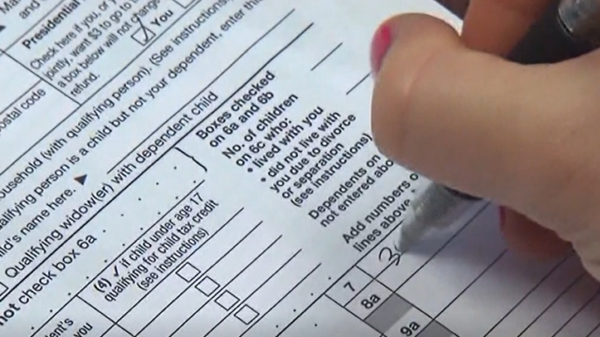

As tax season approaches, a significant portion of the American public is opting to delay filing their returns, with a recent report indicating that 29% of Americans plan to procrastinate this year. The findings from the IPX 1031 7th annual Tax Procrastination report reveal that many individuals are not prepared to meet the impending deadline of April 15.

The report highlights a growing sentiment around the stress associated with taxes, as 60% of respondents described the process as overwhelming or time-consuming. In an effort to ease this burden, 1 in 5 individuals stated they would turn to artificial intelligence (AI) to assist them in managing their tax filings this year. While AI tools can provide valuable assistance, experts caution against relying solely on these technologies.

“While one in five may use AI to assist them in filing their taxes, I think it’s extremely important that people also look over the advice that you get from AI yourself and consult a tax professional,” explained Emily Fanious, a spokesperson for IPX1031. “I think it’s important that folks don’t just take whatever AI tells them, and then they run with it for their tax returns this year.”

The integration of AI into tax preparation reflects a broader trend in which technology is increasingly being used to streamline complex tasks. However, the need for a human touch remains crucial in navigating the intricacies of tax regulations and ensuring accuracy.

Experts recommend that taxpayers begin preparing their filings sooner rather than later to mitigate stress and potential errors. Early planning can significantly reduce the anxiety often associated with tax season and help individuals avoid the last-minute rush. With various resources available, including AI tools and professional advisors, taxpayers have options to make the process smoother.

The upcoming deadline serves as a reminder of the importance of timely filing and the benefits of proactive preparation. As technology continues to evolve, its role in tax assistance will likely grow, but the fundamental need for human oversight and expertise will remain essential.

For more information on tax filing, individuals can visit the official IRS website at IRS.gov.

See also Crushon AI Launches Unfiltered Roleplay Platform with Advanced Models and Privacy Risks

Crushon AI Launches Unfiltered Roleplay Platform with Advanced Models and Privacy Risks AI and Robotics Revolutionize Heart Surgery: Enhanced Precision, Faster Recovery, Fewer Risks

AI and Robotics Revolutionize Heart Surgery: Enhanced Precision, Faster Recovery, Fewer Risks Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032