Artificial intelligence is reshaping risk assessments across various industries, compelling insurers to pivot from implicit coverage of AI-related risks to more explicit policy language. This shift, discussed in a recent insight report by WTW, highlights the evolution of insurance as it adapts to the complexities introduced by AI technologies.

Currently, risks associated with AI are often bundled within existing policies such as cyber, liability, or professional indemnity. The report, authored by Dr. Anat Lior and Sonal Madhok, draws parallels to the early days of cyber insurance, when losses were absorbed under traditional lines of coverage until dedicated products emerged. However, as AI continues to permeate various sectors, relying on such implicit coverage has created uncertainty. Gaps in coverage can surface when losses do not neatly align with existing definitions, leaving insurers and policyholders in a precarious position.

In response, insurers are beginning to roll out AI-specific endorsements or exclusions, signaling a significant shift towards policies that directly address the unique risks associated with AI. Some companies are even launching standalone AI insurance products, particularly targeting small and medium-sized enterprises, while larger tech firms tend to self-insure their AI-related exposures.

As the landscape matures, the report suggests that AI risks may eventually be integrated into mainstream insurance lines as claims data becomes more robust. This anticipated evolution mirrors previous trends in cyber insurance, where tighter terms around autonomous decision-making and algorithmic errors have become increasingly prominent. Consequently, policy reviews during renewal periods are becoming more critical than ever.

While most AI risks can still be mapped to traditional insurance policies, limitations persist. For example, cyber policies may not cover a company’s own data loss, and general liability often excludes pure financial loss, highlighting the need for tailored coverage. Insurers are adapting their underwriting practices to include more detailed inquiries regarding AI governance, human oversight, and the controls in place to mitigate risk.

Insurers show a preference for “human-in-the-loop” AI systems for high-impact decisions. Regulatory frameworks, such as the EU AI Act, are poised to further influence liability exposure in the sector. Insurers are also increasingly adopting roles as risk partners, requiring policyholders to implement stringent safety measures to maintain coverage.

Dr. Lior emphasizes that clearer policy language, enhanced governance, and improved underwriting data are critical for fostering greater certainty in the insurance landscape. This, in turn, could facilitate safer AI adoption across numerous industries. As technology continues to advance, the insurance sector will need to evolve alongside it to address the complexities introduced by AI, ensuring that both insurers and policyholders are adequately protected.

The ongoing transformation in the insurance domain reflects a broader trend of increasing sophistication in risk management strategies as industries integrate more advanced technologies. Stakeholders will need to stay vigilant and adaptable in the face of these changes, as the implications of AI extend beyond traditional boundaries.

For more details, you can visit the official sites of WTW, EU, and OpenAI.

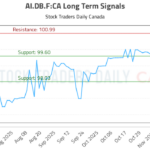

See also Strategic Investment Insights: AI.DB.F Signals Reveal Key Trading Opportunities

Strategic Investment Insights: AI.DB.F Signals Reveal Key Trading Opportunities AI, Internet Blackouts, and Youth Protests: 2026’s Digital Landscape Challenges

AI, Internet Blackouts, and Youth Protests: 2026’s Digital Landscape Challenges Microsoft’s Charles Lamanna Predicts AI Will Shift from Assistance to Autonomy in 6 Months

Microsoft’s Charles Lamanna Predicts AI Will Shift from Assistance to Autonomy in 6 Months AI Celebrity Friends Surge in 2025, Transforming Human Connection and Raising Ethical Concerns

AI Celebrity Friends Surge in 2025, Transforming Human Connection and Raising Ethical Concerns Amazon Eyes $10B OpenAI Investment to Boost AI Infrastructure Amid Holiday Demand Surge

Amazon Eyes $10B OpenAI Investment to Boost AI Infrastructure Amid Holiday Demand Surge