The race to dominate artificial intelligence (AI) is intensifying, placing Meta Platforms at the center of a narrative that captivates investors and the broader tech industry. As of early February 2026, Meta’s ambitious AI strategy has catapulted it to the forefront of Big Tech innovation, but its substantial spending and market volatility have raised questions about whether this strategy is a masterstroke or a precarious gamble.

According to The Motley Fool, Meta’s financial results reflect its AI-driven momentum. The company reported a remarkable 24% year-over-year revenue increase, reaching $59.9 billion in the fourth quarter of 2025, surpassing analyst expectations. Daily user engagement also soared, with an average of 3.58 billion “family daily active people” reported in December 2025. However, it is within these figures that the transformative impact of AI on Meta’s business model—and potentially the future of digital advertising—becomes apparent.

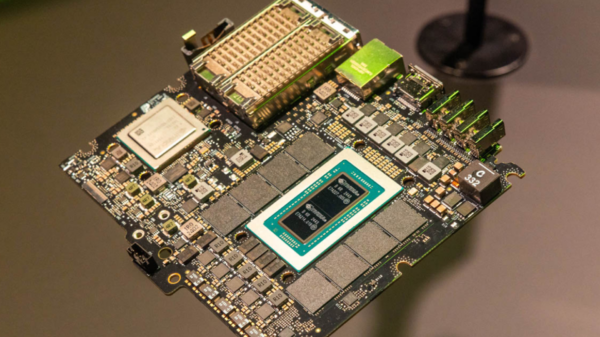

Jensen Huang, CEO of Nvidia, recently identified Meta as a leader in AI deployment during an interview with CNBC. Huang commended the company’s shift from traditional CPU-based recommendation systems to generative AI agentic frameworks, asserting that this transition has significantly enhanced social media operations and content creation for advertisers. He stated, “Meta’s AI-driven ad ranking has delivered about four times more revenue impact than simply increasing ad load,” highlighting Meta’s strategic advantage in the current AI arms race.

The AI-driven growth is particularly evident in Meta’s advertising sector. The company announced that AI innovations contributed to a 3.5% rise in Facebook ad clicks and improved Instagram conversions by over 1%. Even more noteworthy, its video generation tools have achieved a $10 billion run-rate, expanding nearly three times faster than overall ad revenue. The incremental return on investment (ROI) for AI infrastructure remains above 20%, with a cash return on invested capital exceeding 52%—promising figures for any CFO.

However, Meta’s aggressive AI strategy has attracted criticism regarding its costs. The company forecasts capital expenditures (capex) for 2026 to range between $115 billion and $135 billion, a significant increase from the $72.22 billion spent in 2025. CEO Mark Zuckerberg described this period as a sprint toward “personal superintelligence,” urging analysts to prepare for a “big year” in infrastructure and operations. Rising third-party cloud expenses, increased depreciation of AI data-center assets, and higher operational costs have driven this uptick.

Market reactions to Meta’s spending habits have been mixed. On February 8, 2026, shares fell 1.3% as investors expressed concern over the rising costs. This decline occurred alongside a broader downturn, with the S&P 500 software and services index dropping nearly 8% in the week ending February 7, resulting in a loss of around $1 trillion in market value since January 28. Concurrently, data analytics firms like Thomson Reuters and RELX saw their shares dip due to fears that emerging AI models could disrupt their business models.

Andrew Wells, chief investment officer at SanJac Alpha, captured the sentiment by stating, “The market’s viewpoint is that the AI build-out trade … got too pricey.” He emphasized that while the trade isn’t over, it has become too costly without factoring in associated risks. Analysts at Morgan Stanley echoed this view, noting that investors are currently reluctant to support large investments lacking clear indications of return on invested capital.

Meta’s operating margin has also faced pressure, dropping to 41% in 2025 from 48% in the fourth quarter of 2024, a decrease attributed to higher depreciation and research expenses linked to AI investments. Free cash flow for the fourth quarter of 2025 stood at $14.08 billion after accounting for investment outlays. Although these figures remain strong, they reflect the delicate balance Meta must maintain between innovation and financial prudence.

Despite market apprehensions, some experts view Meta’s AI investments as a long-term strategy with significant potential. The Motley Fool posited that Meta might join the $4 trillion market capitalization club by 2032, requiring a compounded annual growth rate of 14.2%. As of February 6, 2026, Meta’s market cap was $1.67 trillion, with shares returning over 144% to investors in the past five years. However, the stock has experienced a 7.8% decline over the past year and traded down 7.51% in the last five sessions, reflecting the volatility associated with ambitious spending.

Looking ahead, Meta’s guidance remains optimistic. The company anticipates first-quarter 2026 revenue between $53.5 billion and $56.5 billion, potentially marking a nearly 30% increase compared to the same period in 2025. Yet, as The Motley Fool notes, the journey to $4 trillion is fraught with challenges. Meta confronts risks such as economic slowdowns and potential reductions in advertising budgets—elements that could significantly impact its stock price. The integration of large language models into its recommendation and ad products is still in the early stages, indicating that the full effects of its AI investments may take time to manifest.

The broader tech sector is similarly navigating turbulence, with projected combined capital expenditures for 2026 in Big Tech reaching around $650 billion, comparable to the GDP of some nations. Microsoft reported a capex of $37.5 billion in its latest quarter, with revenues up 17% and profits surging 60%. Alphabet saw its cloud revenue grow 48% to $17.7 billion, yet its capex forecast of $175 billion to $185 billion raises questions about when AI platforms like Gemini and Genie will yield sustainable profits.

For Meta, the immediate focus will be on execution: Can it sustain increases in ad prices and impressions? Will it manage expenses effectively? And as data-center investments ramp up, will cash flow remain robust? Tom Hainlin, investment strategist at U.S. Bank Wealth Management, summarized the situation as a pivotal moment for large-cap tech companies, stating, “This is the first time we’ve seen the large-cap tech companies … go through a really large capex cycle … and we’re seeing this volatility about whether this investment will translate, ultimately, into results.”

If Meta successfully scales its early AI achievements, it could set a precedent for profitable AI integration across various sectors. However, as evidenced by its stock fluctuations, the path forward is fraught with uncertainty. For now, Wall Street remains vigilant, eager to ascertain whether Meta’s ambitious AI vision will yield substantial returns or if the costs of such aspirations will prove unsustainable.

See also AI’s Energy Demands Drive $3.8B Surge in Nuclear Fusion Investment, Promising Breakthroughs by 2034

AI’s Energy Demands Drive $3.8B Surge in Nuclear Fusion Investment, Promising Breakthroughs by 2034 Brightcove Unveils AI-Driven Video Strategy to Capture $22B Streaming Market Growth

Brightcove Unveils AI-Driven Video Strategy to Capture $22B Streaming Market Growth Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032