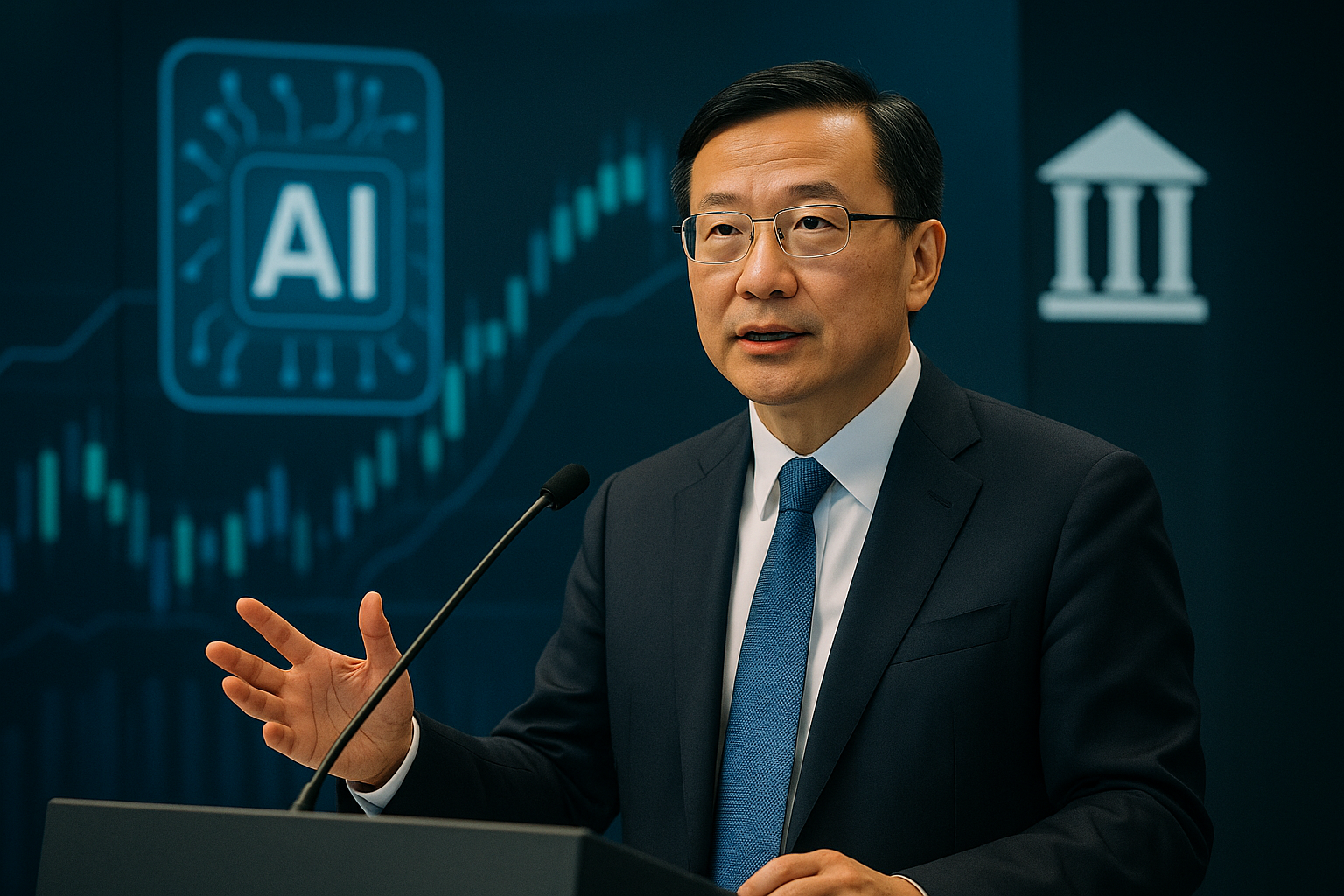

At the Singapore FinTech Festival on November 14, 2025, Eric Jing, Chairman of Ant Group, emphasized the company’s commitment to empowering small and medium-sized enterprises (SMEs) with innovative payment and operational tools driven by AI and tokenization technologies. Jing stated, “We are passionate about using frontier technology to support SMEs, and the use of AI will really uplift inclusion.”

This vision aligns with the growing recognition of the pivotal role that SMEs play in the global economy, particularly as they navigate increasingly complex payment and risk environments. During a panel discussion titled “Steering the Global Future,” Jing shared the stage with notable figures such as Agustín Carstens, Former General Manager of the Bank for International Settlements, and Ravi Menon, Chairman of the Board of Directors of the Global Finance & Technology Network.

Empowering SMEs with Agentic AI

Jing highlighted the emergence of personalized AI financial managers and advisors for consumers, while introducing the concept of “Agentic payment” as a critical force in transforming commerce. He noted that many SMEs often lack sophisticated digital skills and a large workforce, which makes the integration of AI agents essential for their success in global markets. “AI agents can really play a role in helping them to navigate the landscape,” Jing pointed out.

To support this initiative, Antom, the merchant payment and digitization services arm of Ant International, has developed Antom Copilot. This tool significantly reduces payment integration time by over 90%, increases chargeback winning rates by 3 percentage points, and shortens chargeback resolution time by 46%. Additionally, during the festival, Antom launched EPOS360, an all-in-one app designed to assist micro, small, and medium-sized enterprises (MSMEs) in scaling efficiently by integrating point-of-sale systems, payments, banking, lending, and growth support.

Jing described Agentic AI as acting like a virtual Chief Operating Officer (COO) or Chief Financial Officer (CFO) for SMEs, facilitating their ability to compete globally.

Tokenization and Real-Time Global Transactions

Another key topic discussed was the role of tokenization in enabling real-time global settlement. Jing noted, “The tokenization of money that enables global real-time settlement across borders will be particularly beneficial to SMEs and companies doing global trade.” He underscored the importance of collaboration between regulatory bodies, such as the Monetary Authority of Singapore (MAS), and industry leaders to create a conducive environment for innovation and risk management.

Ant International’s involvement in initiatives like Project Guardian and PathFin.ai reflects a successful public-private partnership aimed at harnessing blockchain and AI technologies. Jing expressed pride in participating in MAS’s regulatory sandboxes, stating, “They provide the clarity and certainty needed to responsibly deploy cutting-edge technologies while managing risks.” He emphasized the importance of harnessing new technology to maximize benefits while remaining aware of potential risks.

In the context of Project Guardian, Ant International has contributed to pilot projects focused on tokenized money and cross-border settlements, demonstrating how blockchain-based payments can facilitate real-time, transparent, and credible transactions for SMEs engaged in global trade.

Advancements in Cash Flow Forecasting

Additionally, through the MAS PathFin.ai program, Ant International is sharing knowledge on AI implementations. Jing highlighted their Falcon Time-Series Transformer Model, a sophisticated 8.5-billion-parameter AI model designed for foreign exchange and liquidity forecasting, which has markedly improved cash flow prediction accuracy. This advancement aids businesses in reducing hedging costs amid current economic volatility.

As Ant International continues to expand its capabilities, the company now collaborates with over 1,400 institutional partners and offers global payment, settlement, and digitization services to 150 million merchants. With a unified techfin platform, Ant International aims to support financial institutions and merchants of all sizes in achieving inclusive growth through cutting-edge digital payment solutions.

To learn more about Ant International and their initiatives, visit ant-intl.com.

AI in Finance Faces Market Crowding Risks, Experts Urge Caution and Vigilance

AI in Finance Faces Market Crowding Risks, Experts Urge Caution and Vigilance AMA Advocates for Physician Oversight in AI Integration to Ensure Patient Safety and Data Security

AMA Advocates for Physician Oversight in AI Integration to Ensure Patient Safety and Data Security Sakana AI Secures $135M Series B, Targets Japanese Finance and Defense Markets

Sakana AI Secures $135M Series B, Targets Japanese Finance and Defense Markets Bain & Company Launches AI Innovation Hub in Singapore to Boost Regional Solutions

Bain & Company Launches AI Innovation Hub in Singapore to Boost Regional Solutions Madison Finance Committee Adopts 2026 Employee Handbook Changes, Modifies Discipline Process

Madison Finance Committee Adopts 2026 Employee Handbook Changes, Modifies Discipline Process