China has officially lifted its almost year-long ban on the export of critical materials such as gallium, germanium, and antimony to the United States. This decision was announced by the country’s Commerce Ministry on Sunday, following a recent meeting between President Donald Trump and Chinese President Xi Jinping, which has been described as an “amazing meeting.”

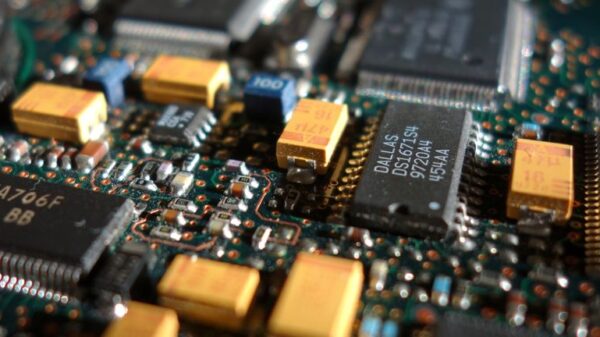

This action signifies a pivotal shift in the complex trade dynamics between the two nations, particularly amidst ongoing tensions regarding technology and supply chains. The materials in question are essential for various high-tech applications, including semiconductors, which are crucial for the advancement of artificial intelligence (AI) technologies.

Recent Developments in Aviation and Technology

In other news, President Donald Trump has urged all air traffic controllers to resume work as the US aviation sector continues to face a crisis characterized by mass flight cancellations. This disruption has been attributed to staffing shortages stemming from the extended government shutdown.

On the corporate front, Taiwan Semiconductor Manufacturing Company Ltd. (NYSE: TSM) experienced an uptick in stock price on Monday after reporting solid financial results for October, highlighting the sustained demand for advanced chips. Meanwhile, Plug Power Inc. (NASDAQ: PLUG) posted quarterly losses of 12 cents per share, which was a slight improvement over analysts’ expectations of 13 cents, though its revenue of $177.05 million fell short of the $179.53 million forecast.

In a similar vein, Rigetti Computing Inc. (NASDAQ: RGTI) reported quarterly losses of three cents per share, also better than the expected four cents, but its revenue of $1.94 million did not meet the $2.17 million estimate. Conversely, CoreWeave Inc. (NASDAQ: CRWV) exceeded expectations with third-quarter revenue of $1.36 billion, surpassing the anticipated $1.29 billion.

Emerging Trends in Tech and AI

Turning to the tech landscape, Apple Inc. (NASDAQ: AAPL) is making strides in its satellite connectivity project, aiming to enhance its offerings with innovative features. Meanwhile, the gaming sector is witnessing excitement with Sony Group Corp. (NYSE: SONY) unveiling a lower-priced version of its flagship PlayStation 5, exclusively available in Japan.

On a broader scale, Microsoft Corp. (NASDAQ: MSFT) announced a significant investment of $10 billion to establish an AI data center on the coast of Portugal. In addition, the company is expanding its operations by launching an AI “super factory” in Atlanta, designed to integrate seamlessly with its existing infrastructure to augment computing power.

As the demand for AI technologies increases, Google‘s parent company, Alphabet (NASDAQ: GOOGL), has allocated €5.5 billion ($6.41 billion) for infrastructural and data center capabilities in Germany. Furthermore, Advanced Micro Devices Inc. (NASDAQ: AMD) saw a rise in shares after projecting a revenue compound annual growth rate exceeding 35% over the next three to five years.

Potential Ramifications for AI Development

As the geopolitical landscape continues to evolve, the lifting of the export ban on key materials could have substantial implications for the AI industry in the US. Access to these critical components will likely bolster the semiconductor manufacturing sector, enabling advancements in AI capabilities and applications.

Additionally, the ongoing developments in corporate investments and product launches reflect a robust and competitive environment, positioning technology companies to respond to the increasing demands of the AI sector. With companies like Tesla Inc. (NASDAQ: TSLA) facing challenges, including a recall affecting thousands of its Powerwall 2 units, the market remains vigilant to how these companies navigate the complexities of technological innovation and regulatory scrutiny.

The recent activities in both the tech and aviation sectors illustrate a rapidly shifting landscape that is likely to shape future developments in AI and related technologies. Stakeholders across the industry will need to stay attuned to these changes to effectively harness opportunities and address challenges as they arise.

Warren Buffett Allocates 27% of $320B Portfolio to 3 AI Stocks, Including Apple and Visa

Warren Buffett Allocates 27% of $320B Portfolio to 3 AI Stocks, Including Apple and Visa xAI Announces Grok 5 Launch with 6 Trillion Parameters, A15 Chip to Drive AI Innovations

xAI Announces Grok 5 Launch with 6 Trillion Parameters, A15 Chip to Drive AI Innovations Peter Thiel Sells Entire Nvidia Stake, Cuts Tesla Holdings by 76% Over AI Bubble Concerns

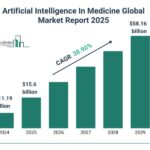

Peter Thiel Sells Entire Nvidia Stake, Cuts Tesla Holdings by 76% Over AI Bubble Concerns Artificial Intelligence in Medicine Market Projected to Reach $58.16 Billion by 2029

Artificial Intelligence in Medicine Market Projected to Reach $58.16 Billion by 2029 Google VP Shantanu Sinha Highlights Creative Student Uses of AI in Education

Google VP Shantanu Sinha Highlights Creative Student Uses of AI in Education