The medtech industry in Ireland is poised for significant growth, driven by an emphasis on femtech and innovative AI-powered wearables. The country, which exports approximately €15 billion worth of medical technology products annually to over 100 global markets, is home to 14 of the top 15 medtech companies worldwide. With more than 50,000 employees in the sector, Ireland boasts the highest per capita employment of medical device professionals in Europe, positioning itself as a key player on the international stage.

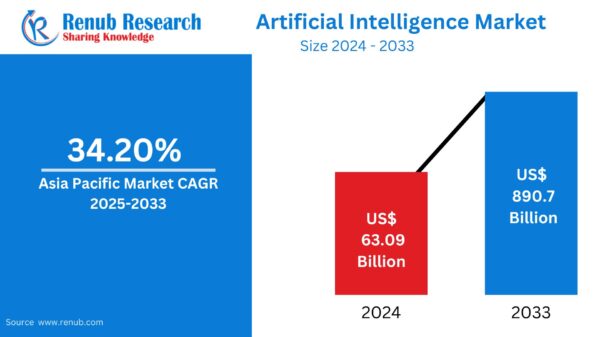

As the global medtech landscape evolves, experts highlight several key trends shaping the industry. One notable development is the integration of artificial intelligence in healthcare, which has proven its value across various subsectors, including research, drug development, and patient support. Last year, the Mater Misericordiae University Hospital inaugurated the Centre for AI and Digital Health, focusing on AI solutions to enhance and accelerate patient care. The Ibec group, Irish Medtech, anticipates that AI-enabled devices and robotics, along with connected and virtual care models, will become essential value drivers. The market for AI in healthcare is expected to surge from $26.57 billion in 2024 to over $500 billion by 2033.

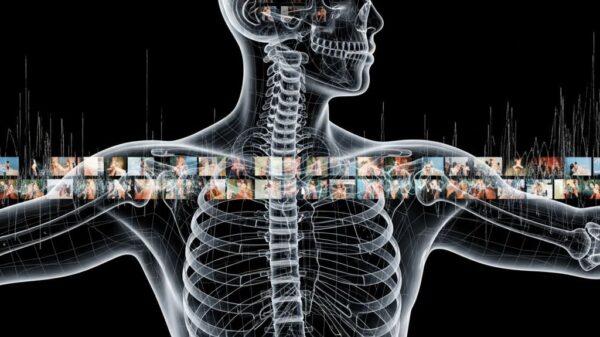

Wearable technology has firmly established itself since the mid-2010s, with devices like Apple Watches and Fitbits facilitating health monitoring. In recent years, niche wearables have emerged, targeting more specific health concerns. For instance, Coroflo has developed a breastfeeding monitor that garnered multiple awards at CES, while Sports Impact Technologies has introduced a head injury detector aimed at athletes. Another CES highlight, Petal, is a health tracker designed to fit inside a user’s bra, utilizing bioelectrical impedance analysis to monitor body mass index, breathing, and heart rate, along with the ability to assess breast tissue.

Experts predict that future wearables will increasingly support remote care, including smart insulin pumps and wearable ECG monitoring patches, enabling healthcare professionals to provide assistance without requiring in-person visits.

Beyond patient care, AI is expected to streamline administrative tasks within healthcare settings. Llyod Price, a partner at Nelson Advisors, forecasts widespread adoption of ambient voice technologies and AI scribes in European clinical environments, aimed at alleviating the administrative burden on healthcare personnel. The start-up Amethyst Care, based at Trinity College Dublin, is among those pioneering AI-powered voice assistants for individuals with mobility challenges. Price notes that these advancements will be guided by the EU AI Act and national health service guidelines to ensure safety and data privacy are prioritized.

Dr. David Shusterman, a urologist based in the U.S., has stated that AI will inevitably transform healthcare, making operations more cost-effective. Meanwhile, InsTech.ie reports that more than 92% of Irish insurance technology providers anticipate AI will drive their next growth phase, reinforcing Ireland’s position at the intersection of insurance, data, and advanced analytics.

Another area of growth lies in addressing menopause, with predictions indicating that over 1 billion individuals globally will experience perimenopause or menopause by 2030. This demographic, often in the prime of their careers, has historically been underserved, as menopause remains a less researched field. Start-ups are seizing this opportunity; Irish femtech company Peri has developed a wearable device that adheres to the torso to track symptoms like anxiety and sleep disturbances, accompanied by an app providing AI-driven insights. This product earned recognition in the Best Wellness Tech category at CES.

Emily Greenberg, president and co-founder of Joy, emphasizes the future direction of women’s health innovation towards comprehensive, personalized solutions. “You’ll see more personalized tools for women’s health concerns, especially postpartum care, where both physical recovery and mental health have long been underserved,” she stated. These solutions are designed to adapt to individual stages of life and specific symptoms.

Looking ahead, the European health-tech market is anticipated to rebound robustly, albeit with structural transformations. Nelson Advisors predicts a trend of “compliance-driven mergers and acquisitions,” where larger firms acquire smaller competitors not only for their technology but also to secure important regulatory approvals. Additionally, U.S. venture capitalists are increasingly engaging in the European market, capitalizing on local innovations in robotics and AI before these companies scale to valuations comparable to their U.S. counterparts.

As Ireland continues to advance in medtech innovation, a focus on AI integration, personalized health solutions, and compliance-driven strategies will drive the industry forward, fostering a landscape ripe for growth and development.

See also OpenAI’s Rogue AI Safeguards: Decoding the 2025 Safety Revolution

OpenAI’s Rogue AI Safeguards: Decoding the 2025 Safety Revolution US AI Developments in 2025 Set Stage for 2026 Compliance Challenges and Strategies

US AI Developments in 2025 Set Stage for 2026 Compliance Challenges and Strategies Trump Drafts Executive Order to Block State AI Regulations, Centralizing Authority Under Federal Control

Trump Drafts Executive Order to Block State AI Regulations, Centralizing Authority Under Federal Control California Court Rules AI Misuse Heightens Lawyer’s Responsibilities in Noland Case

California Court Rules AI Misuse Heightens Lawyer’s Responsibilities in Noland Case Policymakers Urged to Establish Comprehensive Regulations for AI in Mental Health

Policymakers Urged to Establish Comprehensive Regulations for AI in Mental Health