Baidu is making significant strides in the competitive landscape of artificial intelligence with its new AI chip strategy, aimed at positioning the company as a strong contender against industry leader Nvidia. This strategic pivot underscores Baidu’s commitment to advancing its technological capabilities as the demand for AI solutions escalates. Analysts and investors alike are closely monitoring Baidu’s initiatives, recognizing the potential implications for the broader Asian tech sector.

Baidu’s focus on AI chip development marks a pivotal moment in its technology strategy. The company is concentrating on enhancing processing power while simultaneously reducing energy consumption, a move that could distinguish it from Nvidia, which has historically dominated the graphics processing unit (GPU) market. This initiative is in line with global trends that prioritize efficiency and sustainability, reflecting a growing demand for energy-efficient technologies. By embracing this strategy, Baidu aims not only to compete but also to stimulate innovation within the AI landscape.

The challenge of competing with Nvidia is substantial. The latter has established a strong market presence through its cutting-edge GPU technologies, which are integral to numerous AI applications. However, Baidu’s efforts to create more energy-efficient chips may capture the attention of investors looking for alternatives to Nvidia’s offerings. As AI applications proliferate across various industries, the race to lead in AI chip technology is intensifying, and Baidu’s entry could herald a new wave of innovation and market growth.

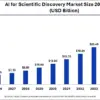

Looking ahead, the global AI market is poised for significant expansion, providing ripe opportunities for companies like Baidu. Industry forecasts suggest considerable growth in the AI sector over the next five years, aligning perfectly with Baidu’s proactive move to develop specialized AI chips. This strategic decision not only aims to enhance Baidu’s market presence but also highlights the potential profitability of tapping into emerging AI opportunities across sectors including healthcare, finance, and entertainment.

As Baidu forges ahead with its AI chip strategy, its stock (BIDU) has experienced moderate price fluctuations, currently resting at $116.34. While the stock remains relatively stable, Baidu’s ventures into AI chip technology could bolster investor confidence. Analysts have issued a general ‘Buy’ consensus on the stock, indicating optimism about Baidu’s strategic direction amidst ongoing market uncertainties. The company’s initiatives resonate with tech investors, who see alignment with anticipated trends in AI development.

Baidu’s entry into the AI chip arena signifies more than just a competitive strategy; it represents a long-term vision to secure a leadership role in AI technology. By diversifying its technological capabilities, Baidu is not only positioning itself for immediate gains but is also laying the groundwork for future innovations. The implications of this move extend beyond Baidu itself, potentially reshaping the competitive dynamics within the AI industry.

As Baidu continues to evolve its strategy, its journey will be closely watched by analysts and investors looking for insights into the future of AI technology. Leveraging tools from AI-powered platforms such as Meyka can provide valuable real-time updates and predictive analytics, aiding investors in navigating these changes effectively. The unfolding narrative surrounding Baidu’s AI advancements will undoubtedly influence market perceptions and investor strategies in the coming years.

FAQs

What is Baidu’s AI chip strategy?

Baidu’s AI chip strategy involves developing efficient, high-performance chips aimed at improving AI application processing. This strategy aims to position Baidu as a major competitor against leading companies like Nvidia.

How does Baidu’s AI focus affect its market position?

Baidu’s AI focus strengthens its market position by aligning with global trends favoring AI technology. This strategic move could enhance investor confidence and expand Baidu’s influence in the tech industry.

Is Baidu successfully competing with Nvidia?

While Baidu is still developing its AI chip technology, its focus on energy efficiency could offer competitive advantages. The success of this strategy will depend on its execution and market adoption.

What are the growth prospects for the AI market?

The AI market is expected to grow significantly, offering opportunities for firms investing in AI technology. Baidu’s entry into the AI chip space positions it well to capitalize on this growth.

See alsoDisclaimer:

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.

AI Unveils New Lion Roar, Enhancing Species Monitoring with 95.4% Accuracy

AI Unveils New Lion Roar, Enhancing Species Monitoring with 95.4% Accuracy Character.ai Launches Stories Feature for Teens, Navigates COPPA Compliance Challenges

Character.ai Launches Stories Feature for Teens, Navigates COPPA Compliance Challenges NYC Nurses Slam Hospitals for AI Rollout, Claiming Job Threats and Patient Risks

NYC Nurses Slam Hospitals for AI Rollout, Claiming Job Threats and Patient Risks APJ’s AI Investment Set to Surge Nearly 100% by 2028, Ushering Agentic Era Transformation

APJ’s AI Investment Set to Surge Nearly 100% by 2028, Ushering Agentic Era Transformation Alphabet Surges to $320 with Gemini 3 and TPU Expansion, Targets $5 Trillion Valuation

Alphabet Surges to $320 with Gemini 3 and TPU Expansion, Targets $5 Trillion Valuation