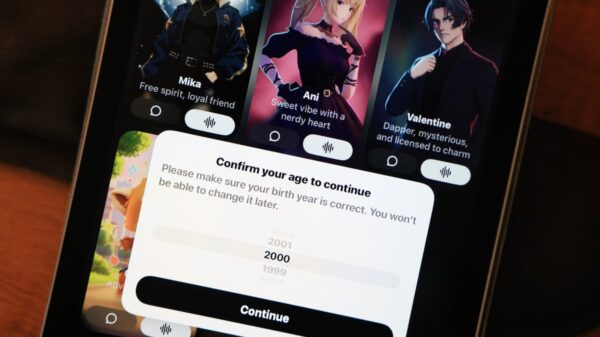

In a bold move to enhance its position in the artificial intelligence sector, Chinese e-commerce powerhouse Alibaba has announced a sweeping strategy that combines an extensive marketing campaign with the launch of a new high-performance chip. This initiative marks a significant effort to carve out a stronghold in the competitive AI landscape as the company gears up for its Qwen AI app launch on February 6, 2026, strategically timed to coincide with the Lunar New Year, a peak period for user engagement across digital platforms.

According to reports from various financial and news outlets, including the South China Morning Post and Benzinga, Alibaba has set aside 3 billion Yuan (approximately $432 million USD) for this promotional onslaught. The campaign will utilize lottery-style incentives and cash giveaways, aiming to rebrand Qwen from a mere chatbot to a versatile personal AI agent. This agent will be capable of performing various tasks within Alibaba’s extensive ecosystem, including integration with platforms such as the online marketplace Taobao and the navigation service Amap.

Alibaba’s latest efforts place it in direct competition with rivals like Tencent and Baidu, both of whom are also pursuing strategies aimed at acquiring users during the holiday season. The race for dominance in China’s AI assistant market is intensifying, with companies focusing on expanding user reach and engagement.

Simultaneously, Alibaba’s semiconductor unit, T-Head, has unveiled the technical specifications for its new processor, the Zhenwu 810E. This chip is designed specifically to meet the computational demands typical of generative AI models, emphasizing the company’s commitment to reducing dependency on foreign semiconductor technologies amid increasing export controls on advanced chips.

Analysts have noted that the Zhenwu 810E’s performance is approximately comparable to Nvidia’s China-focused H20 chip, highlighting a critical strategic shift among China’s tech leaders to foster domestic semiconductor innovation. This effort is particularly relevant in the current geopolitical climate, where reliance on foreign technology is increasingly scrutinized.

Despite these ambitious initiatives, investor sentiment surrounding Alibaba has been somewhat volatile. In recent trading, shares of Alibaba were listed at 139.80 Euros, reflecting a decline of 2.37%. This comes on the heels of a notably stronger year, characterized by improved market sentiment towards the company.

The upcoming earnings release, projected around February 19, 2026, will be a critical moment for the company. Estimates from Nasdaq and MarketBeat suggest this report will provide vital indicators of whether Alibaba’s dual-pronged AI strategy has succeeded in generating genuine user growth and invigorating its ecosystem, or if it merely attracts short-term market attention.

As Alibaba prepares for this transformative phase, the broader implications of its moves will resonate throughout the industry, signaling a heightened focus on AI capabilities and technological independence in an increasingly competitive market.

See also DeepSeek R1 Matches ChatGPT Performance at 96% Lower Cost, Targets Developers

DeepSeek R1 Matches ChatGPT Performance at 96% Lower Cost, Targets Developers EU Leaders Convene in Dubai to Tackle AI, Trade, and Geopolitical Challenges

EU Leaders Convene in Dubai to Tackle AI, Trade, and Geopolitical Challenges Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032