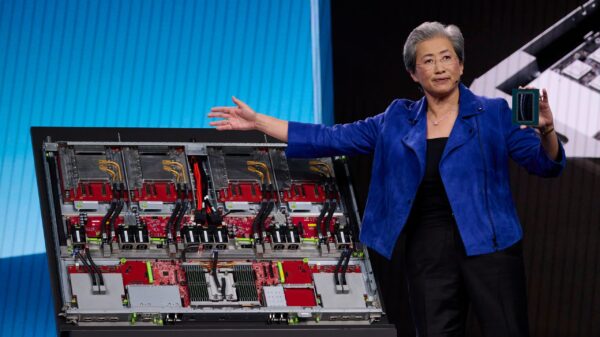

Microsoft Corporation (NASDAQ:MSFT) is currently facing scrutiny as its stock continues to decline, a topic highlighted by Jim Cramer during a recent episode of “Mad Money.” Cramer noted that while Microsoft has been performing well operationally, the market has reacted negatively to the company’s substantial investments in artificial intelligence (AI). He remarked, “How about Microsoft? Alright, this company’s been doing very well, but its stock’s been punished by the fact that management wants to spend a fortune on AI.” Following Microsoft’s latest quarterly report, the stock has experienced a downward trend, dropping from a summer peak of $555 to approximately $485.

Cramer elaborated on the company’s performance, stating, “The third-best performer in the Mag Seven last year, Microsoft was humming until late July. It peaked at… 555 bucks. Then it started getting hit and failed to regain its old highs, finishing the year up just under 15%.” This decline, according to Cramer, can be largely attributed to the cautious guidance provided for Azure, Microsoft’s cloud infrastructure division, which was perceived as insufficient by investors. The company’s revised outlook on capital expenditures also raised concerns, further complicating its market position.

Despite these challenges, Cramer remains optimistic about Microsoft’s long-term prospects, particularly in light of its partnership with OpenAI. Microsoft currently owns a 27% stake in OpenAI’s for-profit business, which Cramer believes could be worth over $100 billion. He noted, “On top of that, OpenAI is committed to spending 250 billion bucks with Microsoft’s Azure over the next several years.” However, there are prevailing worries that OpenAI might struggle with its financial obligations, which could pose significant risks for Microsoft.

Cramer expressed a growing confidence in Microsoft’s trajectory, particularly if OpenAI can successfully secure funding at a valuation near the rumored $800 billion mark. “I think Microsoft’s doing fine,” he stated, emphasizing that improved performance in Azure could significantly boost stock value. He suggested that if Azure’s growth could approach 39% or 40% instead of the previously lowered guidance of 35%, it could lead to a strong recovery for Microsoft’s stock.

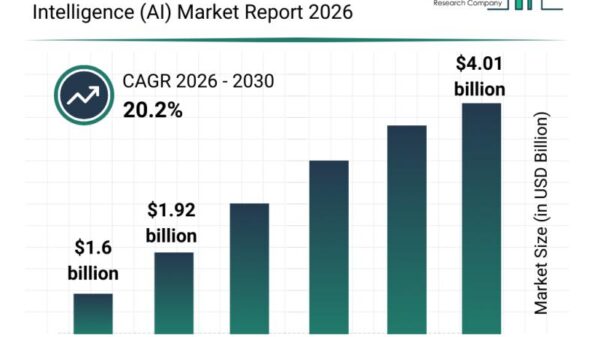

The tech industry continues to evolve rapidly, with AI advancements playing a crucial role in shaping market dynamics. Investors are increasingly scrutinizing companies with significant AI investments, as the potential for both growth and risk becomes more pronounced. While Microsoft remains a strong contender in this space, Cramer pointed out that other AI-focused stocks might also offer enticing opportunities for investors, particularly those who are seeking undervalued options amidst ongoing market shifts.

As the tech landscape becomes more competitive, Microsoft’s strategy, particularly its heavy investment in AI, will be closely monitored. The company’s ability to navigate these challenges while capitalizing on its cloud services could determine its market strength in the coming months. Cramer’s insights suggest a cautious but optimistic outlook for Microsoft, highlighting the importance of its Azure business in future growth.

Disclosure: None. This article was originally published at Insider Monkey.

See also Parents Equip Themselves for AI Challenges at Marquette Library Workshop

Parents Equip Themselves for AI Challenges at Marquette Library Workshop OpenAI, Google DeepMind Employees Demand Transparency and Safety in AI Oversight

OpenAI, Google DeepMind Employees Demand Transparency and Safety in AI Oversight Toy Makers Tackle AI Risks After Chatbot-Infused Toys Trigger Controversy and Suspensions

Toy Makers Tackle AI Risks After Chatbot-Infused Toys Trigger Controversy and Suspensions Toast’s AI Retail Tools Revolutionize Inventory Management, Boosting $47.75 Fair Value Potential

Toast’s AI Retail Tools Revolutionize Inventory Management, Boosting $47.75 Fair Value Potential