Jakarta, Pintu News – In a New Year’s greeting on the X platform, Strategy, the largest corporate Bitcoin holder led by Michael Saylor, announced a significant pivot in their focus from Bitcoin to data strategy. As the company looks toward 2025, they emphasized the transition from fragmented tools to a unified, AI-ready data foundation. The core message for 2026 highlights the need to simplify, scale, and unlock new insights, marking a notable change in Strategy’s investment approach.

In the company’s recent communication, they stated, “Data strategy has never mattered more.” This assertion reflects a growing consensus among organizations that a robust data strategy is essential for navigating the complexities of AI integration. With Strategy currently owning 672,497 Bitcoin (BTC) at an average price of $75,004, the unrealized gain on this investment stands at 17.04%, equating to a total value of approximately $59.04 billion. However, despite these figures, Strategy’s market share has faced a decline, as evidenced by MSTR stock trading at $151.95 per share—down 2.35% from its peak in 2025. This trend suggests that investor interest in Bitcoin as a primary asset may be waning.

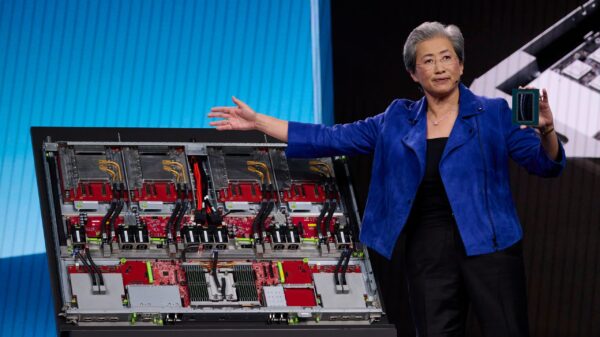

The company’s shift in focus indicates a broader change in market sentiment regarding cryptocurrencies. As companies increasingly prioritize AI infrastructure, Strategy aims to adapt by helping enterprises streamline their operations and enhance their data strategy. This commitment to innovation illustrates an understanding that reliance on Bitcoin may not sustain long-term growth.

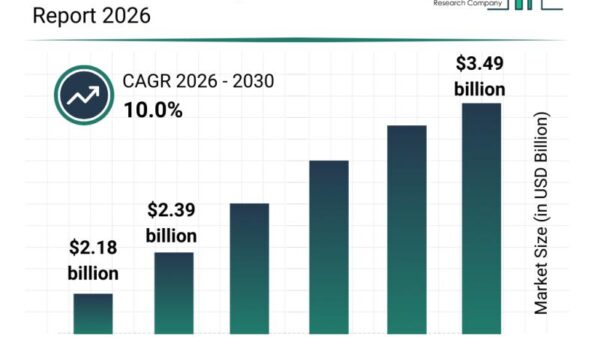

With a market value nearing $44 billion and an enterprise value close to $57 billion, Strategy appears well-positioned for growth through its new strategy. Their internal metrics reveal a market NAV of 0.739 (base), 0.824 (dilution), and 0.967 (EV), suggesting a lack of high premiums being placed on their Bitcoin holdings. This insight substantiates the rationale for their pivot toward AI, particularly if corporate investment in AI continues its upward trajectory.

Strategy’s departure from a Bitcoin-centered approach is indicative of a transformative era for the firm. By recognizing evolving market demands and tailoring their services accordingly, the company is setting a course for future success. As the landscape of technology and investment continues to shift, the emphasis on AI and data-driven solutions may become a primary focal point for many organizations.

In summary, while Strategy has been a prominent player in the Bitcoin market, their transition to a data-first approach reflects a broader industry trend. This strategic pivot not only aims to enhance their competitive edge but also signifies a response to the changing dynamics within the tech and financial sectors. The growing importance of AI integration may shape the future of many businesses, including Strategy.

Also Read: Latest Crypto Market Analysis. Follow us on Google News for updates on crypto and blockchain technology. Stay informed about Bitcoin prices and other cryptocurrency values through Pintu Market.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Past performance does not determine future performance. Crypto trading activities are subject to high risk and volatility; always conduct your own research and use caution before investing.

See also Renowned Fallout Artist Deimos Rejects AI, Elevates New Vegas Art with Unique Vision

Renowned Fallout Artist Deimos Rejects AI, Elevates New Vegas Art with Unique Vision Google’s AI Misguides Users with Dangerous Medical Advice, Reports The Guardian

Google’s AI Misguides Users with Dangerous Medical Advice, Reports The Guardian Meta Acquires AI Startup Manus for $3B, Boosting Growth Amid Regulatory Challenges

Meta Acquires AI Startup Manus for $3B, Boosting Growth Amid Regulatory Challenges India Orders X to Curb Grok After Obscene Image Complaints from Users, Legislators

India Orders X to Curb Grok After Obscene Image Complaints from Users, Legislators