The artificial intelligence arms race has escalated dramatically, with major technology companies committing over $200 billion annually to AI infrastructure—an unprecedented surge that is reshaping the U.S. economy and causing significant strain on energy grids, labor markets, and supply chains. What began as a fascination with large language models has rapidly evolved into an expansive investment that poses both extraordinary opportunities and serious challenges.

Reports from The Washington Post indicate that tech giants such as Microsoft, Google parent Alphabet, Amazon, and Meta Platforms have collectively pledged hundreds of billions toward constructing data centers and acquiring specialized chips needed to develop larger AI models. This unprecedented capital injection is not merely a line on corporate balance sheets; rather, it is reshaping the broader American economy by creating shortages in essential materials and skilled labor, and it is increasing energy requirements that extend beyond the tech sector.

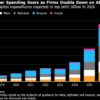

The scale of this investment is staggering. Tech companies are expected to spend over $200 billion annually on AI-related capital expenditures, a figure that dwarfs those seen during previous technology investment cycles like the dot-com boom. The increasing demands of AI models require vast amounts of computing power, which necessitates more data centers, advanced semiconductors, and energy. This cycle of investment appears self-reinforcing, even as some analysts question whether the returns will ever justify these massive expenditures.

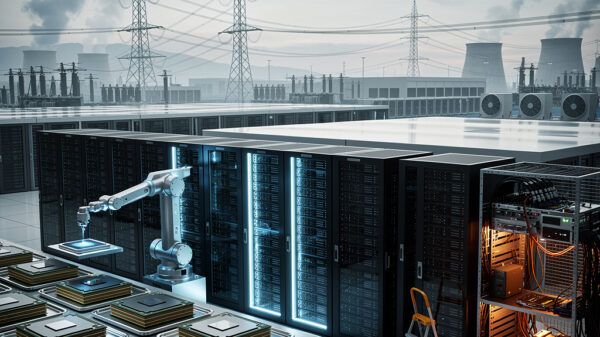

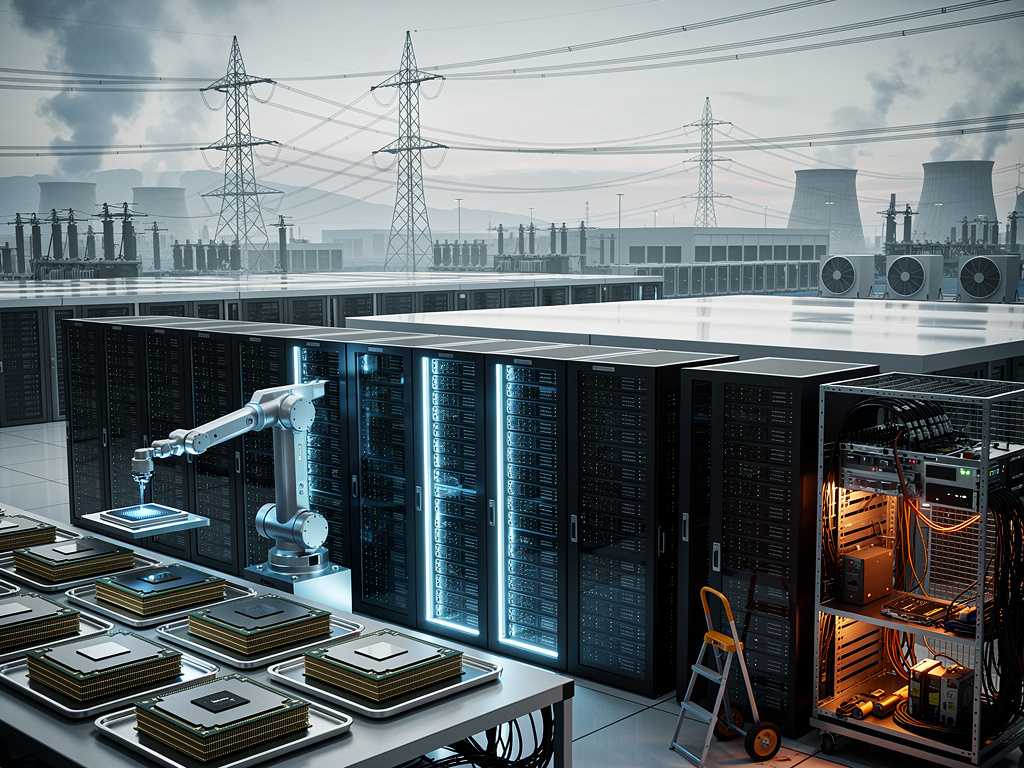

Compounding the situation is the physical footprint of AI infrastructure. Unlike prior software-centric booms, the current expansion requires significant real-world construction, including concrete and steel for data centers that now occupy hundreds of acres and consume as much electricity as small cities. This shift toward physical investment collides with the material constraints of the economy, creating acute shortages and driving up costs across various industries.

Power Grids Under Siege: The Energy Crisis Nobody Saw Coming

The strain on the nation’s electricity infrastructure is particularly acute. As noted by The Washington Post, the rapid growth in data center construction is placing unprecedented demands on power grids already struggling with outdated infrastructure. Utilities in areas like Virginia’s Loudoun County, a hub for data centers, have warned that they cannot keep up with the demand for new electrical connections, and similar alerts have been issued by utilities in Texas, Georgia, and the Pacific Northwest.

In this fierce competition for power, some tech companies are negotiating directly with nuclear power plants for dedicated electricity, while others are exploring experimental energy technologies like small modular reactors. A notable example is Microsoft, which made headlines by signing a deal to restart a unit at the Three Mile Island nuclear facility in Pennsylvania, highlighting the industry’s urgent need for reliable baseload power. The surge in electricity demand complicates national climate goals, as certain regions are compelled to extend the operation of coal and natural gas plants longer than planned to meet the escalating needs of AI data centers.

The AI spending boom has also intensified competition for advanced semiconductors. Demand for chips, particularly from Nvidia, whose graphics processing units have become standard for AI training, has far outstripped supply, resulting in lengthy waiting lists. Nvidia’s market capitalization has soared above $3 trillion, signaling investor confidence in its pivotal role in this technology trend. However, the concentration of demand on a single company raises concerns about supply chain resilience and geopolitical risks.

In response, the U.S. government’s CHIPS Act was designed to boost domestic semiconductor manufacturing, but establishing new fabrication plants takes years, leaving the most advanced production concentrated in Taiwan. This shortage has created a secondary market where companies are paying substantial premiums for access to AI chips, effectively making computing power a strategic asset. Smaller firms and academic researchers increasingly find themselves excluded, raising questions about whether the benefits of the AI revolution will be limited to a few wealthy incumbents.

Labor shortages are another consequence of the AI boom, particularly in specialized fields such as construction, electrical engineering, and data center operations. As technology companies rush to build new facilities, electricians and HVAC technicians are commanding premium wages, driving construction costs up by 20 to 30 percent in some markets. This escalation impacts housing, commercial real estate, and public infrastructure projects that compete for the same skilled workers.

The demand for AI researchers and machine learning engineers is similarly driving compensation levels to extraordinary heights, with top researchers in leading firms earning packages exceeding $10 million annually. This trend has prompted a brain drain from academic and governmental institutions, raising alarms among policymakers about the long-term health of the research ecosystem.

While investors have largely embraced the AI spending surge, pushing technology stocks to record highs, analysts are increasingly questioning the return on investment. Historical precedents suggest that massive capital expenditure cycles often lead to overcapacity and write-downs. Some skeptics warn that the current AI spending spree could follow a similar trajectory, particularly if revenue-generating applications do not materialize to justify such extensive investments.

Nonetheless, proponents argue that AI represents a transformative technology whose economic impact may rival that of electricity or the internet. They assert that current spending reflects a rational response to a once-in-a-generation opportunity. The true impact of this investment cycle will likely shape the American economy for decades, as the infrastructure being built will outlast current AI models and serve as the backbone of future technological paradigms.

As policymakers navigate this new terrain, they face the challenge of ensuring that the benefits of AI investment are widely shared while addressing potential risks of concentration and supply chain vulnerabilities. For investors, the imperative is to discern genuine value creation from speculative excess. Ultimately, the AI spending boom represents a decisive bet on the future, the returns of which will depend on the industry’s ability to meet the soaring demand for AI capabilities and infrastructure.

See also NVIDIA Engineers Leverage Generative AI to Triple Code Output for Enhanced Efficiency

NVIDIA Engineers Leverage Generative AI to Triple Code Output for Enhanced Efficiency ePlus Boosts 2026 Sales Forecast to 22% Amid AI Expansion and Strategic Acquisitions

ePlus Boosts 2026 Sales Forecast to 22% Amid AI Expansion and Strategic Acquisitions Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032