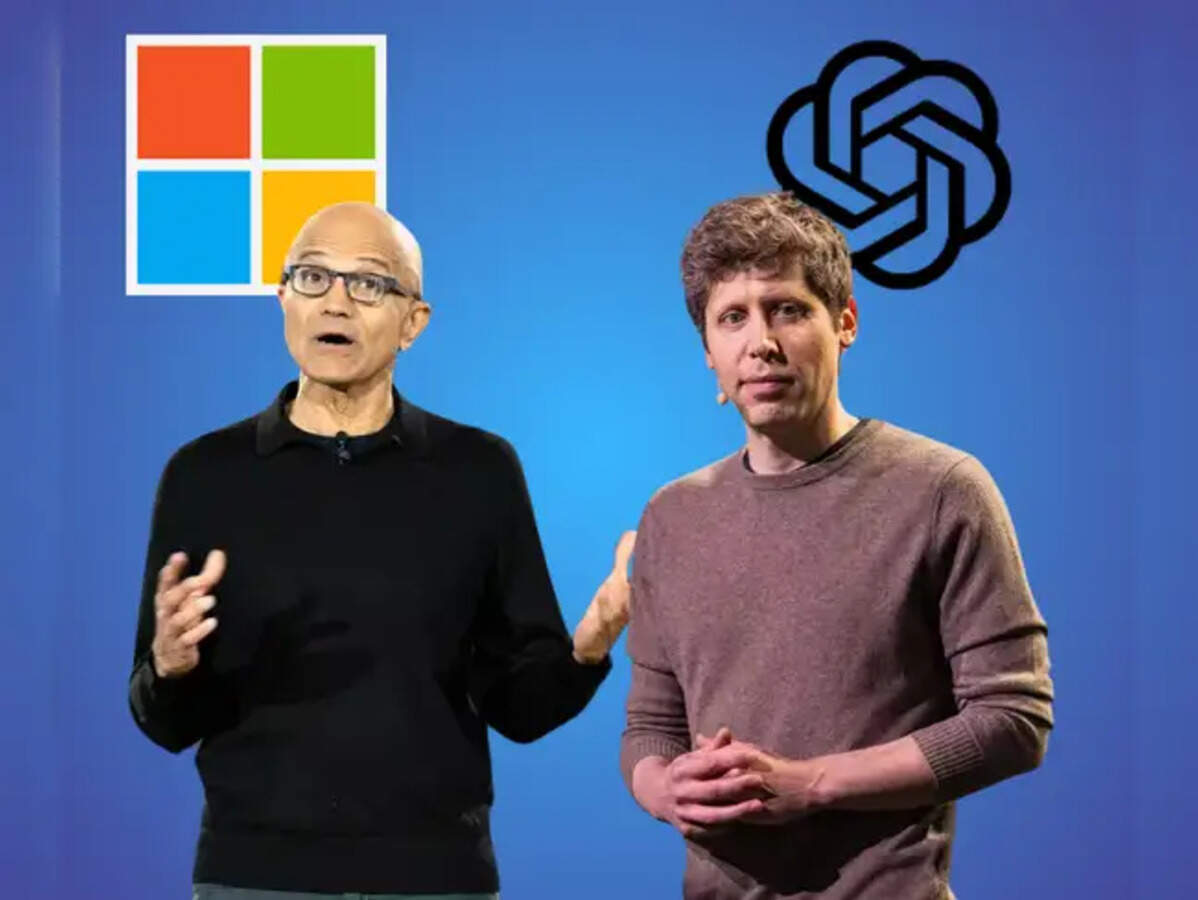

OpenAI has recently attracted renewed scrutiny following the leak of documents that shed light on its financial operations and relationship with Microsoft. These documents, disclosed by tech blogger Ed Zitron, reveal specific revenue figures and operational costs associated with OpenAI’s AI models over the past two years.

According to Zitron’s findings, Microsoft earned $493.8 million from OpenAI in 2024 through revenue-sharing arrangements. This amount surged to $865.8 million in the first three quarters of 2025. Citing unnamed sources, TechCrunch reported that OpenAI shares approximately 20% of its revenue with Microsoft as part of their large investment agreement.

Interestingly, the same sources indicated that Microsoft reciprocates by providing about 20% of revenue generated from its Bing and Azure OpenAI Service back to OpenAI. However, the internal adjustments made by Microsoft complicate the tracking of financial transactions between the two entities, making it challenging to gauge the full financial interplay.

OpenAI’s CEO, Sam Altman, has noted that the company’s annual revenue far exceeds the commonly cited figure of $13 billion. He even projected that OpenAI could achieve an annualized revenue run rate exceeding $20 billion by the end of 2025.

The leaked documents also outline the company’s significant expenditures, revealing that OpenAI spent approximately $3.8 billion on inference in 2024. For context, inference refers to the computational power required to run pre-trained models and generate user responses. This cost escalated to around $8.65 billion in just the first nine months of 2025. While most of this computing power is sourced from Microsoft Azure, OpenAI maintains agreements with other providers, including CoreWeave, Oracle, AWS, and Google Cloud.

A source quoted by TechCrunch mentioned that Microsoft often covers training costs through credits, while the inference costs are primarily settled in cash. This financial structure places a considerable burden on OpenAI, suggesting that their spending on inference may surpass their revenue.

The implications of these financial dynamics reveal the complex relationship between OpenAI and Microsoft, as well as the ongoing evolution of the AI industry. The high operational costs associated with inference highlight the challenges faced by AI companies in balancing revenue generation with substantial infrastructure expenses necessary for deployment and scalability.

As the AI landscape continues to develop, understanding these financial underpinnings will be crucial for stakeholders aiming to navigate the intricacies of partnerships and revenue-sharing models within this rapidly changing sector.

See also AI-Created Song “Walk My Walk” Tops Billboard Country Chart, Sparking Industry Debate

AI-Created Song “Walk My Walk” Tops Billboard Country Chart, Sparking Industry Debate Vine Reboots as DiVine, Banning AI-Generated Content and Reviving 100.000 Clips

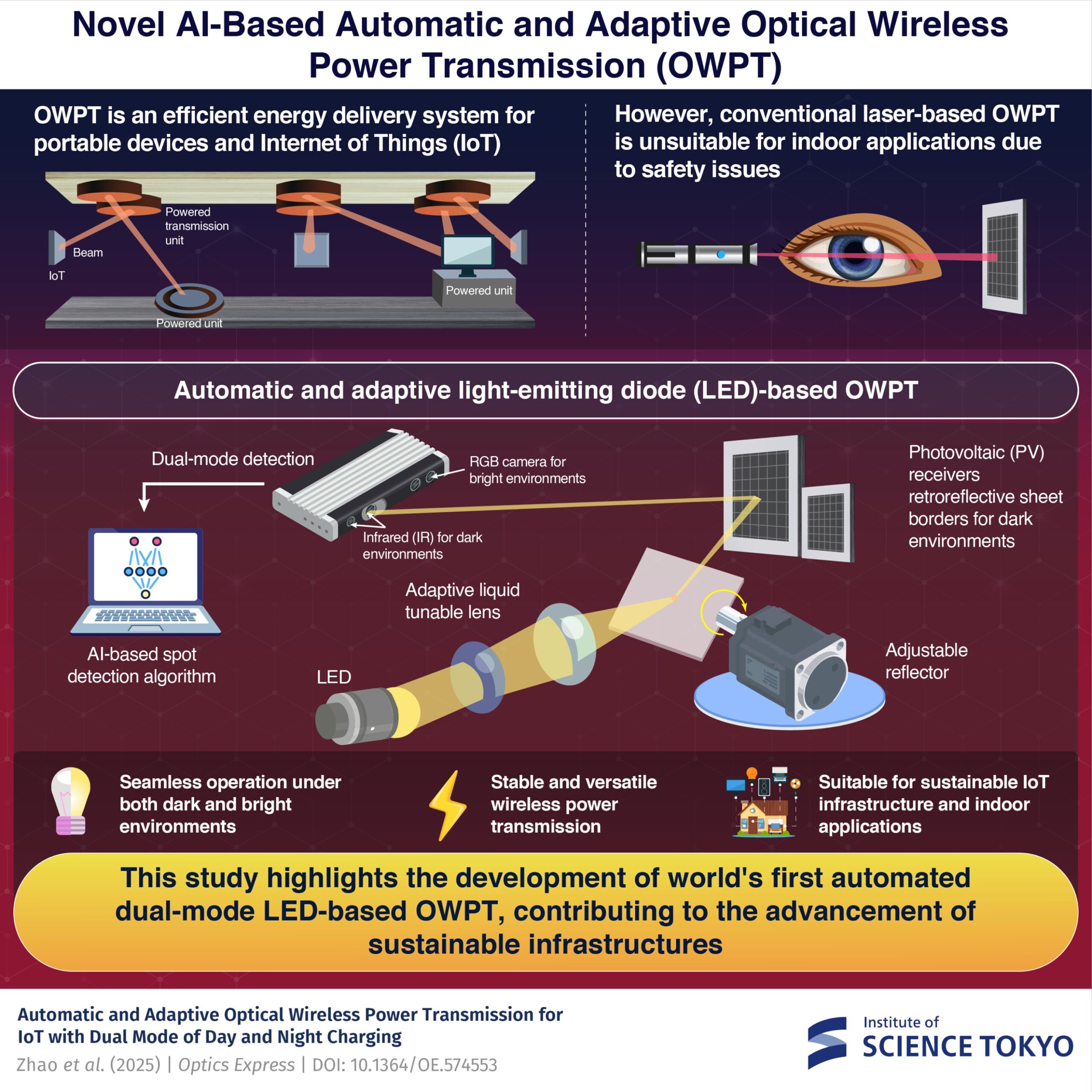

Vine Reboots as DiVine, Banning AI-Generated Content and Reviving 100.000 Clips Institute of Science Tokyo Unveils LED-Based Wireless Power System for Indoor IoT Devices

Institute of Science Tokyo Unveils LED-Based Wireless Power System for Indoor IoT Devices AI Enhances Colorectal Cancer Surgery Outcomes, Reveals Systematic Review Insights

AI Enhances Colorectal Cancer Surgery Outcomes, Reveals Systematic Review Insights