ePlus Inc. reported on February 1, 2026, a strong financial performance for the latest quarter and the first nine months of the fiscal year. The Virginia-based technology firm raised its full-year 2026 net sales growth guidance to between 20% and 22% year over year, based on a base of US$2.01 billion. In conjunction with its financial updates, ePlus declared a quarterly dividend of US$0.25, provided details on its share repurchase activity, and expressed ongoing interest in acquisitions supported by a new universal shelf registration.

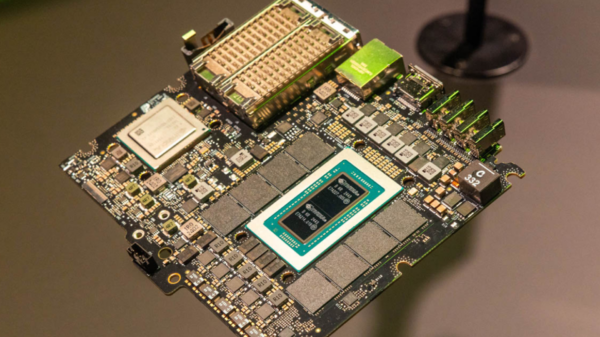

Investors may find interest in how ePlus is aligning its robust earnings momentum with plans to expand its offerings in AI-driven solutions, professional and managed services, as well as workplace transformation capabilities. The company aims to pursue growth through both organic investments and potential mergers and acquisitions (M&A). This shift toward integrated technology solutions comes as the demand for AI and related services surges amid a broader industry supercycle.

The latest quarterly results reinforced ePlus’s narrative as a vital IT partner for organizations looking to integrate AI, cloud, networking, and security solutions. The increase in revenue and earnings provides a solid foundation for management’s optimistic sales forecast. However, the company’s focus on executing AI-driven projects and efficiently integrating future acquisitions will be pivotal in determining its ongoing success. The new universal shelf registration not only signifies ePlus’s acquisition ambitions but also emphasizes its commitment to disciplined capital allocation, mitigating the risk associated with overpaying for growth.

Despite the positive trajectory, ePlus’s shares have gained traction but may still be undervalued—potentially by as much as 30%. The Simply Wall St Community values ePlus between US$108 and US$124.84, based on differing fair value estimates. This disparity highlights the varying perspectives on the company’s future potential, particularly in light of its enhanced growth guidance and strategic acquisition plans. Investors are urged to consider multiple viewpoints as they evaluate how ePlus fits into their portfolios.

While the evolving narrative around ePlus is compelling, potential investors should also be mindful of how future acquisitions could reshape the company’s risk profile. The firm’s ongoing efforts to expand its AI and managed services capabilities will require not only investment but also careful integration of any acquired entities. This will be crucial in maintaining momentum in a highly competitive market.

As ePlus positions itself within the ongoing AI infrastructure supercycle, it offers a unique blend of growth potential and emerging technology solutions. The market remains dynamic, with a strong focus on AI infrastructure and related services. Investors looking for opportunities in this space might consider ePlus as part of their strategy to capitalize on the evolving landscape.

In summary, ePlus Inc. stands at a pivotal juncture as it seeks to leverage its strong earnings and expansion plans to solidify its role as a leader in integrated technology solutions. The company’s proactive approach to capital allocation, coupled with its focus on AI-driven services, may offer significant upside as it navigates the complexities of the technology sector.

For those interested in the broader implications of the AI supercycle and how companies like ePlus are positioned, further analysis can be found in reports from organizations such as MIT and IBM.

See also AI Revolutionizes HR Decisions: 60% of Managers Now Rely on AI for Promotions and Raises

AI Revolutionizes HR Decisions: 60% of Managers Now Rely on AI for Promotions and Raises Nvidia GB10 System Automates Reporting, Reducing Staffing Needs by Over 99%

Nvidia GB10 System Automates Reporting, Reducing Staffing Needs by Over 99% Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032