NEW YORK, Jan 2, 2026, 09:37 ET — Microsoft shares fell 0.8% to $483.62 in early trading on Friday, continuing a trend of declines among megacap technology stocks as the market opened for the first session of 2026. This drop comes as investors recalibrate their positions following a tumultuous year influenced by optimism surrounding artificial intelligence and fluctuating expectations for interest rates.

As one of the largest companies by market value, Microsoft’s stock movements can have significant implications for major indexes. The current shift reflects broader investor anxiety regarding economic conditions, with market participants keenly awaiting upcoming U.S. economic data later in the day that could provide insights into interest rate trajectories.

Dan Ives, an analyst at Wedbush Securities, maintained a bullish outlook on Microsoft, reiterating a price target of $625. He characterized fiscal 2026 as a crucial “inflection” year for AI growth at the company, citing its advancements in integrating AI across its products. Ives noted, “FY26 for Microsoft remains the true inflection year of AI growth,” emphasizing the potential for broader AI deployment within corporate technology budgets.

Investors are closely monitoring Microsoft’s Azure cloud division for signs of a shift from preliminary AI testing to full-scale implementation, a key factor influencing sentiment in large-cap tech. The company’s performance in this area is considered a barometer for overall enterprise technology spending. As Microsoft approaches its next earnings report, anticipated in late January, analysts expect clarity on cloud demand and AI-related momentum.

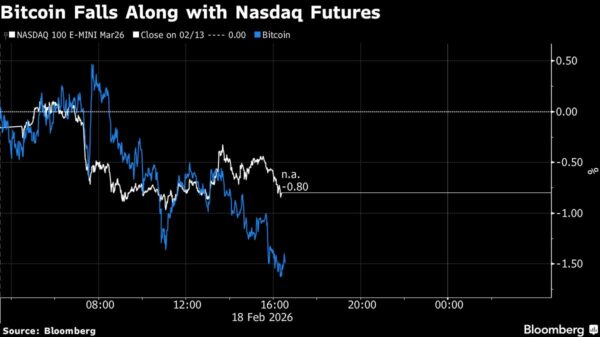

Market trends reveal that other technology heavyweights are also experiencing declines, with the Nasdaq 100 tracker Invesco QQQ down approximately 0.8%, Nvidia falling 0.5%, and Amazon decreasing by 0.7% in early trading. This collective downturn follows a somewhat more stable pre-market environment, indicating ongoing volatility as traders digest late-2025 performance.

In a related development, Microsoft has increased its focus on security and compliance for business customers. Reports indicate that Microsoft Teams will introduce enhanced messaging safety defaults on January 12, including measures to block risky file types and malicious links. These updates signal the company’s commitment to addressing corporate security concerns amid rising cyber threats.

Currently, Microsoft trades at around 37 times earnings, a premium valuation that renders the stock sensitive to any shifts in expectations regarding cloud growth and AI adoption. Proponents of the stock argue that the anticipated broader enterprise deployments of AI features could sustain demand even in an uneven macroeconomic environment.

As the session continues, traders are keenly observing whether the selling pressure on big tech stocks will subside or if a rotation away from richly valued U.S. technology stocks will persist. The trajectory of Microsoft’s stock is expected to remain closely linked to changing expectations around enterprise AI spending and the pace of real-world AI deployments.

With economic indicators on the horizon and analyst forecasts suggesting a pivotal year for Microsoft, the path forward for both the company and the broader tech sector stands at a critical juncture. Investors are poised to gauge the effectiveness of AI integration in driving growth and stability in an uncertain economic landscape.

See also Top 3 AI-Focused ETFs to Maximize Returns amid Rapid Tech Growth

Top 3 AI-Focused ETFs to Maximize Returns amid Rapid Tech Growth Two AI Stocks Set for Major Gains in 2026: SentinelOne and Datadog Poised for 42% Upside

Two AI Stocks Set for Major Gains in 2026: SentinelOne and Datadog Poised for 42% Upside FuriosaAI Launches RNGD Chip, Promises Double Efficiency Over Nvidia GPUs

FuriosaAI Launches RNGD Chip, Promises Double Efficiency Over Nvidia GPUs Microsoft AI CEO Mustafa Suleyman Warns of Existential AI Risks, Demands Global Regulations

Microsoft AI CEO Mustafa Suleyman Warns of Existential AI Risks, Demands Global Regulations Meta Acquires AI Startup Manus for $2B Amid Legal Challenges and Strategic Shift

Meta Acquires AI Startup Manus for $2B Amid Legal Challenges and Strategic Shift