Xero Ltd (ASX: XRO) is drawing attention as it reports significant strides in its integration of artificial intelligence (AI) and U.S. payment solutions, boasting over two million subscribers utilizing its AI features. The announcement comes in light of the successful integration of Melio, which has strengthened Xero’s footprint in the U.S. market.

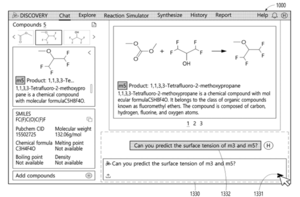

In its latest update, Xero revealed that more than two million subscribers are now benefiting from its AI capabilities, with 300,000 users actively engaging with new generative AI tools. The integration of Melio’s U.S. payment functionality has enhanced Xero’s service offerings, enabling the company to better cater to small and medium-sized businesses (SMBs) across the states. Furthermore, Xero has reiterated its guidance for fiscal year 2026, projecting operating expenses to be around 70.5% of revenue, which includes the impact of Melio.

Melio is anticipated to achieve breakeven in Adjusted EBITDA by the second half of fiscal year 2028 on a run-rate basis. Overall, Xero reports that it now serves over four million customers globally, driven in part by the expansion of AI features aimed at making accounting smarter and more efficient for its users.

Central to Xero’s strategy is a focus on enhancing its AI features. The company aims to provide quick assistance to customers, streamline processes, support informed business decisions, and unlock growth through technology. The combination with Melio is expected to yield further benefits, with integrated teams and improved payment solutions driving higher revenue per customer and enhanced unit economics. In this context, Xero has begun reporting more granular U.S. business metrics, including payment volumes and customer profitability, offering a clearer picture of its performance in this key market.

Xero’s CEO, Sukhinder Singh Cassidy, emphasized the company’s commitment to capturing the global artificial intelligence and U.S. accounting plus payments market. “We are deeply focused on capturing the global AI and U.S. accounting plus payments TAM. Xero is well positioned to shepherd SMBs into the AI era and take advantage of this technology,” she stated. Cassidy highlighted Xero’s status as a trusted system of record, stating that the company is evolving into a pivotal system for action and decision-making for its customers through its expansive data platform and market strengths.

Looking ahead, Xero aims to accelerate the rollout of its AI features, deepening product adoption and starting to monetize new AI-powered functionalities in fiscal year 2027. The company is also transitioning to an Adjusted EBITDA framework for its forward guidance, which is intended to provide investors with greater clarity regarding ongoing profitability. For fiscal year 2028, Xero has set an ambitious target of more than doubling its fiscal year 2025 group revenue while achieving Rule of 40 outcomes at the group level, supported by growth in the U.S. and efficiencies stemming from the Melio acquisition.

In terms of market performance, Xero’s shares have seen a decline of 49% over the past year, contrasting sharply with the S&P/ASX 200 Index (ASX: XJO), which has risen 5% during the same timeframe. This disparity underscores the challenges Xero faces as it navigates a competitive landscape while striving to leverage AI and enhance its value proposition for businesses.

As Xero continues to enhance its AI capabilities and integrate new technologies, the broader implications for the accounting software industry and the potential for transforming how SMBs operate remain significant. With a focus on innovation and strategic growth, Xero is positioning itself to not only recover from its recent stock performance but also to emerge as a leader in the evolving landscape of digital accounting.

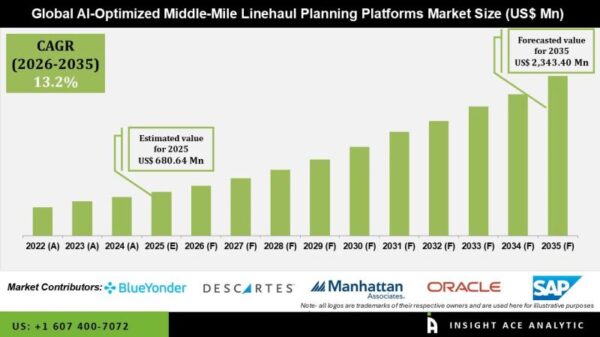

See also AI-Optimized Middle-Mile Linehaul Platforms Market to Surge 244% by 2035, Driven by E-Commerce Demand

AI-Optimized Middle-Mile Linehaul Platforms Market to Surge 244% by 2035, Driven by E-Commerce Demand Nvidia Establishes $105M Taipei HQ to Secure AI Chip Supply Amid TSMC Demand Surge

Nvidia Establishes $105M Taipei HQ to Secure AI Chip Supply Amid TSMC Demand Surge Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032