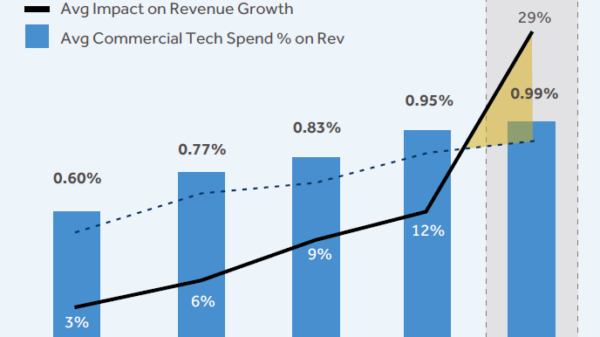

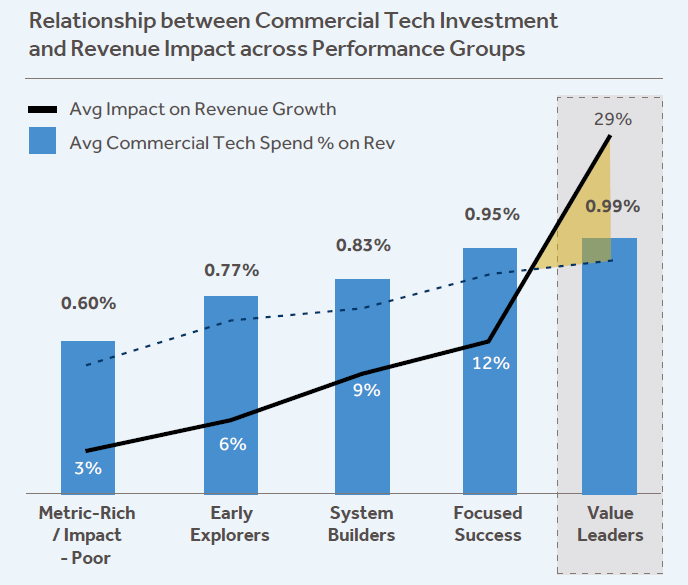

As companies increasingly invest in Commercial AI, a common misunderstanding persists: higher spending does not automatically equate to greater value creation. A recent survey conducted in late 2025 among over 150 commercial leaders reveals that organizations, regardless of their investment levels in Commercial AI, report similar, or even diminished, impacts on revenue growth. This trend emphasizes that merely increasing expenditure on AI tools is insufficient for driving meaningful results.

Among the 87% of companies still in the early stages of deploying Commercial AI, many have experienced limited success. These organizations often report inconsistent outcomes, which feeds into a broader skepticism regarding the reliability of AI in commercial applications. However, within this group, a subset of companies has begun to achieve significantly better results than their peers. Interestingly, the differentiation between high-impact and low-impact performers does not stem from the tools they use or the amount they spend, but rather from the targeted use of their investments.

Successful companies prioritize foundational capabilities essential for AI initiatives to thrive. These foundational investments focus on several key areas including improving data quality and accessibility, clarifying ideal customer profiles, standardizing core commercial workflows, and clearly delineating between human judgment and system-driven decisions. Without these elements in place, AI often yields inconsistent insights and limited adoption, reinforcing the notion that AI “doesn’t work.” Conversely, when foundational elements are established, even modest AI deployments can begin to show promising results.

Once organizations advance beyond this initial threshold of readiness, the dynamics shift dramatically. Companies identified as Value Leaders—those reporting more than 15% impact on revenue growth from Commercial AI—exhibit a marked increase in both investment levels and the number of deployed AI solutions. Notably, this increase is not characterized by indiscriminate tool acquisition, but rather a strategic shift in how AI is integrated into their operations.

Value Leaders tend to embed predictive capabilities powered by machine learning into their core workflows. This encompasses initiatives such as identifying customers at risk of churn and enhancing forecast accuracy. By prioritizing execution-enabling use cases like sales enablement and management, these companies reinforce the interconnected nature of their commercial processes. The result is a significant improvement in operational efficacy, marking an inflection point rather than a simple linear enhancement.

Understanding the Commercial AI Inflection Point

The concept of the Commercial AI inflection point is pivotal in understanding the non-linear nature of returns from AI investments. This moment is defined not by technological sophistication but by operational readiness—where foundational elements are sufficiently robust to allow AI to add value instead of generating noise. Four conditions must be satisfied for this inflection point to occur: a well-defined sales process, repeatable workflows, directionally reliable data, and operationalized key performance indicators.

Before reaching this critical juncture, companies often find that discipline in workflow execution outweighs the importance of increased spending. Early investments in AI tend to yield minimal value, and it is only after organizations have established the necessary infrastructure that they begin to see substantial returns. As companies navigate their position along the Commercial AI readiness curve, the focus should not be on escalating expenditures but on fortifying the foundational components that will enable investment to create leverage rather than noise.

In essence, as companies grapple with the evolving landscape of Commercial AI, understanding their operational readiness may prove more crucial than their financial commitments. Those who recognize and act upon this principle are likely to differentiate themselves from competitors, turning what could be a noisy investment into a powerful tool for growth and efficiency.

See also Eversheds Sutherland Elevates US AI Chief to Lead Global AI Initiatives Amid Rapid Adoption

Eversheds Sutherland Elevates US AI Chief to Lead Global AI Initiatives Amid Rapid Adoption Seize Microsoft Stock at $400: Strong AI Growth and 39% Azure Surge Ahead

Seize Microsoft Stock at $400: Strong AI Growth and 39% Azure Surge Ahead Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032