Nvidia (NVDA 0.05%) continues to dominate the artificial intelligence (AI) landscape, being a primary supplier of high-performance chips essential for powering AI models. The company’s position as a leader has resulted in significant stock gains, particularly as it introduces new hardware faster than ever. In a recent update, CEO Jensen Huang noted that “Blackwell sales are off the charts, and cloud GPUs are sold out,” emphasizing the robust demand for their latest GPU offerings.

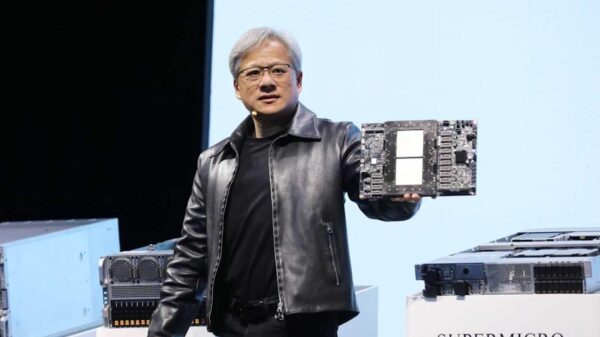

Looking ahead, Nvidia is already in production of its next-generation Rubin architecture, designed as an AI supercomputer. Huang introduced the platform at the recent CES conference, asserting its timely arrival amidst soaring demand for AI computing. He remarked, “With our annual cadence of delivering a new generation of AI supercomputers — and extreme codesign across six new chips — Rubin takes a giant leap toward the next frontier of AI.” The Rubin platform promises significant improvements over its predecessor, Blackwell, including a reduction in cost per token that could attract even more demand, propelling profitability for developers.

Nvidia’s innovations signal a flourishing environment for AI companies, setting the stage for what Huang describes as the “ChatGPT moment for physical AI.” This refers to advancements in machines capable of understanding, reasoning, and acting autonomously. Among the beneficiaries of this trend is Serve Robotics (SERV 4.54%), known for its autonomous delivery robots that utilize Nvidia’s Jetson Orin platform. Although Nvidia previously held a stake in Serve, they currently maintain a strategic partnership, highlighting the growing importance of mobility technology fueled by AI advancements.

Serve, which has expanded its active fleet of delivery robots significantly, combines technology and innovation to meet the demands of an evolving market. Its partnership with Uber Technologies, along with integrations with DoorDash, indicates a promising trajectory as it continues to build its operational footprint. Despite the company being classified as a speculative investment with a market cap exceeding $1 billion, its projected revenue growth from $2.5 million in 2025 to an estimated $25 million in 2026 could yield substantial returns for investors if these predictions materialize.

However, Nvidia’s prospects are intricately tied to the unpredictable landscape of international trade, especially with China. Management has refrained from including potential sales to Chinese customers in their forecasts due to ongoing trade restrictions and geopolitical issues. Yet, Huang has indicated optimism about future sales, expecting approval for high-demand H200 chips from Chinese tech companies. This additional revenue could further bolster Nvidia’s stock value, promising attractive returns for shareholders.

As Nvidia’s innovations drive demand not just for its products but also for other players in the AI ecosystem, the future appears bright for companies positioned around this transformative technology. With a robust market cap of $4.5 trillion and a gross margin of 70.05%, Nvidia remains a compelling option for investors seeking long-term growth. The potential for AI to revolutionize various sectors signifies a broader trend that will likely shape the tech landscape for years to come.

For more insights on Nvidia, visit Nvidia’s official website. To explore innovative solutions in AI, check out OpenAI and Microsoft’s initiatives. For detailed information on Serve Robotics, refer to their page at Serve Robotics.

See also Microsoft’s AI Investment Strategy Sparks Stock Decline Despite Long-Term Growth Potential

Microsoft’s AI Investment Strategy Sparks Stock Decline Despite Long-Term Growth Potential Parents Equip Themselves for AI Challenges at Marquette Library Workshop

Parents Equip Themselves for AI Challenges at Marquette Library Workshop OpenAI, Google DeepMind Employees Demand Transparency and Safety in AI Oversight

OpenAI, Google DeepMind Employees Demand Transparency and Safety in AI Oversight Toy Makers Tackle AI Risks After Chatbot-Infused Toys Trigger Controversy and Suspensions

Toy Makers Tackle AI Risks After Chatbot-Infused Toys Trigger Controversy and Suspensions