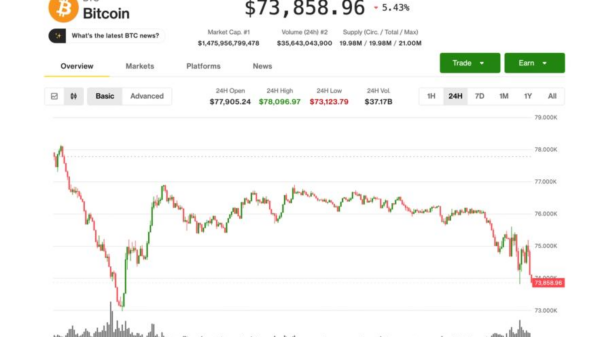

The global cryptocurrency market is currently grappling with significant turmoil as of November 2025, marked by a sharp decline in market value and a prevailing sentiment of “extreme fear” among investors. Over the past six weeks, approximately $1 trillion to $1.2 trillion has been erased from the market, with major cryptocurrencies like Bitcoin (BTC-USD) falling to seven-month lows. This downturn has highlighted the increasing correlation between the crypto market and broader macroeconomic factors, challenging previous assumptions about its independence from traditional financial markets.

This downturn isn’t just a temporary setback; it stems from a complex interplay of macroeconomic headwinds, persistent regulatory uncertainties, and unique market dynamics. Investors are contending with diminishing expectations for aggressive interest rate cuts by the Federal Reserve, stubbornly high inflation at 2.9% year-over-year, and the disruptive consequences of renewed trade tensions alongside a US government shutdown in October 2025. These external factors have fostered a “risk-off” sentiment, directing capital away from volatile assets, including cryptocurrencies.

Analysts are referring to the current crypto market slump as a “crypto winter,” with significant declines noted throughout 2025, particularly in the latter half of the year. February saw Bitcoin and Ethereum (ETH-USD) lose over 20% of their value, with further declines pushing Bitcoin below the critical threshold of $90,000 and erasing all year-to-date gains. The Fear and Greed Index, a key sentiment indicator, has dropped to a concerning 18, firmly placing it in the “extreme fear” category.

Market Dynamics and Regulatory Challenges

Multiple interconnected factors have contributed to this dramatic decline. Central to the issue are macroeconomic conditions. The Federal Reserve’s hawkish stance, alongside looming tariffs imposed by the Trump administration on imports from countries like China, Canada, and Mexico, has resulted in significant market turbulence. Furthermore, the October government shutdown created a “data blind spot,” compounding liquidity issues and increasing market pressures.

Regulatory uncertainty is also a critical component of the current landscape. Despite progress in some areas, global cryptocurrency regulation remains inconsistent. While the US has made strides with initiatives like the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, which aims to create a framework for stablecoins, a cohesive federal regulatory structure is still lacking. This ambiguity, combined with the potential for stricter policies, has engendered fear among investors.

From within, the crypto market is also facing challenges resulting from trust issues linked to past security breaches and notable project failures, including the collapse of $LIBRA in Argentina and the ongoing repercussions from the FTX fallout. Practices like “pump-and-dump” schemes and excessive leverage among traders have intensified price volatility, leading to cascading liquidations during downtrends. The slowdown in speculative activities, especially in memecoins since Q1 2025, has further diminished trading volumes.

The Role of AI in Resilience

Despite these challenges, the potential of Artificial Intelligence (AI) is becoming increasingly relevant as companies seek to develop stable revenue streams. Many cryptocurrency mining companies are pivoting towards AI and high-performance computing (HPC) to stabilize and diversify their revenue. For instance, seven of the ten largest publicly traded mining companies are generating revenue from AI initiatives. Companies like TeraWulf (NASDAQ: WULF) have secured long-term contracts for AI cloud services, while Iris Energy (NASDAQ: IREN) is projecting that AI will account for 40% of its revenue by mid-2025.

Moreover, AI is transforming trading efficiency, with projections suggesting that AI-driven algorithms could handle nearly 89% of global trading volume by 2025. These systems enhance market liquidity and stability by executing trades with unprecedented speed and efficiency. Additionally, AI can analyze historical data alongside on-chain activity and market sentiment to make accurate forecasts, offering traders significant advantages in navigating volatility.

Looking ahead, the current weakening of the cryptocurrency market should be viewed as a “mid-cycle cooldown” rather than a catastrophic collapse. In the short term, analysts anticipate a sideways consolidation with a mildly bullish trend, contingent on improvements in global liquidity. Longer-term forecasts for Bitcoin suggest potential peaks ranging from $200,000 to $300,000 by late 2026, driven by institutional demand and investments in spots for Bitcoin ETFs.

In summary, while the global cryptocurrency market is experiencing profound challenges, the ongoing advancements in AI present a promising avenue for stability and growth. Companies that embrace AI technology may find themselves better equipped to navigate the turbulent waters of the current market and emerge resilient in the long term.

See also US Stock Markets Drop 1.5% Amid Ongoing AI Bubble Concerns and Inflation Jitters

US Stock Markets Drop 1.5% Amid Ongoing AI Bubble Concerns and Inflation Jitters ASML Invests €1.3 Billion in Mistral AI to Enhance Lithography Systems with Generative AI

ASML Invests €1.3 Billion in Mistral AI to Enhance Lithography Systems with Generative AI Artificial Intelligence in Epidemiology Market Expected to Reach $10B by 2032, Reports Analyze Trends

Artificial Intelligence in Epidemiology Market Expected to Reach $10B by 2032, Reports Analyze Trends Perplexity Launches Comet AI Browser for Android, Enhancing Mobile Web Navigation with AI Features

Perplexity Launches Comet AI Browser for Android, Enhancing Mobile Web Navigation with AI Features AI Leaders Must Optimize Generative Engine Strategies for Increased Visibility and ROI

AI Leaders Must Optimize Generative Engine Strategies for Increased Visibility and ROI