Alphabet stock surged nearly 6% on Monday, driven by the debut of Google’s new Gemini 3 AI model, which has significantly boosted the tech giant’s market position and raised new questions about Nvidia’s dominance in the AI computing landscape. For the first time, shares of both GOOGL and GOOG crossed above $300, reaching an intraday high of $317.75. Analysts noted that Gemini 3 is outperforming competitors from OpenAI and Anthropic, with its performance bolstered by Google’s custom AI chips, indicating a reduction in long-term reliance on Nvidia.

Nvidia’s stock, however, experienced a slight decline of about 0.5% despite reporting strong earnings. Meanwhile, other tech stocks showed mixed results, with AMD climbing nearly 4% and Arista gaining over 3%. The dynamics illustrate early signs of a competitive realignment in the sector, as Google’s AI capabilities gain traction.

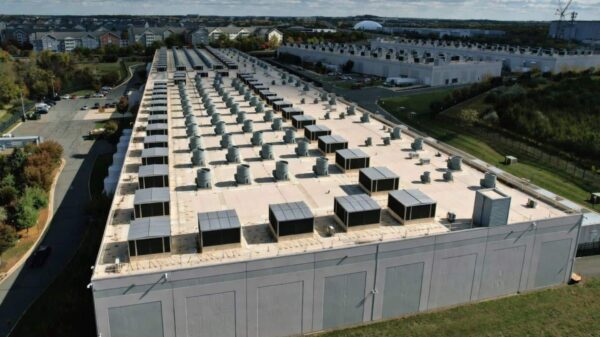

The boost in Alphabet’s stock is notable, coming off a year of remarkable growth, with a 70% annual gain noted recently. Shares closed at $299.66 on Friday following four consecutive quarters of earnings beats. The company’s Q3 pretax profit rose 39% year-over-year, and margins expanded by seven percentage points even as capital expenditures surged from $13 billion to $24 billion. In terms of cloud services, Google Cloud revenue grew 34% year-over-year, outperforming Microsoft Azure’s 33% and Amazon AWS’s 20% growth. This performance positions Google Cloud as a serious competitor, capturing 13% of the global market share.

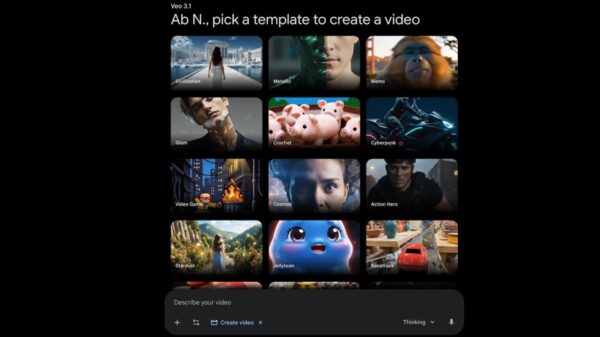

The launch of Gemini 3 has significantly increased its user base as well, with monthly active users now totaling 650 million. The share of generative AI web traffic has more than doubled from 5.6% to 13.7% over the past year, indicating strong adoption driven by innovations like Deep Think and updated coding tools. Price targets among analysts have been raised, with expectations now ranging from $325 to $355. Alphabet’s current market capitalization exceeds $3.6 trillion, making it the fastest-growing stock among the “Magnificent Seven” tech companies.

Alphabet’s robust performance in the third quarter has captured Wall Street’s attention, with BNP Paribas reinstating coverage and assigning a $355 price target, while Evercore raised its estimate to $325. The consensus among analysts now stands at approximately $321.94, suggesting further potential upside. Despite technical indicators showing that the stock may be overbought, analysts believe that support remains strong around $290 in the event of a pullback.

Amidst its impressive financial results, Alphabet’s shareholder confidence has also been bolstered by a significant investment of $4.34 billion from Berkshire Hathaway. The company trades at 26 times earnings, a rise from 20 times the previous year, reflecting investor optimism regarding its long-term AI strategy. Google Search continues to be a strong revenue driver, accounting for 55% of its total revenue with a growth rate of 15% in Q3.

As Alphabet continues to build momentum with its AI initiatives, particularly through Gemini 3, the company is poised to challenge traditional leaders in the sector. Analysts point to potential growth in its self-driving unit, Waymo, as another catalyst leading into 2026. With nearly a 59% gain year-to-date, Alphabet leads the tech pack, reinforcing its position as a formidable player in the rapidly evolving landscape of artificial intelligence.

See also Worldpay Launches MCP to Transform AI into Active Payment Agents for Seamless Commerce

Worldpay Launches MCP to Transform AI into Active Payment Agents for Seamless Commerce Amazon Announces $50 Billion Investment to Expand AI and Supercomputing for US Government

Amazon Announces $50 Billion Investment to Expand AI and Supercomputing for US Government Nokia Commits $4 Billion to U.S. AI-Ready Networks, Boosting R&D and Manufacturing Capacity

Nokia Commits $4 Billion to U.S. AI-Ready Networks, Boosting R&D and Manufacturing Capacity AlphaFold Enhances Drug Discovery as Genesis AI Unveils Pearl Model with Sub-Angstrom Accuracy

AlphaFold Enhances Drug Discovery as Genesis AI Unveils Pearl Model with Sub-Angstrom Accuracy Europe’s AI Act Sets Strict Risk Regulations: Major Compliance Deadlines Looming for Tech Firms

Europe’s AI Act Sets Strict Risk Regulations: Major Compliance Deadlines Looming for Tech Firms