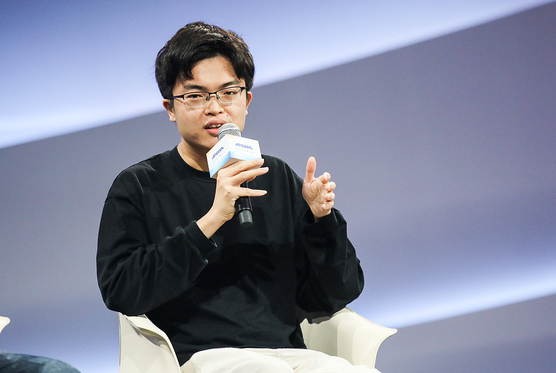

Moonshot AI, a leading Chinese artificial intelligence firm, has announced that it is not currently planning to go public, according to its founder, Yang Zhilin. This statement follows the recent closure of a substantial fundraising round that bolsters the company’s financial standing amid increasing competition from rivals poised to list in Hong Kong.

In an internal letter dated December 31, Yang revealed that the company had successfully completed a significantly oversubscribed Series C funding round, raising $500 million. This funding brings Moonshot AI’s cash reserves to over 10 billion yuan (approximately $1.4 billion), providing the firm with a robust financial cushion as it continues to develop its technology.

The decision to delay an initial public offering (IPO) comes as several competitors are gearing up for listings, suggesting a strategic approach by Moonshot AI to solidify its market position without the pressures of public scrutiny. Yang emphasized that the company is prioritizing growth and innovation over immediate public market access, a move that could allow for a more stable long-term trajectory.

Moonshot AI has gained significant attention in recent years for its advancements in machine learning and AI applications, positioning itself as a key player in an increasingly crowded marketplace. The company’s recent funding round highlights investor confidence in its capabilities and the broader potential of the AI sector.

As the demand for AI solutions continues to surge across various industries, companies like Moonshot AI are leveraging their financial strength to enhance research and development efforts. This trend is indicative of a broader movement within the technology sector, where firms are seeking to capitalize on the burgeoning interest in artificial intelligence.

The firm’s latest financial influx is expected to fuel innovations in AI technologies, which are transforming sectors such as healthcare, finance, and manufacturing. By focusing on internal growth and technological advancements rather than immediate public offerings, Moonshot AI aims to maintain its competitive edge in a field characterized by rapid evolution and intense competition.

With over $1.4 billion at its disposal, Moonshot AI is in a position to continue expanding its research initiatives, potentially securing its role as a leader in the AI landscape. Investors and analysts will be closely watching how the company utilizes its resources in the coming months, particularly as it navigates a market filled with both opportunity and challenge.

As the landscape of artificial intelligence continues to evolve, Moonshot AI’s strategic decisions may set a precedent for other firms in the industry. The broader implications of its financial maneuvers and market strategies could influence how AI companies approach growth and public engagement moving forward.

See also Korea’s Venture Ecosystem Reforms for 2026: AI Growth, $7.4B Investment Surge, and New Policies

Korea’s Venture Ecosystem Reforms for 2026: AI Growth, $7.4B Investment Surge, and New Policies OpenAI’s GPT-5 Faces Pressure as AI Bubble Rumblings Intensify Ahead of 2026

OpenAI’s GPT-5 Faces Pressure as AI Bubble Rumblings Intensify Ahead of 2026 Japan Supreme Court Launches AI Pilot for Civil Trials in January 2026, Targeting Evidence Organization

Japan Supreme Court Launches AI Pilot for Civil Trials in January 2026, Targeting Evidence Organization California’s New AI Regulations Start in 2026: Key Protections for Minors and Transparency Measures

California’s New AI Regulations Start in 2026: Key Protections for Minors and Transparency Measures AI Governance and Data Privacy: 5 Key Tech Regulation Trends to Watch in 2026

AI Governance and Data Privacy: 5 Key Tech Regulation Trends to Watch in 2026