GeekStake has unveiled its latest feature, the Market Stability & Staking Resilience Report, which provides a comprehensive analysis of how AI-assisted staking tools navigate extreme market fluctuations. This study focuses on major digital assets, particularly Bitcoin (BTC) and Ether (ETH), revealing how automated systems react during periods of significant volatility, network congestion, and changes in validator activity.

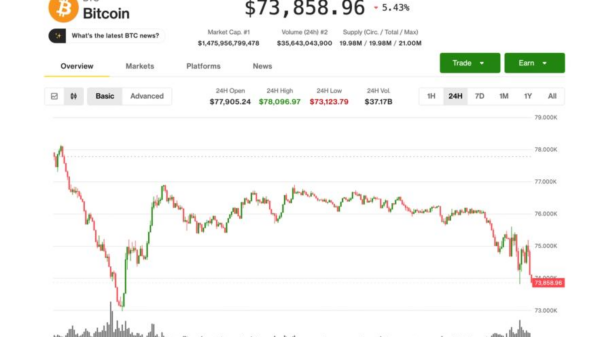

Recent market dynamics have seen rapid corrections followed by quick recoveries in major cryptocurrencies. The report indicates that these fluctuations have had a direct impact on validator performance, network throughput, and liquidity across various proof-of-stake ecosystems. As validator performance can vary amidst peak volatility, the necessity for AI-driven tools that adapt proactively becomes clear, especially when manual interventions prove inadequate.

Operational Insights from GeekStake

GeekStake has shared updated operational metrics about its ecosystem infrastructure, highlighting its management of a significant pool of staked digital assets and a diverse global user base. The platform aims to simplify participation and streamline settlement processes while minimizing common risks associated with decentralized environments.

Its automated reward-distribution system allows users to monitor staking outcomes transparently, fostering trust among participants. Additionally, an integrated referral structure encourages community engagement, aligning with GeekStake’s mission to make staking more accessible while ensuring a secure environment for its users.

Currently, GeekStake’s Ethereum staking infrastructure manages approximately $130 million in staked assets. Users, including its more than 250,000 global participants, can start earning daily rewards by creating an account and securing their login details. Following this, participants can transfer supported digital assets like ETH, SOL, DOT, and more, selecting a staking duration that suits their preferences. Rewards are processed on a standard daily cycle, and users have the option to automate the withdrawal process.

Enhanced Stability with AI Tools

A focal point of the report is the AI-based model that GeekStake employs to monitor risk indicators, reward-band variability, and validator health metrics. These advanced systems assess block-propagation patterns, identify irregular transaction intervals, and measure deviations in network latency.

During the recent market downturn, the AI tools identified several temporary anomalies, such as unexpected fee spikes and unusual transaction timings, which were later stabilized as network conditions normalized. By contrasting real-time contract behavior with historical baselines, GeekStake’s anomaly-detection engine plays a crucial role in the early identification of operational irregularities, aiding developers and infrastructure teams in maintaining reliability even under unpredictable market conditions.

“The recent BTC and ETH cycle highlighted how quickly operational conditions can shift in decentralized environments. Our intention with this report is to share transparent data on how automated systems can help maintain stability and reduce operational disruptions during periods of elevated risk,” said a GeekStake spokesperson.

Despite the steep short-term declines in asset prices, GeekStake observed that the core fundamentals of major networks remained stable, particularly with consistent validator uptime. As market conditions started to stabilize, participation levels began to rebound, underscoring the critical need for resilient infrastructure capable of operating effectively in both downturns and recoveries.

Looking ahead, GeekStake plans to release quarterly editions of the Market Stability & Staking Resilience Report, which will include expanded cross-chain metrics and an in-depth analysis of validator performance trends. The reports will also feature technical appendices detailing methodologies related to stress classification, validator scoring, and network behavior modeling.

For media inquiries, please contact GeekStake at [email protected] or visit their website at geekstake.com.

Disclaimer: The information provided in this press release does not constitute investment advice, solicitation, or a trading recommendation. Readers are encouraged to conduct independent research and consult professional financial advisers before participating in cryptocurrency or digital asset investments.

See also Theologian Urges Catholic Bishops to Address AI’s Ethical Risks and False Comforts

Theologian Urges Catholic Bishops to Address AI’s Ethical Risks and False Comforts Microsoft AI CEO Mustafa Suleyman Critiques Cynicism Surrounding AI Advances

Microsoft AI CEO Mustafa Suleyman Critiques Cynicism Surrounding AI Advances AMD Surges 99% in 2025, Outpacing Nvidia and Broadcom in AI Chip Market

AMD Surges 99% in 2025, Outpacing Nvidia and Broadcom in AI Chip Market Yungblud Sparks Debate on AI’s Impact at Future of Music Event with THR and Frost School

Yungblud Sparks Debate on AI’s Impact at Future of Music Event with THR and Frost School