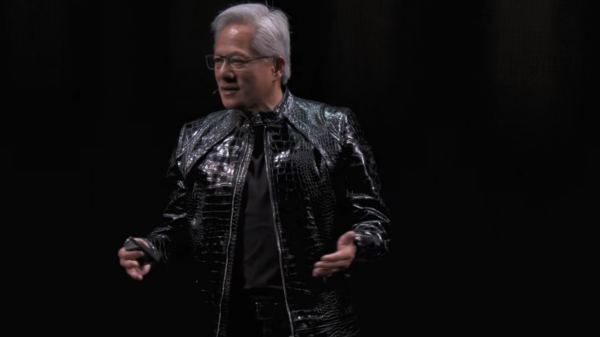

Nvidia shares fell sharply on Tuesday, declining over 3% in pre-market trading, as reports emerged that Meta Platforms is considering a significant investment in Google’s AI chips. This potential shift signals an impending confrontation in the AI chip sector, likened to a “Godzilla vs. Kong” moment between two titans of the tech industry.

According to a report by The Information, Meta is in discussions to utilize Google’s tensor processing units (TPUs) within its data centers starting in 2027. Furthermore, the company may begin renting these chips from Google’s cloud division as soon as next year. This move highlights Google’s intensified efforts to challenge Nvidia’s long-held dominance in the AI accelerator market, where Nvidia’s graphical processing units (GPUs) have been the standard for years.

In contrast to Nvidia’s downturn, Alphabet saw its shares rise more than 2%, continuing a rally fueled by enthusiasm surrounding the latest iteration of its Gemini AI model. Analysts are increasingly optimistic about the implications of Meta’s potential shift, particularly as it pertains to Google Cloud’s growing prominence in the AI landscape.

Securing Meta would be a significant triumph for Google, which has been systematically advancing its TPU strategy. Recently, the tech giant signed a deal to provide up to 1 million TPUs to Anthropic, another major player in the AI space. Seaport analyst Jay Goldberg characterized this deal as a “really powerful validation” for TPUs, suggesting that the conversation around these chips is growing stronger among tech leaders.

Moreover, analysts at Bloomberg Intelligence, Mandeep Singh and Robert Biggar, noted that Meta’s capital expenditure plans indicate an investment of at least $100 billion in AI by 2026, with an estimated $40–50 billion allocated for inferencing-chip capacity as early as next year. This strategy could lead to increased demand for TPUs and contribute to a burgeoning backlog for Google Cloud as enterprises seek access to enhanced AI services.

The news has sparked a positive response across the Asian market, with shares of Alphabet-linked suppliers experiencing notable gains. For instance, South Korea’s IsuPetasys surged 18% to a record high, while Taiwan’s MediaTek saw a nearly 5% increase in stock value.

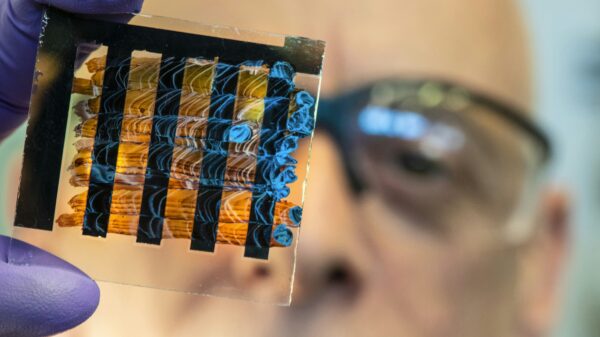

Google’s TPUs, first developed over a decade ago specifically for AI workloads, have gained traction as organizations increasingly seek alternatives amid concerns over dependence on Nvidia’s offerings. While Nvidia’s GPUs were initially designed for graphics rendering, their capability to process vast datasets has made them the preferred choice for training contemporary AI models. In contrast, TPUs are application-specific chips dedicated to AI and machine learning tasks, benefiting from close integration with Google’s Gemini and DeepMind teams.

The evolving landscape of AI chip technology underscores a broader trend in the industry, with major players like Google and Meta positioning themselves to reshape the competitive dynamics. As companies steadily ramp up investments in AI infrastructure, the potential for innovation and disruption remains high, suggesting a future where the landscape is increasingly defined by collaborations and strategic partnerships among tech giants.

The implications of Meta’s potential shift towards Google’s TPUs may extend beyond immediate market reactions. With a projected spend of at least $100 billion on AI, Meta’s approach could catalyze further advancements in cloud-based AI services and chip technology, ultimately reshaping the competitive landscape in ways that challenge existing norms.

As the tech world watches closely, developments in this sector will likely continue to reverberate through financial markets, influencing not just the companies involved but also the broader trajectory of AI technology.

Nvidia, Meta, Google Cloud, and Anthropic are all key players in this evolving narrative.

See also Elon Musk Claims His AI Can Defeat League of Legends Champion Faker in Upcoming Match

Elon Musk Claims His AI Can Defeat League of Legends Champion Faker in Upcoming Match

Broadway’s Marjorie Prime Sparks Urgent Debate on AI’s Ethical Implications in Grief

Bachchan Lawsuit Against Google Highlights Urgent Need for AI Personality Rights Reform

Bachchan Lawsuit Against Google Highlights Urgent Need for AI Personality Rights Reform MIT’s BoltzGen AI Model Transforms Drug Discovery with Novel Protein Design for Undruggable Diseases

MIT’s BoltzGen AI Model Transforms Drug Discovery with Novel Protein Design for Undruggable Diseases AI Boom Fuels Tech Stocks Surge; Musk’s xAI Hits $230B Valuation Amid Chip Rivalry

AI Boom Fuels Tech Stocks Surge; Musk’s xAI Hits $230B Valuation Amid Chip Rivalry