Leading technology firms are significantly increasing their investments in data center infrastructure as the demand for artificial intelligence continues to surge. Recent earnings reports from major players such as Amazon, Alphabet, Microsoft, and Meta revealed ambitious capital expenditure projections for 2026, prompting comparisons to historical economic booms like the Gilded Age and the Information Age. However, analysts are expressing skepticism about the potential return on investment, leading to notable fluctuations in stock prices following the announcements.

Amazon announced a staggering $200 billion in capital expenditures for 2026, a more than 50% increase from its previous budget in 2025. This figure exceeded analysts’ expectations by $50 billion, yet it prompted a negative market response. The company’s stock plummeted as much as 10% after the announcement and was down 8% by the following morning, despite achieving a 14% growth in revenue year-over-year for the quarter. Bernstein analyst Mark Shmulik critiqued the situation, stating, “If we’re going to peg the share price to 2026 CapEx, maybe Amazon should have guided even higher,” highlighting the risks associated with such aggressive spending.

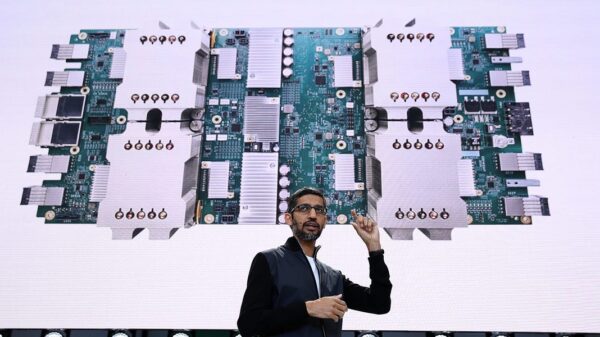

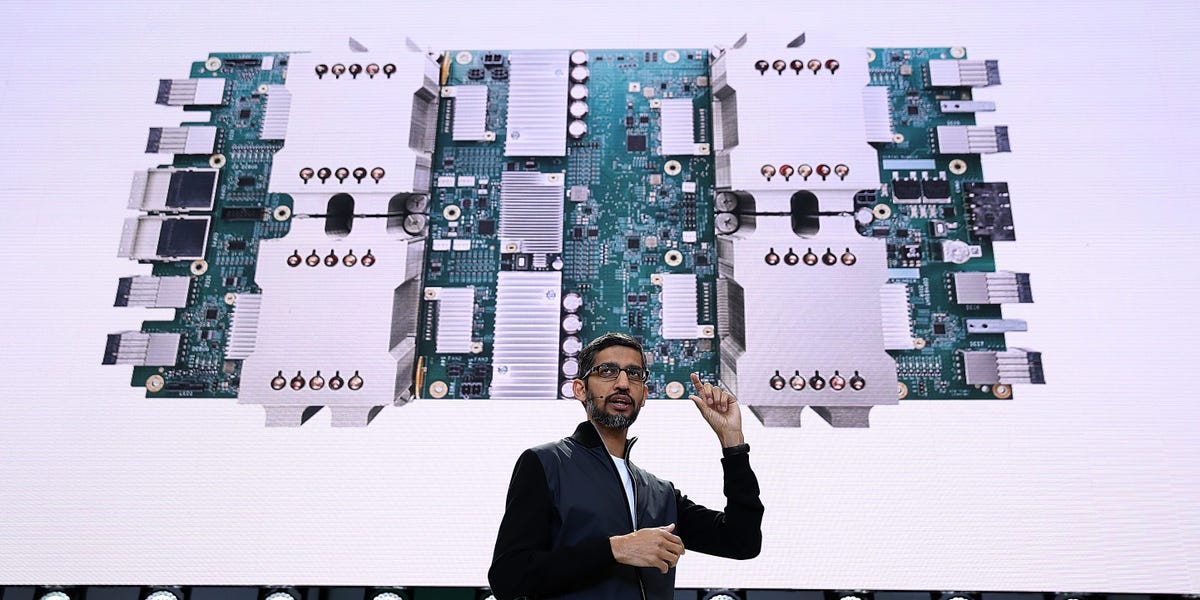

Similarly, Alphabet shocked investors with its announcement to double its capital expenditures for the second consecutive year, pledging between $175 billion and $185 billion for 2026. This surge in spending reflects the growing demand for its Gemini AI models, which have reportedly surpassed 750 million monthly active users. While Alphabet’s stock saw a modest decline of about 2%, analysts like BNP Paribas’s Nick Jones expressed optimism, suggesting that the investments position Alphabet well to excel in the evolving AI landscape.

Meta also committed to a substantial increase in its capital expenditures, targeting between $115 billion and $135 billion for 2026, nearly doubling last year’s spending. Initially, this announcement was met with enthusiasm, as Meta’s stock surged 8% following its earnings report, buoyed by strong advertising revenue of $58.14 billion for the quarter and improvements from its AI-driven advertising tools. However, sentiment has since soured, with the stock experiencing a downturn as investor expectations recalibrate.

In contrast, Microsoft reported $37.5 billion in capital expenditures for the second quarter of its fiscal 2026. While full-year guidance was not provided, estimates from S&P suggest a figure around $97.7 billion. Microsoft’s future revenue projections are heavily tied to its partnership with OpenAI, which constitutes 45% of its backlog. Despite a 17% increase in total revenue, including a notable 39% spike in Azure and cloud services, Microsoft experienced a significant stock drop of 12% the day after its earnings report—a stark reminder of investor caution amidst high spending.

The implications of these massive investment plans extend beyond immediate financial outcomes. As these technology giants funnel substantial resources into data center infrastructure and AI development, the competitive landscape will likely shift, with companies that adapt effectively to new demands standing to gain significant market advantages. The ongoing focus on AI technologies underscores a larger trend within the industry, potentially shaping the future of technological development and operational frameworks for years to come.

See also Survey Unveils How 190 E&C Officers Leverage AI’s Benefits and Risks in Compliance

Survey Unveils How 190 E&C Officers Leverage AI’s Benefits and Risks in Compliance Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032 Satya Nadella Supports OpenAI’s $100B Revenue Goal, Highlights AI Funding Needs

Satya Nadella Supports OpenAI’s $100B Revenue Goal, Highlights AI Funding Needs