Perplexity AI has generated bold predictions for major cryptocurrencies, including XRP, Cardano, and Bitcoin, suggesting that each asset could hit new all-time highs by the end of 2026. These forecasts, which may take investors by surprise, align with current market trends and potential catalysts that could impact long-term holders.

For XRP, currently trading around $1.39, Perplexity anticipates a surge to approximately $8, representing a potential sixfold increase. Ripple, the company behind XRP, continues to emphasize that the cryptocurrency is integral to its goal of establishing the XRP Ledger as a leading global payments network. The network is known for its rapid settlement times and low transaction fees, which positions it favorably in the growing markets for stablecoins and real-world asset tokenization. Chart data suggests a bullish sentiment with XRP’s Relative Strength Index (RSI) currently at 31, indicating that the recent selloff may be winding down. Catalysts for future growth include institutional inflows following the approval of U.S.-listed spot XRP exchange-traded funds and new partnerships that Ripple is forming, alongside legislative progress in the form of the CLARITY bill currently being finalized in the U.S.

Turning to Cardano ($ADA), Perplexity sees a remarkable potential for the asset, predicting a rise of more than 2,100% from its current price of around $0.27 to approximately $6 by Christmas 2026. This forecast would mark a significant rebound, surpassing its previous all-time high of $3.09 in 2021. Founded by former Ethereum co-creator Charles Hoskinson, Cardano is built on a foundation of peer-reviewed research and a commitment to sustainability. However, ADA is presently trading at its lowest levels since October 2024, presenting risks of further declines. Should the current trend continue, ADA might retest the $0.20 to $0.25 support range, making its future outlook somewhat precarious despite the long-term growth narrative.

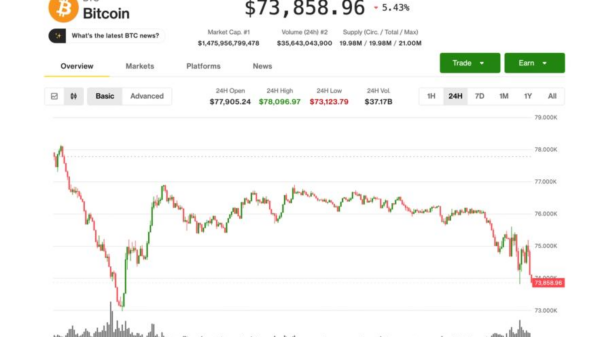

In the case of Bitcoin ($BTC), the original cryptocurrency has experienced fluctuations, recently hitting a new all-time high of $126,080 before dropping approximately 46% to its current level of around $67,750. Often described as digital gold, Bitcoin remains a favored hedge against inflation and economic uncertainty, attracting interest from both institutional and individual investors. Despite recent geopolitical tensions, particularly around U.S. military actions in Iran and Greenland, Perplexity maintains that Bitcoin’s upward trajectory is intact, with a price target of $250,000 by 2026. Key factors driving this potential include escalating institutional adoption and supply constraints following the next halving event. Moreover, if U.S. policymakers fulfill plans outlined in Trump’s Executive Order for a Strategic Bitcoin Reserve, the price could exceed even these optimistic projections.

For those interested in higher-risk opportunities, a new player has emerged in the meme coin market: Maxi Doge ($MAXI). The presale has already garnered $4.6 million and features a character claiming the throne from Dogecoin. Maxi Doge is quickly becoming a talking point in 2026, leveraging humor and competition to attract attention. Currently available for $0.0002803 in presale, investors can stake MAXI tokens for yields up to 68% APY, although rewards are expected to diminish as the staking pool expands. The presale supports purchases through various wallets, including MetaMask and Best Wallet, allowing early investors to access potential gains.

As the cryptocurrency landscape continues to evolve, these predictions underscore the volatility and potential rewards awaiting investors. With technological advancements and regulatory updates on the horizon, participants in the crypto market may need to stay vigilant and adaptable in the coming years.

See also India’s AI Summit: A Call for Global Oversight to Shape Responsible Tech Governance

India’s AI Summit: A Call for Global Oversight to Shape Responsible Tech Governance DreamWeaver Launches AI Storytelling Platform, Seeks $500,000 Seed Funding to Enhance Long-Distance Connections

DreamWeaver Launches AI Storytelling Platform, Seeks $500,000 Seed Funding to Enhance Long-Distance Connections Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT