomes

AI Transforms Health Care Workflows, Elevating Patient Care and Outcomes Tamil Nadu’s Anbil Mahesh Seeks Exemption for In-Service Teachers from TET Requirements

Tamil Nadu’s Anbil Mahesh Seeks Exemption for In-Service Teachers from TET Requirements Top AI Note-Taking Apps of 2026: Boost Productivity with 95% Accurate Transcriptions

Top AI Note-Taking Apps of 2026: Boost Productivity with 95% Accurate Transcriptions