As of mid-January 2026, International Business Machines Corp. (IBM:NYSE) has completed a multi-year transformation hailed by analysts as one of the most significant corporate turnarounds in the technology sector’s recent history. With its stock trading near record highs of $312.00 and a market capitalization that has outpaced broader market indices over the last twelve months, IBM is no longer viewed merely as a legacy hardware provider. Instead, it has emerged as a dominant leader in the “Enterprise AI” and Hybrid Cloud sectors, demonstrating that its focus on regulated industries and data governance meets the modern corporate world’s demands.

The implications of this transition are profound. IBM has carved out a distinct niche that allows it to avoid a direct “price war” with commodity cloud providers such as Amazon.com Inc. (AMZN:NASDAQ) and Microsoft Corp. (MSFT:NASDAQ). Instead, IBM is aiding the world’s largest banks, healthcare providers, and government agencies in navigating the complexities of “Agentic AI”—technology that not only generates text but also autonomously executes complex business workflows. As the company prepares to report its full-year 2025 earnings on January 28, 2026, investor sentiment is buoyed by a substantial $9.5 billion GenAI bookings backlog and a strategic acquisition spree that has redefined its software portfolio.

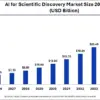

IBM’s resurgence in 2025 and early 2026 is rooted in disciplined execution and a clear departure from a “one-size-fits-all” cloud strategy. Throughout 2025, the company focused heavily on its watsonx platform, which evolved from a promising experiment into a mission-critical foundation for Fortune 500 companies. By year-end 2025, IBM reported that its generative AI business bookings had nearly doubled year-over-year to approximately $9.5 billion, largely driven by the “Granite” family of models—domain-specific language models (DSLMs) that prioritize legal indemnity and data efficiency over sheer model size.

A turning point came in February 2025 when IBM finalized its $6.4 billion acquisition of HashiCorp Inc., integrating industry-standard tools like Terraform and Vault into its Red Hat ecosystem. This move positioned IBM as the “gatekeeper” of multi-cloud infrastructure, enabling enterprises to manage their workloads across various environments with unmatched security. In December 2025, IBM further surprised the market by announcing an $11 billion deal to acquire Confluent Inc. (CFLT:NASDAQ), the leader in real-time data streaming, which is expected to close by mid-2026. This acquisition aims to provide the “central nervous system” for AI agents requiring real-time data for autonomous decision-making.

The market reaction has been overwhelmingly positive, with IBM’s stock price surging approximately 39% over the past year, significantly outperforming the S&P 500 index. Analysts attribute this momentum to IBM’s “Client Zero” strategy, which uses its own AI tools to automate internal HR and finance functions, resulting in a reported $3.5 billion reduction in its annual cost base. This served as a compelling proof of concept for global CEOs previously skeptical about AI’s return on investment (ROI). By January 2026, IBM is no longer just selling software; it offers a blueprint for the automated, high-margin enterprise of the future.

In this shifting landscape, IBM emerges as a primary winner, particularly within the Hybrid Cloud sector. By specializing in “Cloud Repatriation”—the trend of companies migrating sensitive workloads off public clouds back into private, governed environments—IBM has found a lucrative path that competitors are hard-pressed to replicate. Other winners include specialized consulting firms that have partnered with IBM. Its consulting arm, which faced a slowdown early in 2025, has since recovered, acting as a primary engine for AI deployment. Nearly 80% of IBM’s current AI-related revenue is linked to its consulting services, as enterprises pay a premium for “AI safety” and “governance” expertise.

Conversely, some “pure-play” public cloud providers may feel pressure as companies like Microsoft and Amazon focus on massive, general-purpose large language models (LLMs), risking losses in specialized sectors where IBM’s smaller, efficient models excel. Traditional IT outsourcing firms that have not invested heavily in AI automation are also experiencing shrinking margins as IBM’s AI-driven efficiencies lower the price floor for enterprise services.

Investors are keeping a close eye on Confluent Inc. and its ecosystem as it prepares to join the IBM family. Its technology is being positioned as the “glue” for the next generation of enterprise applications. However, competitors in the data integration space may feel the squeeze as IBM creates a “walled garden” of highly integrated, high-performance data streaming and AI governance tools.

The resurgence of IBM aligns with a broader industry trend toward “Sovereign AI” and data privacy. While the tech world was primarily focused on AI’s capabilities in 2024 and 2025, the spotlight has now shifted to control. Regulatory bodies in the EU and North America have tightened rules surrounding data lineage and AI bias, which plays directly into IBM’s historical strengths in mainframe security and ethical AI. The “Granite” models exemplify this approach, as they are trained on curated, high-quality data with full legal backing, contrasting sharply with the “scrape-everything” methods that have caused legal troubles for other AI companies.

Looking ahead to the remainder of 2026, IBM is entering a virtuous cycle. The company has teased the launch of its “z17 Mainframe” series later in 2026, expected to feature specialized AI-acceleration chips designed to run Agentic AI workflows locally at scale. This hardware cycle, combined with the complete integration of Confluent and HashiCorp, positions IBM to dominate the “Edge AI” market by bringing intelligence closer to where data is generated.

The short-term challenge for IBM will be translating its impressive $9.5 billion in AI bookings into consistent, high-margin software revenue growth in the 10-12% range. Any delays in the Confluent acquisition or a slowdown in enterprise AI spending due to macroeconomic headwinds could temporarily dampen its stock momentum. Nevertheless, IBM’s guidance of $15 billion in free cash flow for 2026 suggests that management is confident in generating cash while also investing in the next wave of innovation. If the company successfully navigates the integration of its recent billion-dollar acquisitions, it could establish a formidable “moat” around its business that is difficult for competitors without a century of enterprise trust to breach.