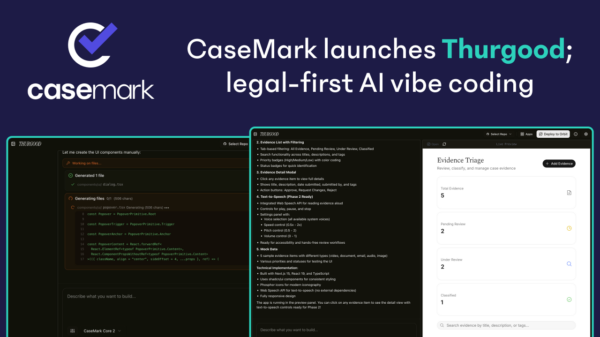

In January 2026, Xerox Holdings and Lexmark, now a combined entity, introduced a comprehensive suite of AI-enabled retail technology solutions at NRF 2026: Retail’s Big Show in New York. This unveiling highlights a range of offerings that include IT, production print, digital workflows, signage, and vision AI tailored for store operations. The collaboration exemplifies how the integration of Xerox’s digital workflow and print capabilities with Lexmark’s retail-focused devices and vision AI can forge a unified platform. This platform aims to connect real-time insights, automated signage, supply chains, and customer-facing content, thereby enhancing the operational efficiency for retailers.

For prospective investors, Xerox Holdings presents a narrative of transformation, bridging a legacy print business with higher-value software, AI, and services. The launch of AI-driven retail solutions with Lexmark aligns with this thesis, illustrating the company’s shift toward integrated, end-to-end platforms rather than standalone hardware. However, in the near term, more immediate catalysts appear to be the forthcoming Q4 2025 results. These results will likely provide insight into cash generation, the sustainability of recent dividend cuts, and overall progress toward profitability.

Compounding the investment considerations is a recently announced US$250 million shelf registration, which raises the possibility of equity or warrant issuance. This could exert additional pressure on a share price that has already experienced significant declines in recent years, despite consensus targets remaining well above current levels. Investors face the dual challenge of navigating not only the potential for future dilution from this shelf registration but also the broader implications for the company’s stock valuation.

Despite these challenges, some market observers maintain varying assessments of Xerox Holdings. According to data from Simply Wall St, the fair value of Xerox shares is estimated between US$3.25 and a high of US$43.59, demonstrating a wide divergence in opinion among analysts. Evaluating these perspectives is crucial, particularly in light of the near-term dilution risks and anticipated earnings, emphasizing the importance of a comprehensive view before forming conclusions about the company’s recovery potential.

For those who may disagree with prevailing assessments, crafting a personalized investment narrative could prove beneficial, as substantial returns often arise from independent analysis rather than conventional wisdom. The opportunity for creating diverse perspectives on Xerox Holdings may be particularly relevant given the ongoing transformation within the company.

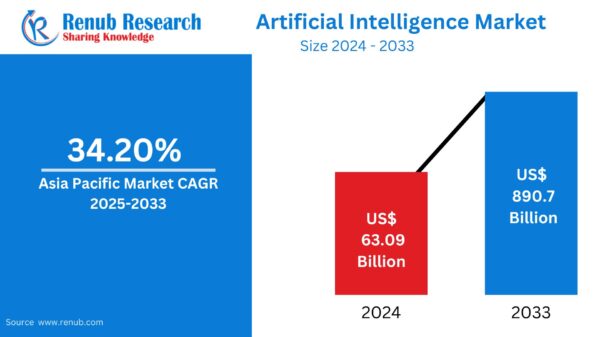

As investors consider the landscape, it is worth noting the broader implications of advancements in AI across sectors, including healthcare, where innovative companies are pursuing breakthroughs in diagnostics and drug discovery. With many of these companies trading under a US$10 billion market cap, there remains a window of opportunity to enter promising investments at an early stage.

As the market evolves, the continuous development of AI technologies will likely influence various sectors, shaping investment strategies and altering traditional business models. Investors and analysts alike will monitor Xerox Holdings closely as it navigates this pivotal period and its efforts to redefine its market position amid a rapidly changing technological landscape.

See also Bank of America Warns of Wage Concerns Amid AI Spending Surge

Bank of America Warns of Wage Concerns Amid AI Spending Surge OpenAI Restructures Amid Record Losses, Eyes 2030 Vision

OpenAI Restructures Amid Record Losses, Eyes 2030 Vision Global Spending on AI Data Centers Surpasses Oil Investments in 2025

Global Spending on AI Data Centers Surpasses Oil Investments in 2025 Rigetti CEO Signals Caution with $11 Million Stock Sale Amid Quantum Surge

Rigetti CEO Signals Caution with $11 Million Stock Sale Amid Quantum Surge Investors Must Adapt to New Multipolar World Dynamics

Investors Must Adapt to New Multipolar World Dynamics