The current enthusiasm surrounding artificial intelligence has prompted investors to consider key stocks in the sector, particularly Palantir Technologies, Nvidia, and Alphabet. As of February 8, 2026, these companies have demonstrated strong growth while maintaining a dominant presence in their respective markets.

Palantir Technologies (PLTR) reported a remarkable fourth-quarter performance, surpassing estimates with a revenue of $1.41 billion—an increase of 70% year-over-year. The company achieved a net income of $609 million, marking a profit margin of 43%. This analytics firm secured 180 contracts exceeding $1 million, including a record contract valued at $4.26 billion, reflecting a 138% increase from the previous year. Palantir’s AI software has proven essential for real-time data analysis in both governmental and commercial sectors, underscoring its growing importance in the industry.

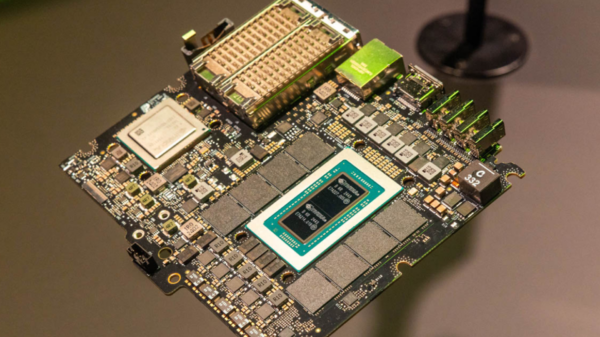

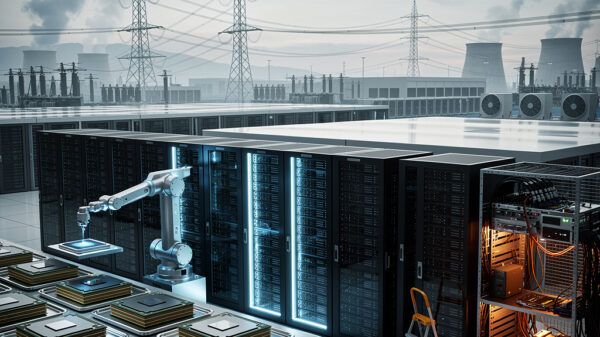

Nvidia Corporation (NVDA), the leading AI chip manufacturer, holds a market capitalization of $4.51 trillion as of February 2, 2026. The company’s GPUs are pivotal not only in AI training but also in cryptocurrency mining, which has become one of its most lucrative segments. Demand for Nvidia’s cloud-based GPU units is high, with subscriptions fully booked ahead of new product releases later this year. Analyst James Schneider from Goldman Sachs has reiterated a Buy rating for Nvidia, setting a price target of $250. Nvidia’s fourth-quarter financial results are anticipated on February 25, with projections of $65.55 billion in revenue and earnings per share of $1.49, according to Benzinga Pro data. The company’s limited offerings have driven increased data center usage, reinforcing its market-leading status.

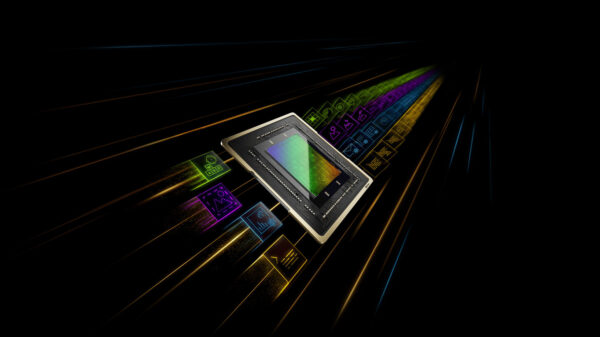

Alphabet, the parent company of Google, reported a 30% year-over-year increase in net income for the fourth quarter, reaching $34.5 billion—outpacing analysts’ expectations of $31.9 billion. For the full year of 2025, Alphabet generated profits of $132 billion. The company’s revenue for the final quarter rose by 18%, totaling $113.8 billion, which also exceeded the median estimate of $111.3 billion. This marks the first time Alphabet’s annual revenue surpassed $400 billion. As of now, Alphabet’s stock is trading at $323.78, reflecting a slight decline of 2.53% and a market capitalization of $3.91 trillion. The company’s Tensor Processing Units (TPUs) have gained traction, successfully securing contracts with significant clients like Anopheles and Meta.

As the demand for AI technologies grows, it is crucial to consider the competitive landscape. While Palantir faces challenges related to premium pricing in an increasingly crowded market, all three companies have maintained positive growth trajectories. With AI spending projected to escalate into the trillions, a modest investment of $1,000 in this portfolio could yield substantial returns through compound growth by 2030, potentially benefiting patient investors.

See also AI Data Centers’ Water Usage Surges 24%, Demand Mirrors Small Towns Amidst Climate Risks

AI Data Centers’ Water Usage Surges 24%, Demand Mirrors Small Towns Amidst Climate Risks Populist Backlash Against AI Gains Momentum as Americans Demand Regulation and Fairness

Populist Backlash Against AI Gains Momentum as Americans Demand Regulation and Fairness Meta Launches Standalone Vibes App for AI-Generated Video Creation and Discovery

Meta Launches Standalone Vibes App for AI-Generated Video Creation and Discovery Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT