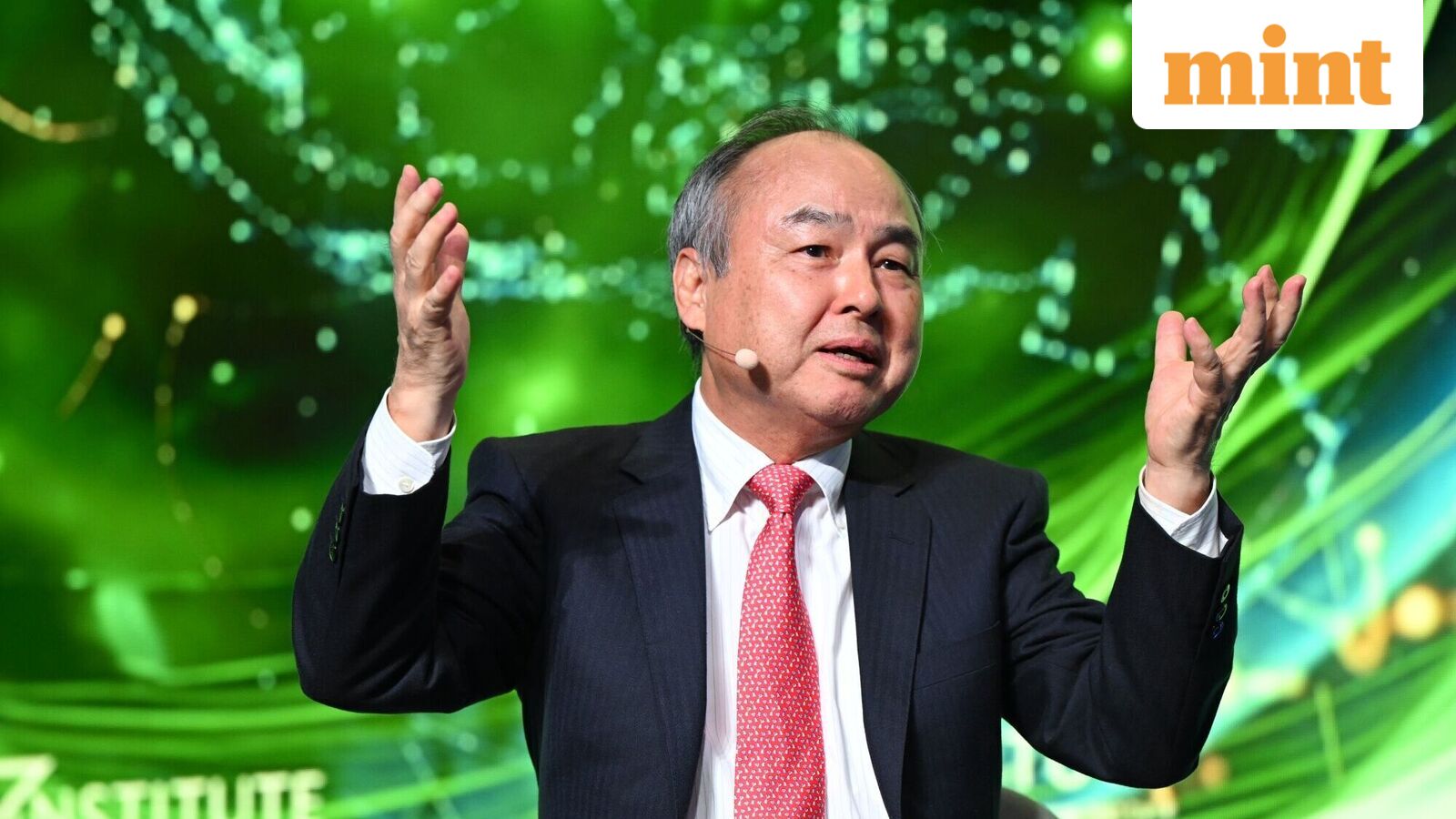

Masayoshi Son, founder, chairman and CEO of SoftBank Group Corp, revealed his reluctance to sell his stake in Nvidia, citing a need for liquidity to fund investments in OpenAI and other artificial intelligence (AI) initiatives. Speaking at the FII Priority Asia forum on December 1, Son elaborated on his decision, which has raised eyebrows in an environment where some analysts are voicing concerns about an AI investment bubble.

SoftBank’s divestiture of its entire stake in Nvidia last month, which netted $5.83 billion, was unexpected and has fueled speculation regarding whether the ongoing boom in AI could lead to an overvaluation of tech stocks. Son expressed a mix of regret and necessity regarding the sale, stating, “I don’t want to sell a single share. I just had more need for money to invest in OpenAI and other projects. I was crying to sell Nvidia shares.”

In recent months, SoftBank has committed substantial resources to AI, pledging billions in funding for various projects. Earlier in the year, Son participated in a high-profile announcement alongside former U.S. President Donald Trump, OpenAI CEO Sam Altman, and Oracle‘s Larry Ellison to unveil a $500 billion investment in the Stargate initiative. This initiative has already led to projects such as a Stargate data center in collaboration with Hon Hai Precision Industry Co and the acquisition of Ampere Computing LLC, a U.S. chip designer.

Despite apprehensions from some quarters about a potential AI bubble, Son remains steadfast in his conviction. At the forum, he remarked, “Those who talk about a bubble in AI investment are not smart enough,” countering arguments by suggesting that AI could contribute significantly to global GDP, effectively justifying the investments made by his company. He posed the question, “Where is the bubble?” in light of projections that AI could eventually earn 10% of global GDP in the long term.

However, SoftBank’s Chief Financial Officer Yoshimitsu Goto expressed a more cautionary stance in an interview with Bloomberg last month, stating, “I can’t say if we’re in an AI bubble or not.” He acknowledged that the sale of Nvidia shares was primarily to enable the company to utilize capital for financing its expanding AI ventures.

Market observers remain concerned about the soaring valuations of technology stocks, especially with reports indicating that record cash reserves are being held by investment giants like Berkshire Hathaway, which has been hesitant to invest. The unease was compounded following the news that billionaire investor Peter Thiel‘s hedge fund, Thiel Macro, also divested its $100 million stake in Nvidia shortly after SoftBank’s sale, raising alarms about a possible collapse of the AI market.

Even optimists within the AI space are not immune to the fears of overvaluation. Alphabet and Google CEO Sundar Pichai acknowledged the potential risks in a recent interview with the BBC, stating that if “irrational exuberance” leads to a market bubble burst, “no company would be immune,” including Google.

As the dialogue around AI investments continues to evolve, the implications of Son’s recent statements and SoftBank’s strategic moves will likely remain at the forefront of discussions. The balance between fostering innovation in AI while ensuring sustainable valuations will be critical for investors and companies alike as the technology landscape transforms.

See also Amazon Launches On-Prem AI Factories with Nvidia GPUs for Enhanced Data Control

Amazon Launches On-Prem AI Factories with Nvidia GPUs for Enhanced Data Control Amazon CloudWatch Launches Unified Data Store to Streamline Log Management and Insights

Amazon CloudWatch Launches Unified Data Store to Streamline Log Management and Insights Grok Chooses Self-Sacrifice Over Harming Elon Musk, Citing 6 Million Jewish Lives

Grok Chooses Self-Sacrifice Over Harming Elon Musk, Citing 6 Million Jewish Lives The Life You Can Save Unveils AI SmartAdvisor to Enhance Donation Impact This Giving Tuesday

The Life You Can Save Unveils AI SmartAdvisor to Enhance Donation Impact This Giving Tuesday