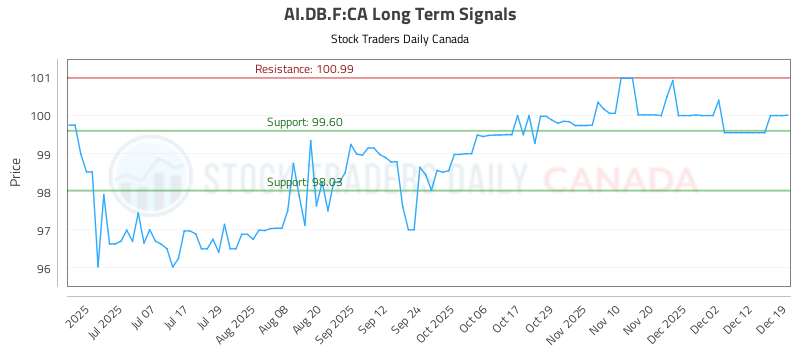

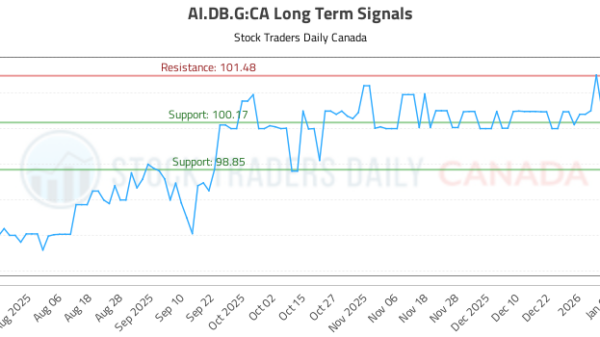

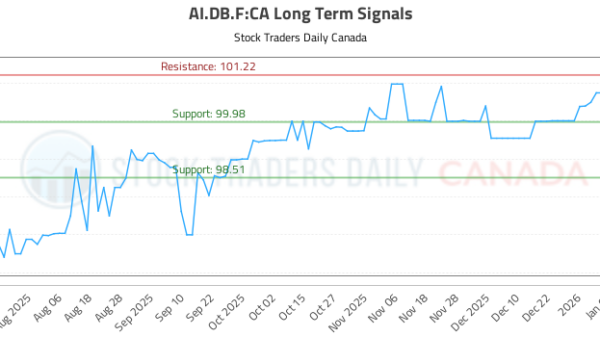

The Atrium Mortgage Investment Corporation 5.00% convertible unsecured subordinated debentures (AI.DB.F:CA) are currently under review, with recent trading signals suggesting specific buying and selling strategies. Investors are advised to consider buying near 99.60 with a target price set at 100.99 and a stop-loss at 99.10. Conversely, short sellers may look to enter near 100.99, targeting 99.60, with a stop-loss established at 101.49.

These trading strategies are accompanied by a neutral rating across all terms—near, mid, and long—reflecting a cautious sentiment among analysts. The market’s current stance is echoed in the latest ratings provided for AI.DB.F:CA, all marked as Neutral.

A detailed chart illustrates the recent price movements of the Atrium debentures, showcasing an upward trend that may influence future investment decisions. The chart, available from Stock Traders Daily, highlights critical price levels that could signify potential entry or exit points for investors.

AI-generated signals have been instrumental in shaping trading strategies for AI.DB.F:CA, providing data-driven insights that help investors navigate market fluctuations. The application of such signals reflects a growing trend in utilizing artificial intelligence for financial forecasting, which aims to enhance decision-making processes in the investment community.

As the market evolves, the implications of these signals will be closely monitored by traders and analysts alike. The integration of advanced analytics in trading strategies indicates a shift towards a more data-centric approach in finance, suggesting that investors will continue to leverage technology in pursuit of better returns. With the current neutral ratings, market participants may remain cautious, awaiting clearer signals before making significant moves.

For those interested in deeper insights into the performance of the Atrium Mortgage Investment Corporation’s debentures, further information and updates can be accessed through official investment resources, ensuring that investors stay informed amid changing market conditions.

The evolving landscape of trading driven by AI technologies underscores the importance of adapting to new methodologies. As stakeholders assess the ramifications of current strategies indicated for AI.DB.F:CA, the broader implications for market dynamics and investment behavior will likely unfold, shaping the future of financial trading.

For more information on Atrium Mortgage Investment Corporation, visit their official site at Atrium Mortgage Investment Corporation.

See also AI, Internet Blackouts, and Youth Protests: 2026’s Digital Landscape Challenges

AI, Internet Blackouts, and Youth Protests: 2026’s Digital Landscape Challenges Microsoft’s Charles Lamanna Predicts AI Will Shift from Assistance to Autonomy in 6 Months

Microsoft’s Charles Lamanna Predicts AI Will Shift from Assistance to Autonomy in 6 Months AI Celebrity Friends Surge in 2025, Transforming Human Connection and Raising Ethical Concerns

AI Celebrity Friends Surge in 2025, Transforming Human Connection and Raising Ethical Concerns Amazon Eyes $10B OpenAI Investment to Boost AI Infrastructure Amid Holiday Demand Surge

Amazon Eyes $10B OpenAI Investment to Boost AI Infrastructure Amid Holiday Demand Surge