By Sophie Kiderlin and Rae Wee

LONDON, Jan 16 (Reuters) – Global stocks remained near record highs on Friday as international tensions persisted, while the dollar hovered close to a six-week peak as traders adjusted their expectations for Federal Reserve interest rate cuts.

Safe-haven gold prices were relatively unchanged, while oil markets saw a rebound following a brief decline. This shift came after U.S. President Donald Trump indicated a cautious stance towards Iran, stepping back from earlier threats of intervention. The geopolitical landscape has significantly influenced market sentiment since the beginning of the year, fueled by Trump’s actions in Venezuela, controversial comments about Greenland, and ongoing tensions in the Middle East.

Michael Brown, senior research strategist at Pepperstone, emphasized that while the immediate risk of U.S. intervention in the Middle East has lessened, it cannot be entirely dismissed. “Although it appears that we’ve sort of dialled down the probability of U.S. intervention in the Middle East for the time being, I don’t think we can entirely rule that out,” he noted.

Market activity may face additional constraints ahead of the Martin Luther King Jr. Day holiday in the U.S. on Monday, leading to a lack of conviction among investors. Brown remarked, “I wouldn’t be entirely confident if I was running a book to be long-risk or short-crude into a three-day weekend with this amount of Middle East tension going on.”

The pan-European Stoxx 600 index dipped 0.1% after reaching a record high on Thursday, poised to conclude its fifth consecutive week of gains despite the slight decline. In contrast, France’s CAC 40 fell 0.7%, impacted by political uncertainty, as the French government postponed discussions regarding its 2026 budget amid a failure to reach a compromise among lawmakers.

In the U.S., stock futures indicated a strong opening on Wall Street, where an earnings-heavy week is set to conclude with results from State Street. Asian markets reflected optimism, with tech-focused indexes in Taiwan and South Korea achieving all-time highs. Solid quarterly results from Taiwanese chipmaker TSMC revitalized the AI sector, contributing to broader tech market enthusiasm.

The U.S. and Taiwan recently finalized a trade agreement that reduces tariffs on many Taiwanese exports and fosters investment in the U.S. technology sector, a move likely to exacerbate tensions with China. Tony Sycamore, a market analyst at IG, remarked, “With the TSMC report yesterday being pretty solid and sounding optimistic, it certainly provided a much-needed shot in the arm for those AI names which have been struggling on Wall Street in recent months.”

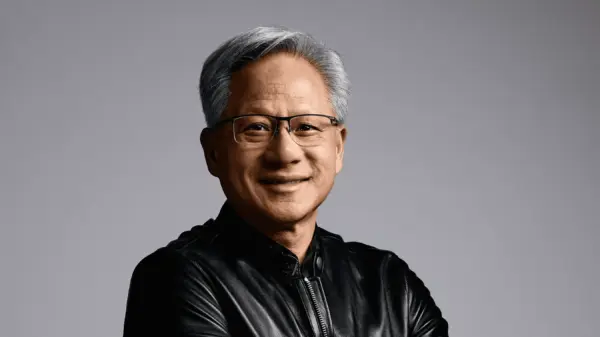

In premarket trading, shares from semiconductor firms were poised to continue their AI-driven rally, as companies like Intel and Nvidia saw upward movement.

The yen emerged as a focal point in currency markets after Japanese Finance Minister Satsuki Katayama stated that Tokyo would not dismiss any options to counter excessive foreign exchange volatility, including coordinated intervention with the United States. These comments buoyed the yen, which gained momentum following a Reuters report indicating that some policymakers at the Bank of Japan see potential for raising interest rates sooner than the market anticipates, with April being a notable possibility. The dollar was last down 0.3% at approximately 158 yen.

There are growing concerns regarding the yen’s sell-off, attributed to speculations about a potential snap election in Japan that could enable expanded fiscal stimulus from Prime Minister Sanae Takaichi. The dollar remained near its six-week high, supported by recent U.S. economic data showing a surprising decline in new applications for unemployment benefits.

Against a basket of currencies, the dollar traded at 99.21, close to its peak of 99.493 reached on Thursday, the highest since early December. Markets are currently pricing in a 20% probability of a Fed rate cut in March, a marked decrease from around 50% just a month ago.

Oil prices saw a slight increase as supply risks continued to be a focal point, despite the diminished likelihood of a U.S. military strike on Iran. Both Brent crude and U.S. West Texas Intermediate rose by approximately 1.2%. Meanwhile, spot gold steadied at around $4,611 an ounce, recovering from earlier losses.

The interplay between global economic indicators and geopolitical developments remains pivotal in shaping market dynamics as traders navigate a complex landscape.

(Reporting by Sophie Kiderlin in London and Rae Wee in Singapore; Editing by Dhara Ranasinghe and Andrew Heavens)

See also Meta Cuts 1,000 Jobs at Reality Labs to Focus on AI and Mobile Energy Solutions

Meta Cuts 1,000 Jobs at Reality Labs to Focus on AI and Mobile Energy Solutions AI Revolutionizes Cardiac Imaging: Ventripoint’s MRI-Precision Shifts $9B Market Dynamics

AI Revolutionizes Cardiac Imaging: Ventripoint’s MRI-Precision Shifts $9B Market Dynamics New Jersey Gov. Phil Murphy Signs $25M MOU with NVIDIA to Boost AI Education and Research

New Jersey Gov. Phil Murphy Signs $25M MOU with NVIDIA to Boost AI Education and Research Apple Partners with Google for AI Features, Meta Expands Compute Capacity Amid Rising Scrutiny

Apple Partners with Google for AI Features, Meta Expands Compute Capacity Amid Rising Scrutiny