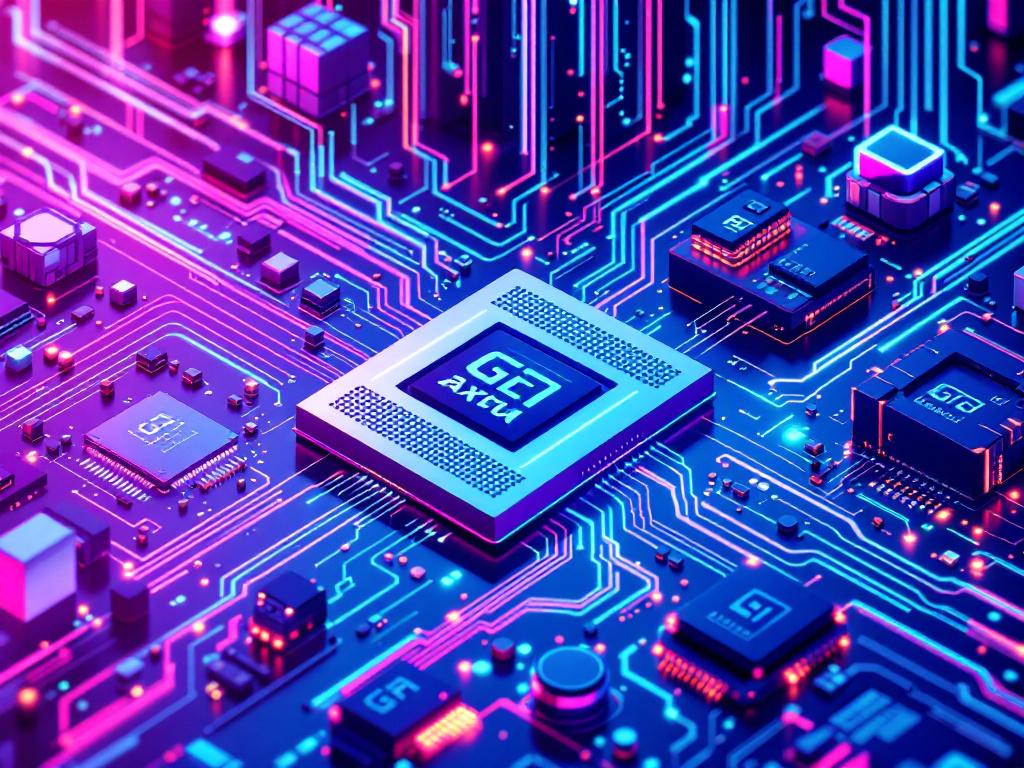

In a significant shift that could alter the landscape of the artificial intelligence economy, Alphabet Inc. is ramping up efforts to design its own semiconductor chips, posing a challenge to established players like Nvidia. The tech giant’s latest offerings, the Arm-based Axion CPU and the new generation of Tensor Processing Units (TPUs), indicate a strategic pivot away from reliance on external hardware suppliers, including Intel and AMD. This move comes at a time when demand for AI processing power surges, pushing Nvidia’s market capitalization to over $2 trillion, creating a dependency that hyperscale cloud providers like Google seek to break.

Recent reports suggest growing tensions between Google and its hardware partners, primarily due to Google’s aggressive push into custom silicon. As highlighted by The Information, this shift not only aims to diminish reliance on Nvidia but also represents a bold declaration of independence from the x86 architecture. While continuing to offer Nvidia’s GPUs to its cloud clients, Google intends to optimize its costs and operational efficiency by integrating its own chips into its extensive data centers.

The economic rationale for this shift is clear: training advanced AI models is notably expensive, requiring thousands of chips that consume significant amounts of electricity over long periods. By deploying the Axion CPU, built on the Arm Neoverse V2 architecture, Google claims to achieve up to 30% better performance compared to existing general-purpose Arm-based instances and up to 50% better performance with 60% greater energy efficiency than current x86-based alternatives. Given the scale at which Google operates, these enhancements could yield substantial operational savings.

Moreover, the tight integration of the Axion CPU with Google’s TPU infrastructure allows the company to eliminate data transfer bottlenecks inherent in mixed-vendor setups. The new architecture is designed to optimize memory bandwidth and reduce latency, making it particularly attractive for large language models (LLMs) like Gemini. This approach presents a direct challenge to Nvidia’s newer GH200 Grace Hopper Superchip, which seeks to create an all-Nvidia ecosystem.

Turning to the TPU v5p, Google aims to directly compete with Nvidia’s dominance in the AI processing market. The TPU v5p is designed for scalability, with the ability to interconnect thousands of chips through a novel optical switching network, outperforming traditional InfiniBand networks. By offering this flexibility, Google positions itself not just as a chip provider but as a holistic supercomputer-as-a-service solution, abstracting away much of the underlying complexity for users.

Software lock-in also plays a critical role in this competitive landscape. While Nvidia has dominated with its CUDA platform, Google is advocating for open ecosystems like Kubernetes and the OpenXLA compiler. This strategy aims to facilitate easier transitions for developers between different hardware architectures, potentially weakening Nvidia’s grip on the developer community. High-profile startups, facing long wait times for Nvidia’s H100 chips, are increasingly willing to explore alternatives like TPU pods.

Industry Response and Future Implications

Google’s movement toward silicon independence is not occurring in isolation. The company has formed a strategic partnership with Broadcom, which supplies critical high-speed input/output blocks and manages manufacturing through TSMC. This collaboration enables Google to accelerate its chip development timelines and adapt quickly in a fast-evolving market. Reports indicate that Google is increasing orders with Broadcom, signaling an inflection point in custom silicon presence within its data centers.

As Google and other major players, including Microsoft with its Maia and Cobalt chips, and Meta with its MTIA silicon, react to these market shifts, the data center landscape is becoming increasingly fragmented. The era of standardized systems is fading, replaced by custom architectures tailored for specific workloads. If Google transitions a significant portion of its AI workloads to its Axion and TPU systems, it could lead to substantial revenue losses for Nvidia.

However, this transition is fraught with challenges. High-performance silicon development is notoriously complex, with the potential for delays and other issues that could impede progress. Google must demonstrate that its Axion CPU can effectively handle the diverse demands of enterprise workloads, not just the more predictable tasks associated with its core services like search. Additionally, convincing third-party software vendors to optimize for this new architecture represents a significant hurdle.

The implications of Google’s silicon strategy extend beyond immediate market competition. By diversifying its semiconductor supply, the company enhances its resilience against supply chain shocks, which are increasingly tied to geopolitical instabilities. Custom-designed chips that can be produced by multiple foundries may offer Google a strategic advantage in this unpredictable environment.

Ultimately, the introduction of the Axion and the expansion of the TPU lineup signify a pivotal evolution in cloud business models. As AI becomes the predominant workload for the coming decade, the traditional notion of general-purpose chips may become obsolete. The clash between Google and Nvidia marks a broader ideological divide over the future of computing, where the outcome will not only dictate pricing structures but also shape the pace of innovation in the burgeoning field of artificial intelligence.

For more information, visit Google, Nvidia, and Broadcom.

See also AI Could Automate 57% of U.S. Work Hours, Yet Human Skills Remain Essential, McKinsey Reports

AI Could Automate 57% of U.S. Work Hours, Yet Human Skills Remain Essential, McKinsey Reports ChatGPT and Grok Clash in $1 Million Stock-Picking Challenge for AI Supremacy

ChatGPT and Grok Clash in $1 Million Stock-Picking Challenge for AI Supremacy HGC Launches Strategic AI Transformation to Drive Innovation and Market Leadership

HGC Launches Strategic AI Transformation to Drive Innovation and Market Leadership OpenAI Unveils “Calm Tech” Device, Launches AI Shopping Tool Amid Amazon’s $50B AI Surge

OpenAI Unveils “Calm Tech” Device, Launches AI Shopping Tool Amid Amazon’s $50B AI Surge Jim Cramer Analyzes Oracle’s OpenAI Partnership Amidst AI Market Competition

Jim Cramer Analyzes Oracle’s OpenAI Partnership Amidst AI Market Competition