SAN FRANCISCO, Jan 23, 2026, 05:14 (PST) — Intel has forecast first-quarter revenue of $11.7 billion to $12.7 billion, falling short of Wall Street expectations as the chipmaker struggles to meet demand for server CPUs essential for AI data center expansions. The outlook prompted a sharp decline in Intel’s shares during extended trading hours, underscoring ongoing challenges in its operational recovery.

The announcement arrives at a critical juncture for Intel, which is working to regain its footing in both manufacturing and the rapidly evolving AI chip market. After a difficult 2024, when the stock plummeted more than 60%, Intel had seen a remarkable recovery in 2025, gaining 84% and outpacing the benchmark semiconductor index’s 42% rise. Analysts had hoped that a firmer product roadmap and external partnerships would help ignite growth, but recent warnings have dampened optimism.

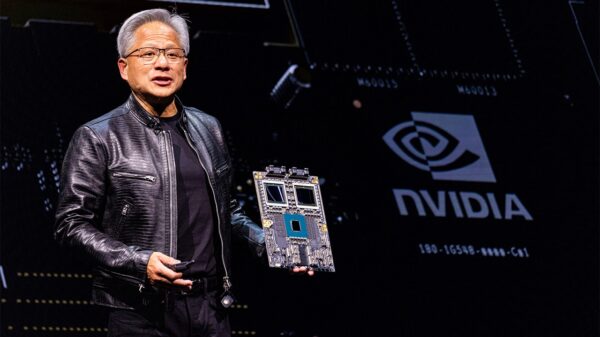

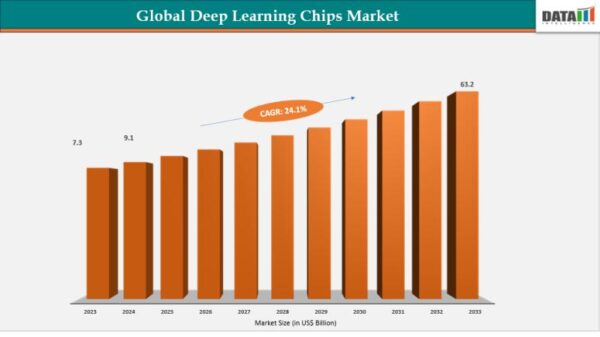

Big technology companies are significantly investing in infrastructure to support AI services, creating a robust market for server central processors (CPUs). Typically, these CPUs operate alongside Nvidia’s graphics processors (GPUs), and Intel’s inability to capitalize on this trend could result in lost profit margins just as it seeks to innovate within its PC chip offerings and ramp up factory output.

Intel’s adjusted earnings per share are expected to be near break-even as Chief Executive Lip-Bu Tan acknowledged the company was “not able to fully meet the demand.” Finance Chief David Zinsner noted that executives were “caught off guard” by an “erosion in networking performance” that necessitated immediate upgrades. Michael Schulman, Chief Investment Officer at Running Point Capital, stated that the situation appears “supply-constrained rather than demand-constrained.”

Company executives attributed the shortfall to a planning miscalculation. Intel’s factories are operating at full capacity, but reallocating resources toward high-demand data-center components requires significant time. Zinsner indicated that the company had not anticipated the surge in demand for data-center products.

Meanwhile, Intel is also in the process of shipping its “Panther Lake” PC chips, which are the first to utilize the new 18A manufacturing technology. Although the company has reported that yields are steadily improving, inconsistent yields continue to exert pressure on profit margins.

The foundry initiative adds another layer of complexity for Intel. The company has slowed investment in its upcoming 14A process while awaiting a major outside customer, and executives have indicated that capital spending will likely reflect this customer acquisition.

Despite the recent optimism regarding Intel’s stock—up nearly 50% in January prior to the earnings report—some analysts remain skeptical. Bernstein noted that while the server cycle appears genuine, Intel seems to have “woefully misjudged” the situation. Jefferies highlighted that Intel’s market share in cloud computing is significantly lower than that of AMD, indicating ongoing product challenges.

In its fourth-quarter results, Intel reported revenue of $13.7 billion, a 4% decline from the previous year, with non-GAAP earnings per share of $0.15. Tan emphasized the increasing importance of CPUs in the AI era, asserting the company’s commitment to ramping up supply to meet robust demand.

Zinsner also pointed out that supply limitations extend beyond server components. “We expect our available supply to be at its lowest level in Q1 before improving in Q2 and beyond,” he said, as investors evaluate whether these constraints will hinder Intel’s ability to capitalize on AI-driven demand. This comes amid concerns that if supply issues and manufacturing yields do not improve quickly, Intel risks ceding further ground to competitors like AMD in both server and PC markets, as well as to Arm-based designs that are gaining traction in the personal computer sector. Higher memory chip prices could additionally elevate PC costs, impacting demand.

The Financial Times reported that Intel shares fell after the company highlighted supply limitations that could impede growth. Market participants are keenly monitoring signs of supply improvement in the second quarter and the potential for Intel to secure external customers for its forthcoming manufacturing processes.

See also Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity

Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity Affordable Android Smartwatches That Offer Great Value and Features

Affordable Android Smartwatches That Offer Great Value and Features Russia”s AIDOL Robot Stumbles During Debut in Moscow

Russia”s AIDOL Robot Stumbles During Debut in Moscow AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse

AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse Seagate Unveils Exos 4U100: 3.2PB AI-Ready Storage with Advanced HAMR Tech

Seagate Unveils Exos 4U100: 3.2PB AI-Ready Storage with Advanced HAMR Tech