IT distribution giant TD SYNNEX (NYSE:SNX) reported revenue exceeding Wall Street expectations in the fourth quarter of calendar year 2025, with sales rising 9.7% year-on-year to reach $17.38 billion. The company’s non-GAAP profit of $3.83 per share also surpassed analysts’ consensus estimates by 2.7%. For the upcoming quarter, TD SYNNEX expects revenue to be around $15.5 billion, aligning closely with market forecasts.

The company’s quarterly highlights included an adjusted EBITDA of $527.1 million, which reflected a 3% margin and exceeded analyst estimates of $515.2 million. Its operating margin held steady at 2.3%, consistent with the same quarter last year, while the market capitalization stood at $11.82 billion.

Despite the positive results, the market response was tepid, indicating investor caution regarding the sustainability of recent gains. Management linked this performance to robust demand for cloud and data center infrastructure, particularly from hyperscaler clients in regions such as Asia Pacific and Europe. CEO Patrick Zammit noted, “We gained significant share in Asia Pacific, especially in India, and Europe outperformed macro trends due to targeted technology and customer segment focus.”

Guidance from TD SYNNEX indicates expectations for ongoing investment in cloud, AI, and advanced software solutions, although management remains cautious about potential volume pressures. Zammit emphasized that while rising component prices are acting as a tailwind for revenue growth, the company remains focused on commercial PCs and enterprise upgrades to mitigate demand elasticity.

Management cited broad-based demand for cloud, AI, and security solutions as key contributors to the quarter’s revenue growth, supported by strong regional execution and product mix enhancements. Specifically, both Asia Pacific and Europe exceeded average growth expectations, benefiting from rapid cloud expansion and ongoing investments in digital transformation. The company’s HIVE business unit, which specializes in advanced solutions, reported over 50% growth in billings due to sustained demand for server and networking rack builds.

The shift towards software and cloud technologies has led to a higher proportion of revenue derived from these strategic segments, reflecting evolving customer needs. Improved operational efficiency and strict cost control measures further bolstered the company’s financial performance, as it generated strong free cash flow while continuing to invest in HIVE and digital platforms.

Looking ahead, TD SYNNEX anticipates future performance to be driven by demand for advanced cloud, AI, and security solutions while remaining vigilant against potential costs and volume risks. Rising memory and component prices have boosted average selling prices, providing a short-term lift to revenue. However, management is cautious about possible demand destruction in categories sensitive to price elasticity, particularly within the PC market. Zammit pointed out the company’s focus on commercial PCs, where he expects demand to remain relatively stable compared to consumer segments.

Future growth is also expected to come from ongoing investments in HIVE, which should strengthen TD SYNNEX’s position with hyperscalers and in complex infrastructure deployments. The company aims to maintain robust free cash flow generation and adhere to its capital allocation framework, which balances shareholder returns with strategic growth investments. Seasonal cash flow fluctuations are anticipated, but management is committed to aligning full-year free cash flow conversion with long-term targets.

In the upcoming quarters, analysts will closely watch several key factors: the pace of HIVE’s expansion and its ability to secure new hyperscaler customers, the impact of rising component prices on revenue growth, and the continued shift towards high-margin software and cloud solutions. Effective execution on digital platform enhancements and further penetration in commercial PC and AI infrastructure markets are also critical areas of focus as TD SYNNEX maneuvers through a complex technological landscape.

Currently trading at $148.61, down from $151 prior to the earnings announcement, TD SYNNEX presents a nuanced opportunity for investors. For a more in-depth analysis, a full research report is available for active Edge members.

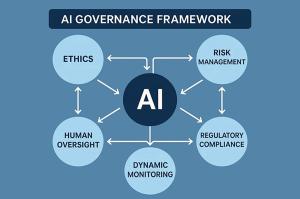

See also RegulatingAI Appoints Mehdi Jomaa to Bolster Global AI Governance Amid Rising International Concerns

RegulatingAI Appoints Mehdi Jomaa to Bolster Global AI Governance Amid Rising International Concerns Meta Unveils ‘Meta Compute’ Initiative, Aiming for $600B AI Infrastructure by 2028

Meta Unveils ‘Meta Compute’ Initiative, Aiming for $600B AI Infrastructure by 2028 NVIDIA’s Jensen Huang Reveals AI’s Job Growth Potential and Future by 2025

NVIDIA’s Jensen Huang Reveals AI’s Job Growth Potential and Future by 2025 WEF Report Warns: AI, Geopolitical Fragmentation Fuel Cyber Fraud Risks by 2026

WEF Report Warns: AI, Geopolitical Fragmentation Fuel Cyber Fraud Risks by 2026 Meta Unveils Ambitious AI Infrastructure Initiative, Targeting Tens of Gigawatts Expansion

Meta Unveils Ambitious AI Infrastructure Initiative, Targeting Tens of Gigawatts Expansion