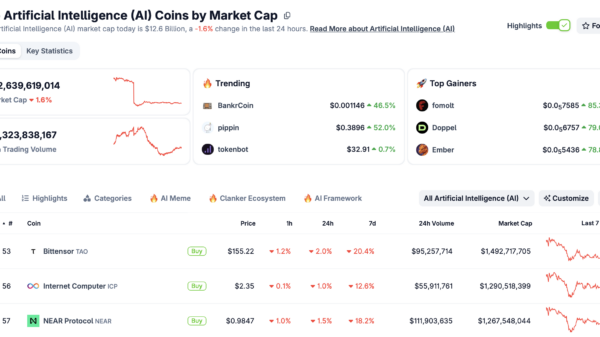

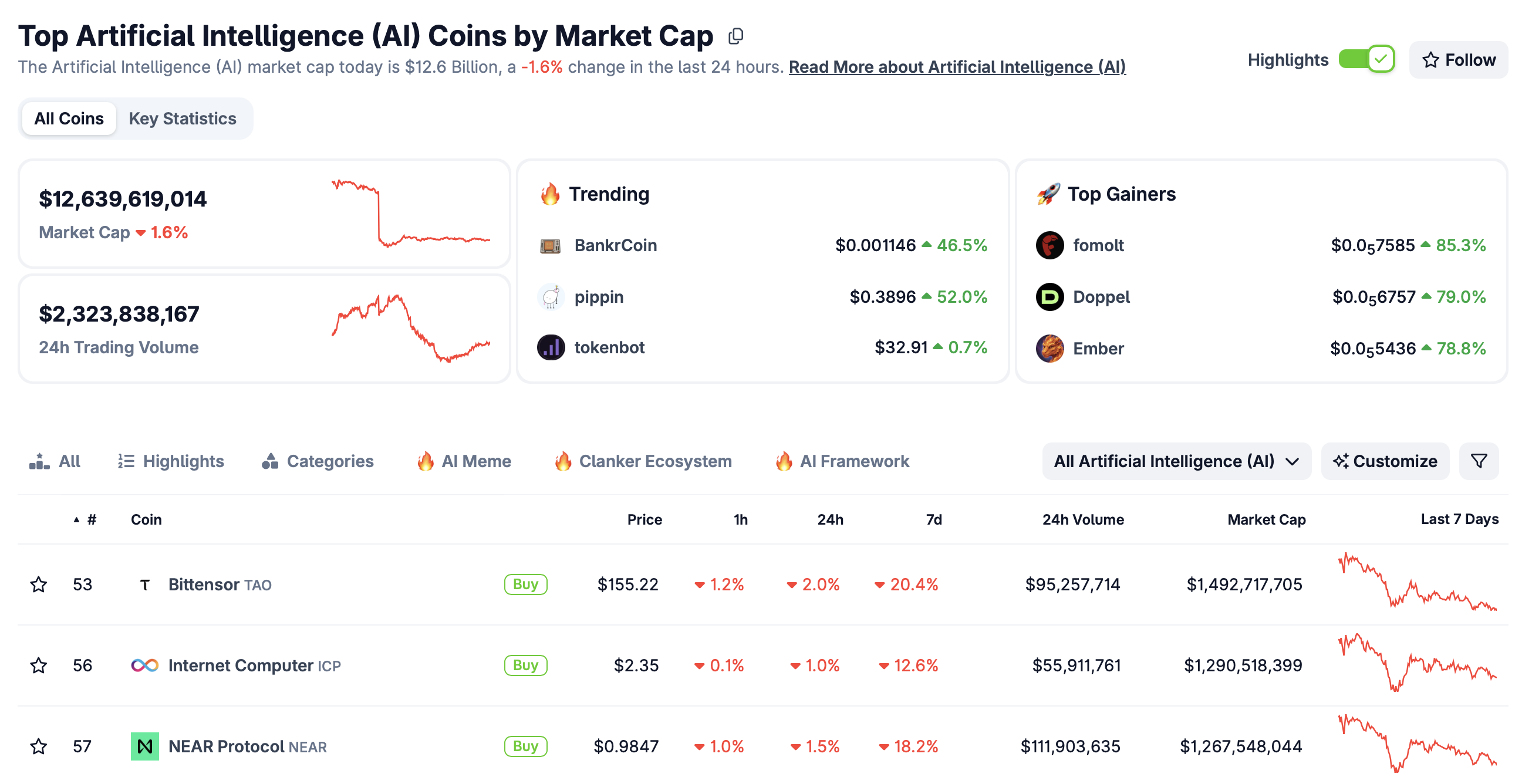

The market capitalisation of the Artificial Intelligence (AI) cryptocurrency segment has stabilised above $12.6 billion amidst a prolonged sell-off. This stability comes as larger coins like Bittensor (TAO) and Internet Computer (ICP) continue to face downward pressure, contributing to a risk-off sentiment that has gripped the broader cryptocurrency market.

However, lesser-known cryptocurrencies such as BankrCoin (BNKR) and Pippin (PIPPIN) are drawing investor attention as they demonstrate resilience. Pippin has surged over 45% to trade at $0.3998, while BankrCoin is holding steady above $0.00100, reflecting an increase of over 22% in intraday trading.

Despite the overall downturn, the AI crypto market remains robust, with Bittensor trading at $155, down 20% over the past week, and Internet Computer at $2.35, down more than 12% in the same period. The AI segment’s market capitalisation has experienced a slight decline of 1.6% in the last 24 hours.

BankrCoin’s recent price activity has garnered significant attention, particularly as it reached an intraday high of $0.001233. This price movement is bolstered by rising retail interest, as evidenced by an uptick in futures Open Interest (OI), which averaged $660,000 on Tuesday, slightly below the record $682,000 set on Monday. An increase in OI signals trader confidence in BNKR’s capacity to maintain this rally.

The Moving Average Convergence Divergence (MACD) indicator supports a bullish short-term outlook for BankrCoin, remaining above the signal line and indicating momentum in favour of buyers. The expanding green histogram bars further suggest that bullish sentiment is building. Traders are eyeing key price targets including the intraday high at $0.001233 and potential price discovery past this level.

While bullish momentum is evident, caution is warranted with the Relative Strength Index (RSI) at 70, indicating potential overbought conditions. A pullback below the immediate support level of $0.00100 could accelerate a correction towards $0.00095, a level tested earlier in the day.

Pippin’s performance has also been noteworthy, trading near its intraday high of $0.4024 as bullish momentum solidifies. The token remains above a descending trendline with established support at $0.3000. Its technical structure is robust, with the MACD well above its signal line and expanding green histogram bars encouraging traders to maintain risk despite an overbought RSI of 82.5 on the daily chart.

Key support for Pippin above $0.4000 is critical to sustaining its bullish trajectory, with the next resistance level identified at $0.4162. Further milestones include targets at $0.4500 and the record high of $0.5535.

The broader implications of these movements underscore a shifting landscape within the cryptocurrency market, where investor interest is increasingly gravitating towards emerging tokens even as established coins face volatility. This trend may indicate a diversification in investment strategies as traders seek opportunities in less mainstream assets.

As the cryptocurrency market evolves, the dynamics between established and emerging tokens will continue to shape investor strategies, revealing insights into market sentiment and potential future directions.

BankrCoin | Pippin | CoinMarketCap

See also AI’s Rise Threatens Democracy: Authoritarian Regimes Leverage Technology for Control

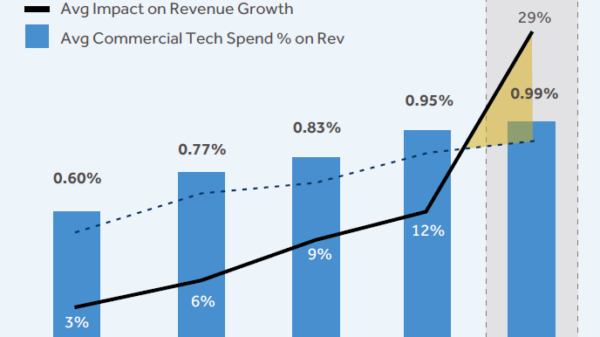

AI’s Rise Threatens Democracy: Authoritarian Regimes Leverage Technology for Control Commercial AI Spending Soars, Yet 90% of Firms Report Low Revenue Impact

Commercial AI Spending Soars, Yet 90% of Firms Report Low Revenue Impact Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032