New York, NY – November 20, 2025 – The US technology sector is undergoing a turbulent phase as investors respond to a complex mix of macroeconomic pressures, geopolitical tensions, and concerns over potentially inflated valuations in the artificial intelligence (AI) sphere. This climate of uncertainty has led to a pronounced “risk-off” sentiment, compelling many to reconsider high-growth tech investments and impacting global financial markets.

As of mid-November 2025, the Cboe Volatility Index (VIX), often referred to as Wall Street’s “fear gauge,” has surged, indicating increased market anxiety and the likelihood of sharp sell-offs. Technology stocks, particularly those with elevated valuations linked to AI, are facing significant declines, contributing to downturns in major indices such as the Nasdaq Composite, S&P 500, and Dow Jones Industrial Average. This volatility has resulted in intensive scrutiny of company fundamentals and has extended its impact to other asset classes, including cryptocurrencies.

Market Dynamics: A Year of Extremes

The current market unrest within US tech stocks can be traced back to a series of interconnected events throughout 2025. The year began with optimism, as the S&P 500 reached all-time highs in January, fueled by expectations of deregulation and economic optimism, particularly in the technology and consumer discretionary sectors. However, by February, consumer sentiment saw its most significant month-over-month decline since August 2021, hinting at underlying economic concerns.

March continued to exhibit tech weakness, with the Nasdaq 100 facing a considerable sell-off. Tensions over a potential trade war escalated when President Trump announced sweeping tariff policies, which took effect in April, resulting in a global market crash. The “Liberation Day” announcement on April 2 provoked widespread panic, leading to the S&P 500’s sharpest two-day decline since the March 2020 pandemic panic. The “Magnificent 7” tech giants—Alphabet (NASDAQ: GOOGL), Amazon (NASDAQ: AMZN), Apple (NASDAQ: AAPL), Meta Platforms (NASDAQ: META), Microsoft (NASDAQ: MSFT), NVIDIA (NASDAQ: NVDA), and Tesla (NASDAQ: TSLA)—fell into bear market territory, losing 21% from their December 2024 peak due to new tariffs and a 10% universal import tax.

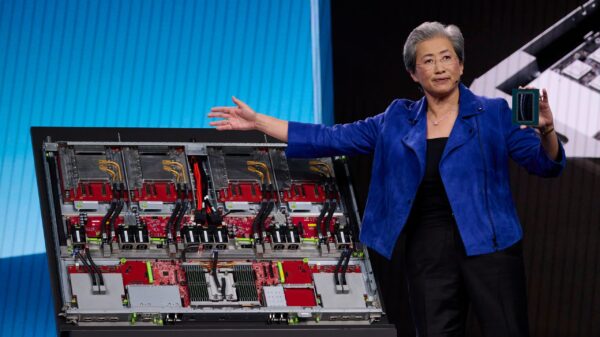

While a temporary pause in tariff increases in April prompted a brief market rally, the damage to investor confidence was already apparent. A diplomatic breakthrough in May between the U.S. and China, which aimed to de-escalate tariff tensions, initially boosted investor sentiment, enabling the S&P 500 to turn positive for the year by May 13. However, by August, renewed volatility emerged, leading to a tech-led sell-off impacting significant firms such as NVIDIA, Palantir Technologies (NYSE: PLTR), and AMD (NYSE: AMD).

A Rising AI Divide: Winners and Losers

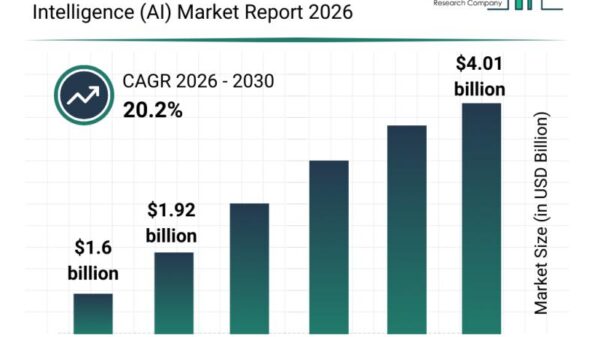

The ongoing volatility in tech stocks and the specter of an AI bubble have created a noticeable divide in the market. Companies with strong fundamentals, diversified revenue streams, and critical roles in AI infrastructure are positioned to excel amid this upheaval.

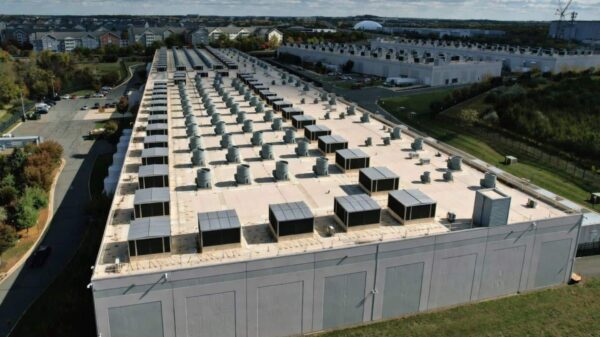

NVIDIA continues to dominate the AI infrastructure space, with its GPUs being essential for AI applications. The company’s strong earnings have frequently countered broader concerns about the AI bubble. Broadcom (NASDAQ: AVGO) has also seen significant benefits, reporting a 53% increase in AI semiconductor revenue. Firms like Seagate Technology (NASDAQ: STX)** and Pure Storage (NYSE: PSTG) are similarly well-positioned due to their roles in data storage, which is essential for AI applications.

Conversely, companies with inflated valuations and untested AI monetization strategies are facing substantial risks. **Palantir Technologies**, despite its strong position in data analytics, has seen its stock decline significantly, with a high price-to-earnings (P/E) ratio raising concerns among investors. The consumer discretionary sector is also under pressure, with anticipated declines in spending due to economic factors such as rising unemployment and inflation. Notably, **Tesla** has experienced a contraction in market capitalization as competition intensifies from Chinese manufacturers.

Broader Industry Implications

The current volatility and concerns surrounding an AI bubble highlight a significant shift in the tech landscape. Investors are increasingly demanding evidence of sustainable business models and measurable returns from AI investments, marking a departure from previous unchecked enthusiasm.

This volatility mirrors the dot-com bubble of the late 1990s, characterized by irrational exuberance about transformative technologies. While today’s leading tech firms generally boast stronger balance sheets and profitability than many dot-com era startups, the challenge remains in differentiating genuine innovation from speculative investments.

As we look forward, the road ahead is filled with uncertainty. Investors should prioritize diversification and focus on firms demonstrating tangible returns from their AI efforts. Meanwhile, companies must pivot strategically to offer measurable operational impacts through AI integration. This period of turbulence may ultimately lead to a more resilient tech sector, equipped to navigate the complexities of an evolving economic and technological landscape.

Top 10 Text-to-Video AI Tools: Features, Pros, and Cons for 2025

Top 10 Text-to-Video AI Tools: Features, Pros, and Cons for 2025 AI Investment Risks Surge as OpenAI’s $1.4T Bet Faces Economic Headwinds and Fading Returns

AI Investment Risks Surge as OpenAI’s $1.4T Bet Faces Economic Headwinds and Fading Returns Google DeepMind’s Lila Ibrahim Reveals Strategies for Global AI Accessibility

Google DeepMind’s Lila Ibrahim Reveals Strategies for Global AI Accessibility Raymond James Upgrades Doximity: AI-Focused Growth Potential Sparks Investor Interest

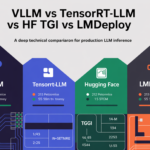

Raymond James Upgrades Doximity: AI-Focused Growth Potential Sparks Investor Interest vLLM, TensorRT-LLM, TGI v3, and LMDeploy: A Technical Breakdown of LLM Inference Performance

vLLM, TensorRT-LLM, TGI v3, and LMDeploy: A Technical Breakdown of LLM Inference Performance