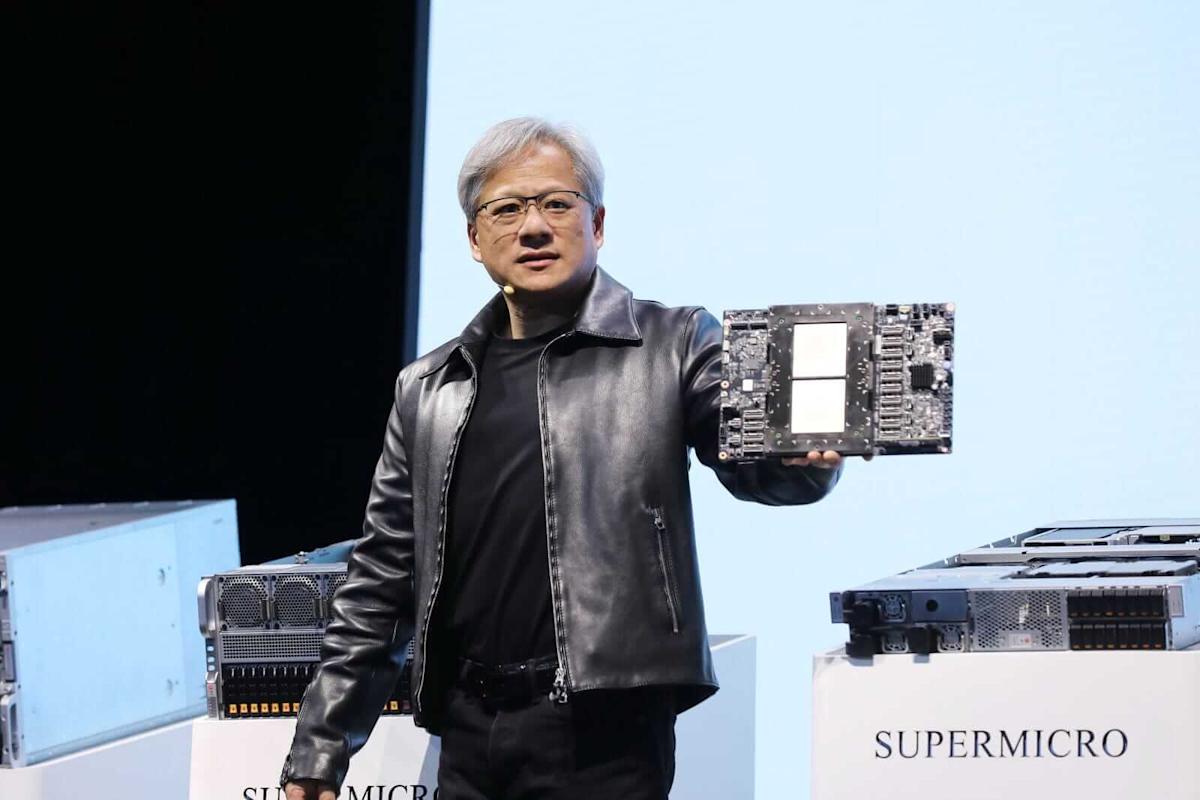

Nvidia (NVDA) CEO Jensen Huang emphasized the extensive nature of the ongoing artificial intelligence (AI) revolution during a recent discussion with the Center for Strategic and International Studies (CSIS). Huang pointed out that there are currently over 1.5 million AI models globally, spanning various sectors such as healthcare and drug discovery, alongside more recognizable names like Elon Musk‘s Grok and Sam Altman‘s ChatGPT.

In his layered perspective on AI, Huang described its development as an infrastructure-scale transformation rather than merely a technological advancement. He underscored the necessity of systems, capital, and a diverse range of applications, all of which contribute to AI’s long-term significance. The discussion highlighted how the current infrastructure buildout of AI can be viewed in multiple layers, beginning with the fundamental need for energy.

Huang framed electricity as the cornerstone of the AI revolution, stating that without sufficient energy, the subsequent layers of AI—namely the chips produced by Nvidia—cannot function. The chips are essential for processing the computational power necessary to run AI models effectively. This leads to the next layer: financial services. Huang emphasized that significant capital investment is required for the development and operation of AI at scale, covering the costs of data centers, networking, and long-lasting computing assets.

The fourth layer of focus, which garners the most public attention, comprises the AI models themselves. While acknowledging the popularity of models like ChatGPT, Anthropic‘s Claude, Google‘s Gemini, and xAI‘s Grok, Huang pointed out that these are only a small fraction of the broader ecosystem. He stated, “those are four of the one and a half million AI models in the world,” illustrating that the well-known generative models represent just a limited subset of a more expansive and diverse landscape.

Huang’s remarks aim to shift the public narrative away from a narrow focus on high-profile models, positioning Nvidia as a key player in a broader technological revolution that permeates various industries. He asserted that AI extends far beyond language and consumer interaction, incorporating systems that understand genetics, proteins, chemicals, physics, quantum mechanics, and even robotics. This multi-disciplinary approach illustrates AI’s capability as a general-purpose technology applicable across numerous sectors.

This viewpoint aligns with Nvidia’s evolution over the past decade, as its hardware and software platforms have found applications in drug discovery, climate modeling, industrial automation, and financial analysis. Huang’s insights reflect Nvidia’s central role in providing the necessary computing infrastructure for a wide array of AI workloads, not limited to popular chat interfaces.

In a broader market context, Huang’s comments highlight a recurring challenge within technology cycles: the public often tends to focus on the most visible applications while underestimating the underlying infrastructure and the diversity of use cases. As investments continue to flow into AI-related companies, the distinctions between model developers, infrastructure providers, and domain-specific applications become increasingly crucial. Huang’s layered framework offers a way to assess AI development that emphasizes capital intensity, specialization, and long-term deployment over fleeting novelty.

By framing AI as a platform with multiple layers and millions of specialized models, Huang positions the technology as a foundational shift, akin to previous industrial transformations. His observations suggest that the long-term impact of AI will be shaped less by any single model and more by the breadth of its application across disciplines, industries, and economic systems.

On the date of publication, Caleb Naysmith did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. This article was originally published on Barchart.com.

See also Invest in AI Stocks: Nvidia and Serve Robotics Poised for Massive Growth by 2026

Invest in AI Stocks: Nvidia and Serve Robotics Poised for Massive Growth by 2026 Microsoft’s AI Investment Strategy Sparks Stock Decline Despite Long-Term Growth Potential

Microsoft’s AI Investment Strategy Sparks Stock Decline Despite Long-Term Growth Potential Parents Equip Themselves for AI Challenges at Marquette Library Workshop

Parents Equip Themselves for AI Challenges at Marquette Library Workshop OpenAI, Google DeepMind Employees Demand Transparency and Safety in AI Oversight

OpenAI, Google DeepMind Employees Demand Transparency and Safety in AI Oversight