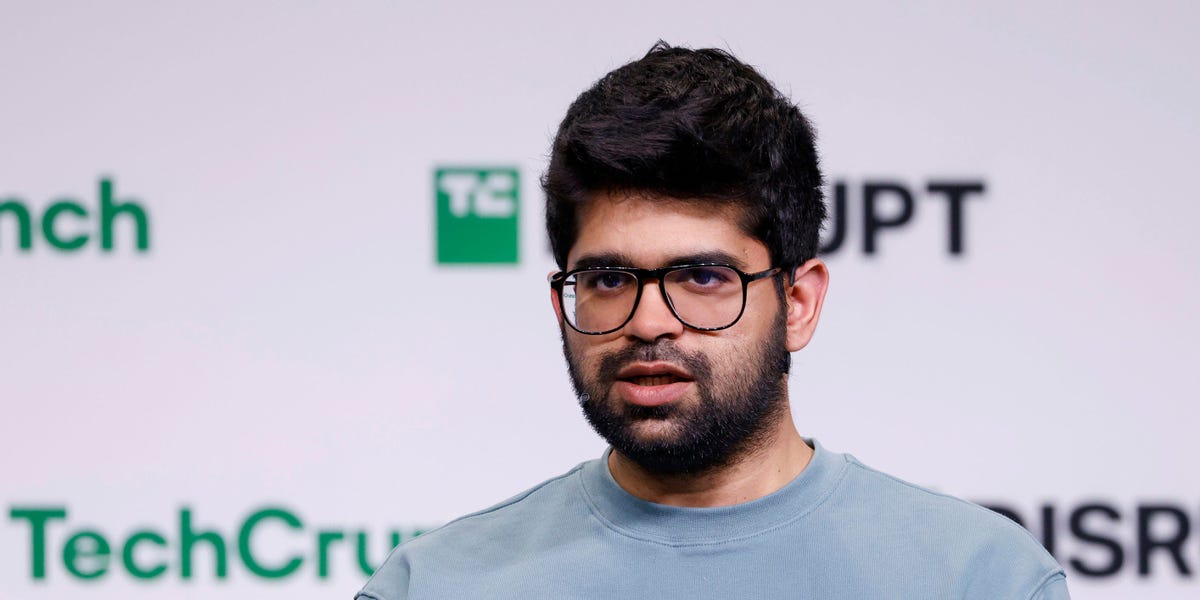

At the recent 2025 Cerebral Valley AI Conference, a gathering that attracts the brightest minds in technology and investment, participants were presented with a provocative question: Which billion-dollar AI startup would you bet against? This unusual inquiry led to surprising results, as it highlighted the growing skepticism around even the most prominent players in the AI landscape.

According to an informal survey conducted by Eric Newcomer, an independent journalist and conference organizer, over 300 attendees named the AI search startup Perplexity as the company most likely to falter. In a twist, OpenAI, often regarded as the flagship success story of the AI boom, came in second.

This response reflects an emerging sentiment in Silicon Valley, where despite substantial investments pouring into AI, doubts about the sustainability and viability of leading firms are becoming more vocal. The results of this survey signal a shift in the narrative surrounding the concentration of AI funding and the expectations tied to high-profile companies.

While it’s essential to approach informal surveys with caution, the findings resonate with ongoing conversations among venture capitalists and entrepreneurs who often discuss the potential for an AI bubble. In a climate where negative public commentary about startups is generally frowned upon, openly naming candidates for potential failure is a bold move.

Perplexity’s position atop the “most likely to fall” list isn’t entirely unexpected, given its rapid rise and the scrutiny that follows. The AI search browser has been raising funds at a torrid pace, with recent valuations ranging from $14 billion to an astonishing $50 billion, as reported by Business Insider. However, concerns about its ability to compete with tech giants like Google loom large in investors’ minds.

A spokesperson for Perplexity, Jesse Dwyer, responded to the survey by suggesting that it reflects more of a “judgmental valley conference” atmosphere. Meanwhile, OpenAI’s second-place ranking raises eyebrows, especially considering its status as a consumer-friendly leader in AI technology.

OpenAI’s ballooning valuation, alongside its substantial commitments to infrastructure spending, has started to unsettle some of its backers. In a recent exchange between OpenAI CEO Sam Altman and investor Brad Gerstner, Altman vehemently defended the legitimacy of the company’s valuation. When Gerstner questioned how OpenAI could commit to $1.4 trillion in spending while generating $13 billion in revenue, Altman quipped, “If you want to sell your shares, I’ll find you a buyer.” This exchange underscores the tension between soaring valuations and financial fundamentals.

Interestingly, the same attendees who expressed skepticism about Perplexity and OpenAI also named them among the companies they would back if given the opportunity. Anthropic, another AI powerhouse rumored to be exploring funding at a staggering $350 billion valuation, topped the list of companies attendees were willing to support.

Understanding the Bubble Dynamics

The consensus at the conference appears to be that we are indeed in an AI bubble—however, this isn’t necessarily a cause for alarm. Ilya Fushman, a partner at Kleiner Perkins, noted that every technological wave contains elements of a bubble, raising the critical question of which companies will endure and thrive post-bubble.

Elad Gil, a solo venture capitalist, compared the current landscape to the dot-com boom and bust of the late 1990s, suggesting that while many companies will collapse, a select few will achieve generational success. As investors like Gil and Fushman dissect the viability of firms like Perplexity, they are tasked with predicting whether it will emerge as a dominant player akin to Google or fade into obscurity like Altavista.

As the AI landscape continues to evolve, understanding these dynamics will be crucial for stakeholders in the industry. The discussions at the Cerebral Valley AI Conference not only reflect current sentiment but also signal the importance of maintaining a critical perspective in the face of rapid growth and hype.

See also Pathologist Dr. Matose Reveals Ethical Challenges of AI in Healthcare at AMP 2025

Pathologist Dr. Matose Reveals Ethical Challenges of AI in Healthcare at AMP 2025 Leaked Documents Reveal OpenAI Paid Microsoft $493.8M in 2024, Spending Surges to $8.65B

Leaked Documents Reveal OpenAI Paid Microsoft $493.8M in 2024, Spending Surges to $8.65B AI-Created Song “Walk My Walk” Tops Billboard Country Chart, Sparking Industry Debate

AI-Created Song “Walk My Walk” Tops Billboard Country Chart, Sparking Industry Debate Vine Reboots as DiVine, Banning AI-Generated Content and Reviving 100.000 Clips

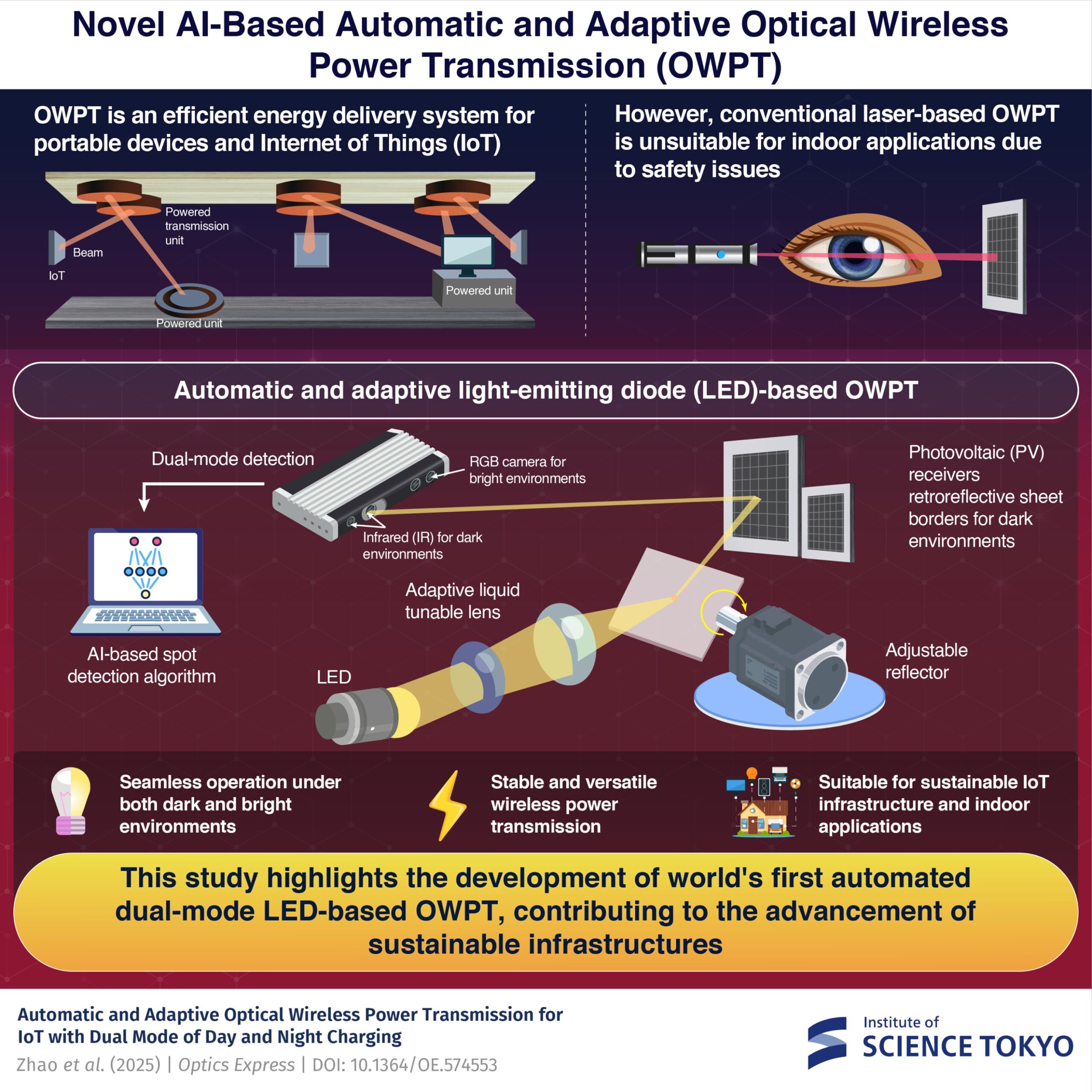

Vine Reboots as DiVine, Banning AI-Generated Content and Reviving 100.000 Clips Institute of Science Tokyo Unveils LED-Based Wireless Power System for Indoor IoT Devices

Institute of Science Tokyo Unveils LED-Based Wireless Power System for Indoor IoT Devices