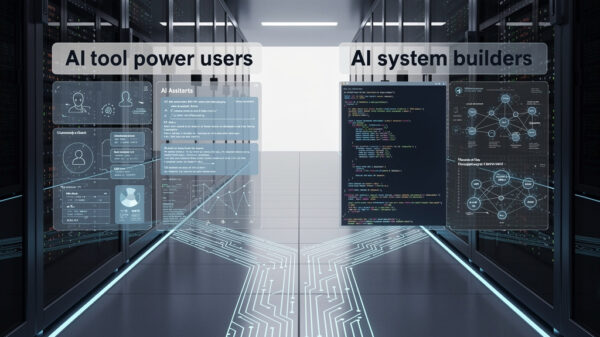

Polymarket, the online prediction market, is evolving rapidly as it attracts a more sophisticated user base. Once viewed as a crowd-driven initiative, it is now transitioning into a serious platform for data-driven trading. Analysts indicate that those equipped with advanced tools and quicker systems are gaining a competitive advantage, signaling a shift in how traders interact with the market.

Initially, prediction markets thrived on the concept of “crowd wisdom,” where collective bets from a large number of participants led to accurate forecasts. This model served Polymarket well during its early stages. However, as the platform has matured, it has drawn experienced traders, analysts, and developers, making the landscape increasingly competitive. With more money and attention in play, the emphasis has shifted from collective insight to individual trading acumen.

The dynamics on Polymarket have changed significantly, as traders who can quickly process information now find themselves at an advantage. This change is particularly evident in how prices fluctuate in response to real-time updates. A single piece of information can move the market dramatically within minutes, rewarding those who act swiftly. In political markets, timely insights from local reports, polling trends, or social media can provide critical advantages. Similarly, in sports betting, factors like injury reports or weather conditions can shift odds before they are widely disseminated.

The Role of Machine Learning

A notable evolution in Polymarket’s trading environment is the rise of machine learning tools. Developers are now creating open-source systems capable of scouring news, data, and online activity to identify patterns that may elude human traders. These tools are designed to assess sentiment, evaluate probabilities, and react more swiftly than traditional trading methods. Unlike conventional finance, which often involves proprietary algorithms, many of these machine learning solutions are publicly accessible, allowing anyone with technical skills to leverage and enhance them. This openness reduces barriers to entry but simultaneously intensifies competition among traders.

Casual traders still have opportunities on Polymarket, where the trading landscape remains relatively transparent. Although anyone can participate, relying solely on instinct may become riskier as algorithm-driven traders increasingly dominate the space. To remain competitive, casual users must enhance their understanding of data, trends, and timing. The market is evolving into a realm where knowledge and analytical skills will play a crucial role in determining success, rather than mere intuition.

As Polymarket continues to mature, it is evident that the platform is moving towards a more structured market environment. The traditional notion of a betting game is giving way to a more serious financial marketplace, where algorithmic trading increasingly shapes pricing. While this shift may lead to more accurate predictions, it also raises the stakes for individual traders.

Ultimately, the landscape of Polymarket indicates that the future will favor those who can swiftly convert information into informed trading actions. As the platform evolves, the emphasis on speed and precision will likely dictate success, making it essential for traders to adapt to the rapidly changing environment.

See also Three Lifetime AI Tools for Entrepreneurs to Reduce Stress in 2026

Three Lifetime AI Tools for Entrepreneurs to Reduce Stress in 2026 10 Best Free AI Tools for Beginners Transforming Creative Processes Today

10 Best Free AI Tools for Beginners Transforming Creative Processes Today MIT Study Reveals AI Writing Tools Reduce Brain Connectivity and Memory Retention

MIT Study Reveals AI Writing Tools Reduce Brain Connectivity and Memory Retention Google’s Demis Hassabis Plans 2026 Launch of AI-Powered Smart Glasses with Key Innovations

Google’s Demis Hassabis Plans 2026 Launch of AI-Powered Smart Glasses with Key Innovations