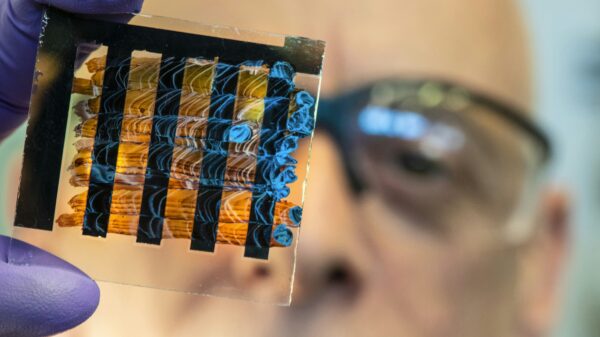

Wall Street is entering an era defined by artificial intelligence (AI), as banks, hedge funds, and asset managers eagerly implement generative AI to enhance productivity and streamline operations. Major financial institutions are now investing heavily in AI technologies to drive efficiencies and reshape traditional workflows. According to consulting firm ThoughtLinks, AI is projected to revolutionize approximately 44% of banking activities by 2030, prompting significant financial players to accelerate their AI adoption.

JPMorgan Chase, the largest bank in the U.S. by assets, is investing $18 billion annually in technology, with a substantial emphasis on AI. CEO Jamie Dimon has become a prominent user of the bank’s generative AI tools, which have reached over 200,000 employees. The bank has begun replacing longstanding manual processes with AI, exemplified by its asset-management division’s move to develop an in-house AI platform, Proxy IQ. This tool will analyze data from more than 3,000 annual company meetings, effectively eliminating reliance on external proxy advisors.

Goldman Sachs follows suit with a $6 billion technology budget for this year, a figure that CEO David Solomon expressed he wishes were larger. In an October memo detailing the latest phase of its OneGS initiative, the bank indicated that AI would not only enhance efficiency but also result in slower hiring and a “limited reduction” in roles. Goldman has rolled out a suite of internal AI tools, including an assistant accessible to employees across the organization.

Morgan Stanley, an early collaborator with OpenAI, has focused on harnessing employee-generated ideas into viable AI products. One of its internally developed tools, DevGen.AI, has reportedly saved engineers over 280,000 hours this year. Among interns, AI usage is particularly prevalent, with 72% indicating they use ChatGPT daily or several times a week.

Meanwhile, Citigroup has ramped up its AI initiatives, providing nearly 180,000 employees across 83 countries access to proprietary tools that have been utilized almost 7 million times this year. CEO Jane Fraser noted that these generative AI tools are yielding significant time savings, equivalent to about 100,000 developer hours weekly through automated code reviews. The bank is also piloting agentic AI with 5,000 employees as part of its forward-looking strategy.

In the competitive world of hedge funds, the urgency to leverage AI has never been greater. Citadel announced that its stock pickers are employing an internal chatbot to expedite their research processes. WorldQuant is similarly utilizing AI to broaden the types of data integrated into its models, with Deputy CIO Andreas Kreuz highlighting its capability to restructure information from images and audio.

Point72 is also investing in technology and has ambitious plans for AI integration within its tech organization. In 2024, Bridgewater introduced an AI-driven fund that aims to automate every phase of the investment process through machine learning. The firm’s co-chief investment officer provided insights into the strategic importance of AI in its operations.

At the $29 billion fund, Balyasny has developed an AI bot intended to alleviate some of the more tedious tasks typically assigned to senior analysts, which could save substantial time for investment teams. According to the firm, approximately 80% of its staff now utilize its AI tools, including the internal chatbot BAMChatGPT, further demonstrating the widespread adoption of AI in hedge fund operations.

In the private equity sector, firms are also recognizing the potential of AI to enhance their investment strategies. Carlyle’s chief information officer, Lucia Soares, recently emphasized the challenge of integrating AI across its global workforce of 2,300 employees. Blackstone is investing in improving its enterprise search capabilities and believes that AI will bolster its efforts to capture greater market share in the insurance sector.

Swedish private equity giant EQT has developed an AI engine named Motherbrain that has transformed its approach to sourcing deals. Similarly, Thomas H. Lee noted that its engineers have become 30% more productive with the assistance of AI coding tools, underscoring the growing reliance on technology in the financial industry.

Asset managers are also capitalizing on AI advancements. Firms such as AllianceBernstein, BlackRock, and JPMorgan have shared insights into how their technologies are expediting portfolio management processes. BlackRock has introduced Asimov, an agentic AI platform designed to enhance its fundamental equity business, as detailed by Kirsty Craig, head of research, data, and AI strategy.

As the financial sector continues to embrace AI, the implications for jobs and productivity are profound. Companies are actively exploring how these tools can reshape their operations, promising a future where AI plays an integral role in financial decision-making and investment strategies. The rapid deployment of AI in finance not only reflects a technological evolution but also signals a cultural shift within these organizations.

For further insights into the ongoing transformation in finance through AI, visit the official websites of JPMorgan, Goldman Sachs, and Citigroup.

See also AI Transforms Aviation: Streamlining Operations and Enhancing Passenger Experience Now

AI Transforms Aviation: Streamlining Operations and Enhancing Passenger Experience Now Google Launches AI Overviews and Inbox in Gmail, Powered by Gemini 3 Features

Google Launches AI Overviews and Inbox in Gmail, Powered by Gemini 3 Features Salesforce Unveils AI-Driven Two-Way Communication Tools to Transform E-Commerce Engagement

Salesforce Unveils AI-Driven Two-Way Communication Tools to Transform E-Commerce Engagement Indigenous Leadership Essential for Ethical AI in Global Conservation Efforts

Indigenous Leadership Essential for Ethical AI in Global Conservation Efforts Indonesia Blocks Grok Chatbot Over AI-Generated Adult Content Concerns

Indonesia Blocks Grok Chatbot Over AI-Generated Adult Content Concerns