Doximity (DOCS) has experienced significant volatility in its share price as high-growth technology stocks undergo profit-taking following a recent rally. This fluctuation occurs despite the company reporting favorable results and rolling out new products, contributing to a mixed market sentiment.

Recent trading data illustrates this contrast: over the past week, Doximity’s shares returned 4.99%, yet the stock has seen a 35.94% decline over the last three months. In a broader context, the company’s three-year total shareholder return stands at 43.40%, indicating a stronger performance in the past that has since cooled.

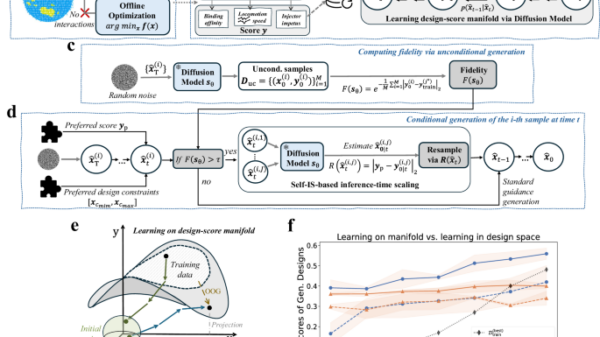

The current share price of $46.49 is significantly below a commonly referenced fair value estimate of approximately $71.11, suggesting that the market may be mispricing the stock. Doximity’s recent introduction of revenue growth in Q3 and AI-driven tools such as Scribe, Doximity GPT, and Pathway AI could position the company for stronger long-term growth. Analysts anticipate these innovations will enhance clinician productivity, increase platform usage frequency, improve customer retention, and ultimately elevate average revenue per user (ARPU), thereby supporting long-term revenue and margin expansion.

Investors are encouraged to evaluate Doximity alongside other healthcare stocks to determine if its current valuation aligns with their investment strategies. As the company navigates a challenging environment marked by short-term spending on free AI tools and potential reductions in pharmaceutical marketing budgets, the sustainability of its growth narrative remains critical.

According to analysts, if Doximity can maintain earnings growth and profitability, there is a plausible pathway to bridging the valuation gap. However, this outlook is contingent on several key assumptions holding firm. The risks associated with this narrative, including the impact of heightened spending and shifting market dynamics, could undermine the view of Doximity as undervalued.

For those skeptical of the bullish outlook or wishing to independently assess the company’s prospects, resources are available to construct a comprehensive analysis of Doximity. Investors are urged to explore three key rewards that have garnered optimism around the stock.

While Doximity’s position as a central player in the healthcare technology sector attracts attention, a long-term investment strategy should consider a diversified approach, incorporating various stocks that align with individual financial goals.

This article is for informational purposes only and should not be construed as financial advice. It reflects historical data and analyst forecasts without accounting for specific financial situations or objectives. Readers are encouraged to assess all data independently and consider any recent price-sensitive announcements that may impact the stock.

Companies discussed in this article include Doximity (DOCS). For feedback or concerns regarding this article, please contact the editorial team directly.

See also Intelligent Tools Transform Remote Work, Boosting Productivity by 30% for Teams

Intelligent Tools Transform Remote Work, Boosting Productivity by 30% for Teams AI Adoption in Mineral Exploration Surges to 77% But Faces Key Adoption Challenges

AI Adoption in Mineral Exploration Surges to 77% But Faces Key Adoption Challenges Walmart Expands Sparky AI with Sponsored Ads, Enhancing Retail Media Strategy

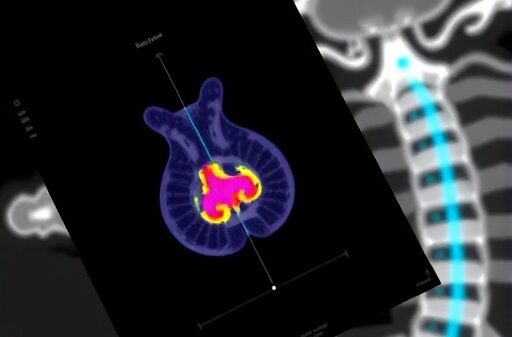

Walmart Expands Sparky AI with Sponsored Ads, Enhancing Retail Media Strategy AI Transforms Health Care Workflows, Elevating Patient Care and Outcomes

AI Transforms Health Care Workflows, Elevating Patient Care and Outcomes Tamil Nadu’s Anbil Mahesh Seeks Exemption for In-Service Teachers from TET Requirements

Tamil Nadu’s Anbil Mahesh Seeks Exemption for In-Service Teachers from TET Requirements