AI Could Transform Investment Strategies by 2026

As artificial intelligence (AI) rapidly evolves from basic conversational tools like ChatGPT to essential partners across diverse sectors, it has emerged as a generational investment opportunity. The Motley Fool’s 2026 AI Investor Outlook Report indicates a strong sentiment among investors, with 93% expressing confidence in their AI exposure. This confidence suggests a pivotal shift in investment strategies as the focus transitions from potential to profitability.

By 2026, companies will be under pressure to demonstrate tangible returns on their AI investments. Goldman Sachs forecasts that AI companies will collectively invest over $500 billion in AI technology, underscoring the scale of commitment in this arena. As excitement gives way to a demand for measurable outcomes, investors are likely to prioritize companies that showcase sustainable business models capable of maximizing the value of AI.

The prevailing optimism regarding AI’s transformative capabilities remains robust. The Motley Fool’s report reveals that 93% of AI investors plan to maintain or increase their investments over the next year, with 36% of respondents intending to allocate additional funds. This trend reflects a broader shift in focus toward long-term value creation amid a landscape characterized by rapid technological advancements.

In 2026, investment strategies may begin to favor companies outside the traditional heavyweights of the S&P 500. Firms that provide foundational technology necessary for AI infrastructure could attract heightened investor interest. This includes entities involved in building data centers, supplying key network components, and offering power and cooling solutions.

Emcor (NYSE: EME) stands as a compelling case. Recently added to the S&P 500 index, Emcor specializes in essential infrastructure services, such as HVAC, electrical systems, power generation, and security solutions. The company reported a 29% year-over-year increase in its remaining performance obligations (RPOs), totaling a record $12.6 billion, with nearly half of that growth stemming from the network and communications sector driven by data center demand.

Emcor’s recent quarterly results showcased record revenue and earnings, alongside a raised quarterly dividend payout from $0.25 to $0.40 per share. Furthermore, the company expanded its share repurchase program by $500 million, signaling management’s confidence in its future trajectory.

Emcor exemplifies the type of investment firms may seek as AI continues to influence market dynamics in 2026. While AI growth is unlikely to follow a linear path, the acknowledgment of its status as a generational investment opportunity is undeniable. Asit Sharma, a Motley Fool AI stock analyst, notes that while there will be various fluctuations in the market, the long-term impact of AI on productivity, GDP acceleration, and wealth creation will eventually be reflected in market performance.

Before considering an investment in Emcor, potential investors should note that it did not make the list of the top stocks identified by The Motley Fool Stock Advisor analyst team. The team has spotlighted ten stocks they believe are currently the best investment opportunities, harking back to moments when companies like Netflix and Nvidia were recommended, yielding monumental returns for early investors.

It’s essential to evaluate investment choices carefully, bearing in mind that the landscape is evolving rapidly. The Motley Fool’s Stock Advisor boasts an impressive average return of 968%, significantly outperforming the S&P 500’s return of 197%. For those keen on aligning their portfolios with emerging trends, following these insights could be vital in navigating the forthcoming AI-driven market transformations.

As AI continues to shape various industries and investment strategies, the companies that effectively harness its potential will likely emerge as leaders in this new economic landscape. The opportunities for growth and innovation are significant, positioning AI as a cornerstone of future market dynamics.

See also CES 2026 Signals Price Hikes as AMD, Dell Face RAM Shortages Amid AI Demand

CES 2026 Signals Price Hikes as AMD, Dell Face RAM Shortages Amid AI Demand TD SYNNEX Reports Q4 Revenue of $17.38B, Driven by Cloud and AI Demand

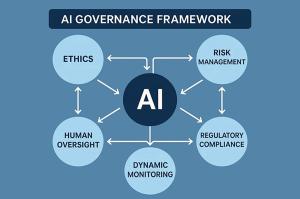

TD SYNNEX Reports Q4 Revenue of $17.38B, Driven by Cloud and AI Demand RegulatingAI Appoints Mehdi Jomaa to Bolster Global AI Governance Amid Rising International Concerns

RegulatingAI Appoints Mehdi Jomaa to Bolster Global AI Governance Amid Rising International Concerns Meta Unveils ‘Meta Compute’ Initiative, Aiming for $600B AI Infrastructure by 2028

Meta Unveils ‘Meta Compute’ Initiative, Aiming for $600B AI Infrastructure by 2028 NVIDIA’s Jensen Huang Reveals AI’s Job Growth Potential and Future by 2025

NVIDIA’s Jensen Huang Reveals AI’s Job Growth Potential and Future by 2025