As investors ponder the current value of Microsoft stock, they are not alone. The company’s immense footprint and leadership position make it a beacon for those seeking both stability and potential growth. After experiencing a remarkable surge over the last few years, Microsoft’s stock price has shown a year-to-date increase of 12.8% and a 14.1% rise over the past 12 months. However, recent fluctuations have seen a pullback of 9.8% in the last month, prompting many to question its true worth.

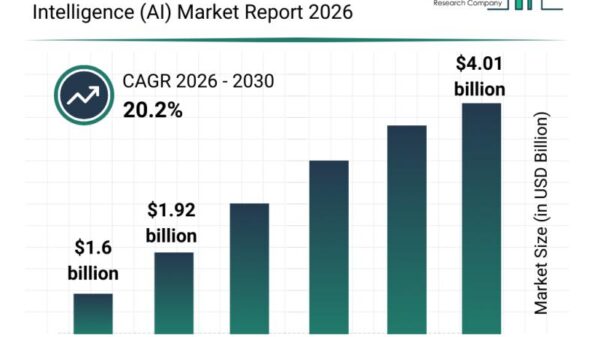

Recent developments highlight Microsoft’s aggressive expansion into artificial intelligence and its ongoing growth in the cloud computing sector. These initiatives have captured the attention of Wall Street and have been pivotal in the company’s long-term stock rally. However, the broader volatility in the tech sector has contributed to the recent swings in Microsoft’s share price.

Currently, Microsoft’s valuation score stands at 5 out of 6, indicating strong performance across key value metrics. To understand the intrinsic value of Microsoft stock, we’ll explore two major valuation approaches: Discounted Cash Flow (DCF) analysis and Price-to-Earnings (PE) ratio analysis, providing insights into the company’s underlying worth.

Understanding Microsoft’s Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model offers an estimation of a company’s true worth by projecting its future cash flows and discounting them to present value. This method aims to reveal what Microsoft is fundamentally worth, independent of daily market fluctuations.

Microsoft’s current Free Cash Flow is reported at $89.43 billion, with analysts forecasting substantial growth, predicting that Free Cash Flow will reach $206.23 billion by 2030. Although analyst estimates typically focus on a five-year horizon, these projections can extend further into the future.

Using the two-stage Free Cash Flow to Equity model, the DCF analysis estimates Microsoft’s intrinsic value at $608.19 per share. With current trading prices, this suggests the stock is undervalued by 22.4%, reflecting Microsoft’s robust cash generation capabilities and strong growth potential well into the next decade.

Result: UNDERVALUED

Our DCF analysis indicates that Microsoft is currently undervalued by 22.4%. Investors might consider tracking this assessment, alongside numerous other undervalued stocks based on cash flow projections.

Evaluating Microsoft’s Price-to-Earnings Ratio

The Price-to-Earnings (PE) ratio is a widely used metric to assess the valuation of profitable companies like Microsoft. It informs investors how much they are paying for each dollar of current earnings, making it especially relevant for established, consistently profitable businesses.

At present, Microsoft trades at a PE ratio of 33.45x, which is slightly below its listed peers at 34.01x and significantly above the broader software industry average of 28.81x. These figures indicate that investors are willing to pay a premium for Microsoft due to its profitability and growth prospects.

Notably, Simply Wall St’s Fair Ratio for Microsoft is estimated at 57.16x. This benchmark considers the company’s earnings growth, profit margins, market capitalization, industry trends, and risk profile, providing a more comprehensive view of Microsoft’s valuation relative to its peers.

When comparing Microsoft’s actual PE (33.45x) to its Fair Ratio (57.16x), the stock appears undervalued based on this proprietary metric as well.

Result: UNDERVALUED

Choose Your Microsoft Narrative

To deepen your understanding of Microsoft’s valuation, consider the concept of Narratives. A Narrative merges your assumptions about fair value with predictions about future revenue and profit growth. This dynamic approach helps investors create a personalized story about a company’s trajectory.

On the Simply Wall St Community page, investors can explore and create their own Narratives, which are visually intuitive and update automatically with fresh news or earnings releases. This feature allows you to see how your estimated fair value compares to the current share price, helping you determine when Microsoft may be an attractive buy or overvalued.

For example, one bullish Narrative estimates Microsoft could be worth as much as $700 per share, driven by aggressive AI adoption and robust long-term growth. Conversely, a more conservative view suggests a fair value closer to $360, reflecting potential challenges in margins or execution.

With these insights in hand, investors are encouraged to examine how these narratives align with their financial goals and market outlooks, as the Microsoft story continues to evolve amidst significant technological advancements.

NVIDIA Surges 25% in Q4 Earnings, Catalyzing Major Market Rally Amid AI Boom

NVIDIA Surges 25% in Q4 Earnings, Catalyzing Major Market Rally Amid AI Boom Meta Slashes Ray-Ban Smart Glasses Price to $238, Half of Gen 2 Cost

Meta Slashes Ray-Ban Smart Glasses Price to $238, Half of Gen 2 Cost Tech Titans Google, Microsoft, and OpenAI Forge AI Safety Pact to Mitigate Risks and Enhance Standards

Tech Titans Google, Microsoft, and OpenAI Forge AI Safety Pact to Mitigate Risks and Enhance Standards ChatGPT-5.1 Surpasses Grok 4.1 in Key AI Test, Dominating 7 of 9 Categories

ChatGPT-5.1 Surpasses Grok 4.1 in Key AI Test, Dominating 7 of 9 Categories NVIDIA’s AI Chip Expansion Sparks Environmental Concerns in South Korea and Taiwan

NVIDIA’s AI Chip Expansion Sparks Environmental Concerns in South Korea and Taiwan