Cisco Systems, the company that built much of the internet’s backbone, is making a substantial move into artificial intelligence (AI), integrating it as a foundational element across its networking hardware, collaboration tools, and security architecture. These initiatives, revealed through a series of recent product announcements and strategic investments, indicate that Cisco is positioning itself for what it perceives to be the future of enterprise technology. This future, according to the company, will be shaped not just by the quality of AI models, but by the infrastructure built to support them.

The San Jose-based networking giant has launched an extensive array of products that spans virtually every aspect of its portfolio, from AI-optimized switches and routers to intelligent collaboration devices and updated security frameworks. Collectively, these announcements signify a corporate strategy grounded in the belief that enterprises will require fundamentally different infrastructure to effectively manage AI workloads, and Cisco aims to be the vendor that fulfills this need.

Recent reports from TechRepublic detail Cisco’s introduction of AI-powered collaboration devices and enhanced networking infrastructure tailored for AI workloads. The company is presenting itself as an essential provider for businesses seeking to deploy AI at scale, asserting that without updated infrastructure, even sophisticated AI models may struggle or fail.

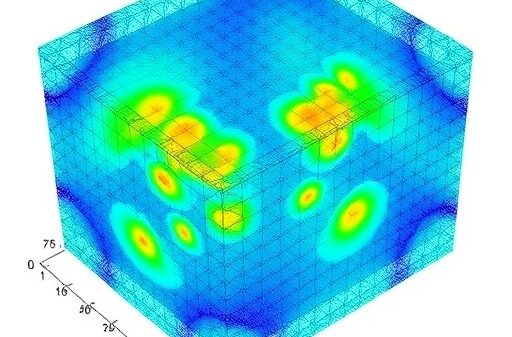

At the core of Cisco’s strategy is an understanding that AI workloads impose distinct demands on networks compared to traditional enterprise applications. AI training and inference necessitate the swift transfer of vast amounts of data between GPUs, storage systems, and end-user devices. Challenges like network congestion and packet loss, often manageable in typical environments, become critical issues when AI models are involved. Cisco’s new offerings aim to tackle these problems directly, featuring specialized silicon, intelligent traffic management, and AI-native security protocols.

The company’s collaboration portfolio, including its well-known Webex devices and software, is undergoing a significant transformation with the integration of AI capabilities. New features such as real-time translation, intelligent noise cancellation, and automated meeting summaries represent a shift in how meeting rooms and collaboration spaces are expected to function. These enhancements leverage on-device AI processing, which offers lower latency and increased privacy by reducing reliance on cloud processing. This design choice resonates with growing enterprise concerns about sharing sensitive data with external servers, as noted by TechRepublic.

Perhaps more crucial than the collaboration upgrades is Cisco’s investment in AI-optimized networking infrastructure. The company is developing new switching and routing platforms designed specifically to manage the unique traffic patterns generated by AI workloads. Unlike traditional data center networks optimized for north-south traffic, AI workloads create substantial east-west traffic as GPUs communicate during model training and inference. Cisco’s new infrastructure products respond to this trend with higher-bandwidth fabrics, lower-latency switching, and intelligent load balancing adapted to the unpredictable nature of AI traffic.

In addition, Cisco’s commitment to Ethernet-based networking solutions positions it against competitors like Nvidia, which has traditionally dominated the space with its proprietary InfiniBand technology. By advocating for open standards, Cisco is betting that enterprises will favor the flexibility and cost benefits of Ethernet over proprietary systems, despite potential trade-offs in performance.

Cisco’s AI strategy also spans cybersecurity, an area where the company has aggressively invested through both organic growth and acquisitions. Organizations must secure not only their AI systems – including models and training data – but also leverage AI to enhance their overall security. Cisco’s new offerings utilize AI to expedite threat detection, automate incident responses, and identify vulnerabilities in increasingly intricate hybrid environments. This integrated security approach is particularly critical, as AI systems introduce new attack surfaces, making traditional security tools inadequate.

The landscape for AI infrastructure is becoming increasingly competitive, with rivals like Arista Networks and Juniper Networks (now being acquired by Hewlett Packard Enterprise) also targeting this market. Meanwhile, Nvidia is extending its reach into networking through its Spectrum-X Ethernet platform, establishing itself as a formidable competitor. Cisco differentiates itself with a comprehensive solution that encompasses campus networking, data center switching, wide-area networking, collaboration, and security, all enhanced with AI capabilities.

For Cisco, this push into AI is not merely a strategic choice but a financial necessity. The company has faced a challenging period characterized by inventory adjustments among enterprise customers and intensifying competition within its core networking markets. AI represents a potential growth engine capable of reinvigorating demand for Cisco’s products. Wall Street is monitoring whether the company can turn its AI ambitions into tangible revenue, as CEO Chuck Robbins has framed this transition as a generational opportunity akin to the rise of the internet. Cisco’s recent $28 billion acquisition of Splunk, a data observability platform, is viewed as a strategic move to bolster its AI capabilities.

As enterprise IT leaders navigate these changes, Cisco’s focus on AI infrastructure raises critical questions about modernization and vendor selection. Delaying infrastructure updates could hinder organizations’ ability to deploy AI effectively. Analysts suggest a holistic evaluation of AI infrastructure needs, weighing not just performance but also security and integration with existing systems. While Cisco’s full-stack offering is compelling, enterprises must also consider the advantages of open, multi-vendor strategies as the technology evolves. The infrastructure layer has become essential for unlocking enterprise AI potential, positioning Cisco at the forefront of this pivotal conversation.

See also Alibaba Faces Overload Crisis Amid AI Shopping Surge and Robotics Breakthrough

Alibaba Faces Overload Crisis Amid AI Shopping Surge and Robotics Breakthrough Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032 Satya Nadella Supports OpenAI’s $100B Revenue Goal, Highlights AI Funding Needs

Satya Nadella Supports OpenAI’s $100B Revenue Goal, Highlights AI Funding Needs