MyOme announced a significant collaboration with Illumina in December 2025 aimed at advancing proactive healthcare. This partnership will underpin the Proactive Health Trial, which plans to test the integration of whole-genome sequencing and AI-driven risk models across a spectrum of diseases, including common, chronic, and rare conditions. Enrollment for the trial is set to commence in 2026. By uniting Illumina’s extensive population-scale sequencing capabilities with MyOme’s advanced risk assessment tools, the collaboration underscores a broader movement towards personalized healthcare interventions, which could potentially mitigate a substantial portion of the approximately US$5 trillion that the U.S. allocates annually to healthcare.

As the healthcare landscape evolves, the implications of Illumina’s backing for MyOme’s AI-enabled whole-genome risk models may reshape its investment narrative and long-term growth prospects. To maintain a stake in Illumina, investors must recognize that sequencing is pivotal as both a research and clinical care infrastructure, and that the company is positioned to uphold its leadership in the expanding field of genomics. Though this collaboration bolsters the clinical and health economics narrative for Illumina, it does not significantly alter the immediate focus on stabilizing research demand or addressing challenges associated with competition and exposure to the Chinese market.

In conjunction with the MyOme initiative, Illumina has announced plans to launch its 5 base solution in October, targeting applications in multiomics, such as methylation analysis. This development could enhance Illumina’s role within clinical and population health workflows, further solidifying its commitment to high-value clinical applications despite existing pressures from softening research funding and increased competition in high- and mid-throughput sequencing.

However, as Illumina advances its clinical growth strategy, investors face the dual challenge of navigating potential headwinds from constrained research funding and ongoing geopolitical tensions affecting its Chinese operations. According to forecasts, Illumina is projected to achieve $4.8 billion in revenue and $873.5 million in earnings by 2028, representing a required annual revenue growth rate of 3.6% and a notable decrease in earnings of approximately $426.5 million from the current earnings of $1.3 billion.

The current market sentiment reveals a fair value estimate of $119.84 for Illumina’s stock, suggesting an 11% downside from its present price level. A review of multiple fair value assessments highlights a significant divergence in opinions within the investment community, with estimates ranging from approximately $102 to $181 per share. This variation emphasizes the importance of exploring diverse viewpoints regarding the company’s future performance, especially in light of its current challenges related to research funding and uncertainties surrounding its operations in China.

For investors contemplating Illumina, the opportunity exists to develop their own investment narratives, diverging from mainstream perspectives. With the potential for extraordinary returns often stemming from independent analysis, resources are available to assess key rewards that may impact investment decisions. Comprehensive analytical reports highlight the overall financial health of Illumina through user-friendly visual aids, assisting stakeholders in making informed choices.

As the healthcare and genomics sectors continue to advance, collaborations such as that between MyOme and Illumina may catalyze essential innovations in personalized medicine. Investors will need to remain vigilant, weighing the implications of these developments against the backdrop of potential market volatility and evolving competitive dynamics. Opportunities within the healthcare technology sphere are fleeting, and those keen on capitalizing on promising prospects should act decisively in their investment strategies.

See also Shanghai Composite Stabilizes Above 3,900 Amid AI IPO Surge and Policy Anticipation

Shanghai Composite Stabilizes Above 3,900 Amid AI IPO Surge and Policy Anticipation NEWMEDIA.COM Launches RankOS™ to Optimize Content for AI Answer Engines like Perplexity

NEWMEDIA.COM Launches RankOS™ to Optimize Content for AI Answer Engines like Perplexity Philippines’ AI Surge Demands Urgent Data Localization to Secure $12B GDP Growth Potential

Philippines’ AI Surge Demands Urgent Data Localization to Secure $12B GDP Growth Potential Insurers Shift from Silent AI Coverage to Explicit Policies Amid Evolving Risk Landscape

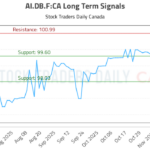

Insurers Shift from Silent AI Coverage to Explicit Policies Amid Evolving Risk Landscape Strategic Investment Insights: AI.DB.F Signals Reveal Key Trading Opportunities

Strategic Investment Insights: AI.DB.F Signals Reveal Key Trading Opportunities